NEW YORK (CNNfn) - The Nasdaq composite index tumbled for the third time in three sessions Monday after a plunge in Microsoft ignited a broad technology sell-off.

Microsoft's quarterly revenue came in weaker than expected, giving investors one more reason to shed the stock, which is now off 45 percent from its 52-week high. Reports that the government may break apart the software maker further hurt its shares.

"Clearly, Microsoft is the catalyst for today's tech sell-off," said Alan Skrainka, chief market strategist at Edward Jones.

But the Dow Jones industrial average rose as gains in American Express, which posted strong earnings, offset Microsoft's weakness.

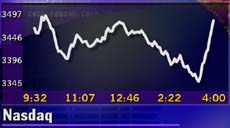

The Nasdaq fell 161.35, or nearly 5 percent, to 3,482.53, building on a 150-point loss suffered Wednesday and Thursday. The index now stands just 161 points above its lowest close of the year.

The broader S&P 500, where Microsoft is also a member, shed 4.68 to 1,429.86.

But the Dow gained for the second time in two sessions, rising 62.05 to 10,906.10 as money moved into drug makers and financial stocks shunned for most of the year.

"You're seeing a return to traditional measures of value as investors become more focused on things like (price-to-earnings ratios), interest rates and earnings," Edward Jones' Skrainka said.

Market breadth was mixed amid moderate trading volume. Advancing issues on the New York Stock Exchange topped decliners 1,551 to 1,493. Trading volume rose to 870 million shares. But Nasdaq losers beat winners 2,969 to 1,234 as more than 1.5 billion shares changed hands. Market breadth was mixed amid moderate trading volume. Advancing issues on the New York Stock Exchange topped decliners 1,551 to 1,493. Trading volume rose to 870 million shares. But Nasdaq losers beat winners 2,969 to 1,234 as more than 1.5 billion shares changed hands.

In other markets, the dollar edged lower against the euro and yen. Treasury securities were mixed.

Microsoft gropes for a bottom

Microsoft shares tumbled Monday in the latest blow for the stock, which has fallen steadily since mid-March ahead of the government's antitrust ruling against the company.

The most recent blow comes after Microsoft late Thursday beat profit targets but reported lower-than-expected revenue for its third quarter.

Further, a prosecution source said the Justice Department and 19 states are leaning toward splitting up Microsoft Corp. as part of the remedy in the government's antitrust case.

Wall Street, which has largely stood by the company, wavered somewhat Monday. S.G. Cowen downgraded Microsoft to "buy" from "strong buy." And Goldman Sachs removed the software maker from its "recommended" list, lowering it to "market outperform."

Still, Peter Cardillo, director of research at Westfalia Investments, said a government breakup of Microsoft actually could be positive for shareholders, giving them a handful of several strong-performing units.

But optimists will have to wait; shares of Microsoft (MSFT: Research, Estimates) fell 12-5/16 to 66-5/8, a 52-week low. More than 156 million shares changed hands, making it Nasdaq's most active stock.

Microsoft was hardly alone. The hard-hit technology sector suffered big losses Monday as money fled chipmakers, Internet firms and telecommunications equipment makers that have fallen steadily in April.

Cisco Systems (CSCO: Research, Estimates) shed 1-5/8 to 63-1/2, Qualcomm (QCOM: Research, Estimates) lost 5-7/8 to 99-5/8, and Dell Computer (DELL: Research, Estimates) dropped 2-3/16 to 47-3/4.

Still, Charles Lemonides, chief investment officer and senior portfolio manager at M&R Capital, speaking on CNNfn's Talking Stocks, put the Nasdaq's recent losses in perspective. (393K WAV) (393K AIFF).

The day's sell-off comes at a vulnerable time for technology stocks. Analysts say the Nasdaq could retest its mid-April lows amid fears that share prices, still high by historical standards, need to fall farther in order to accurately reflect growth prospects.

"We think it's time for investors to be cautious about technology stocks," Edward Jones' Skrainka said.

With an average price-to-earnings ratio of 200, Skrainka sees more vulnerability for Nasdaq stocks. Still, one analyst said the worst may be over.

"We've always felt that we were going to have to test the bottoms that we've seen," said Marc Klee, technology fund manager at John Hancock Funds. "We think what you are seeing today is probably that test and we really don't think that the market is going much lower."

Indeed, the Nasdaq closed well above its worst levels of the session Monday, a positive sign for Tuesday's open. And the moderate trading volume has led some to think that the selling is near an end.

Dow lifted by earnings

While technology stocks fell, strong quarterly earnings helped other sectors at the start of another big week for corporate results.

Dow component American Express (AXP: Research, Estimates) jumped 7 to 150 after the financial services company said it earned $656 million, or $1.44 a diluted share, in the first quarter. That's 2 cents above the average forecast of analysts compiled by earnings tracker First Call.

And Merck & Co. Inc. (MRK: Research, Estimates), another Dow component, gained 2-3/16 to 71-15/16 after the drug maker reported that first-quarter earnings rose to 63 cents a diluted share, topping Wall Street forecasts of 62 cents a share and its year-earlier results of 54 cents a share.

(Click here for a comprehensive look at the day's earnings)

(Click here for a look at CNNfn's tech stocks.)

(Click here for a look at CNNfn's hot stocks.)

|