NEW YORK (CNNfn) - Microsoft set a negative tone for technology issues Monday, as investors punished the company's stock in the wake of a disappointing third-quarter revenue outlook and reports that the government is leaning toward a breakup of the company as a remedy for its monopolistic practices.

Shares of Microsoft (MSFT: Research, Estimates) finished at a new 12-month low Monday, ending the session 12-5/16, or 15.6 percent, lower at 66-5/8.

And that weighed heavily on the tech-laden Nasdaq composite index, which ended the session 161.5 lower at 3,482.38, a 4.43 percent decline on the day. Microsoft is the second most heavily weighted stock on the Nasdaq.

The catalyst for Monday's sell-off was news that the U.S. Justice Department and 19 states are leaning toward splitting up the company as part of the remedy in their landmark antitrust case against the software giant.

Earlier this month, the judge in that case said Microsoft violated the nation's antitrust laws by using its monopoly power in personal computer operating systems to stifle competition. Government sources said Monday that they are likely to propose that the company be split up, with the Windows operating system -- the focal point of the antitrust suit -- in one unit and software applications in the other.

The government has until this Friday to submit its proposed remedies.

Monday also was the market's first chance to react to a downbeat near-term revenue-growth forecast, which executives gave after the close of trading Thursday. The financial markets were closed Friday in observance of the Good Friday holiday.

In an interview on CNNfn Monday, Microsoft chief operating officer Bob Herbold said he is still bullish on the company's future, but noted that there would likely be some gyrations as it moves ahead. [317K WAV or 317K AIFF]

Analysts weigh in

Goldman Sachs' analyst Rick Sherlund on Monday took Microsoft off his firm's "recommended" list and downgraded the stock to "market outperform" from "buy." Drew Brousseau at S.G. Cowen also downgraded Microsoft

to a "buy" from a "strong buy," saying that a maturing PC market is likely to offset positive momentum for Windows 2000, its latest computer operating system.

"We've cut our revenue and earnings projections to reflect more modest growth assumptions of 15-to-20 percent over the next couple of years," Brosseau said.

However, some analysts had a more positive view on Microsoft, such as ING Barings analyst George Godfrey.

"Guidance for fiscal 2001 is more cautious than necessary and (we) remain very optimistic on the next 12 months for Microsoft and believe we are reaching absolute bottom in the company's share price, if not there already," Godfrey said in a research note.

Some competitors boosted

Some of Microsoft's competitors were lifted by the news Monday.

Shares of database software vendor Oracle (ORCL: Research, Estimates) added 1-5/8, or 2.3 percent, to 72-7/16. Red Hat (RHAT: Research, Estimates), a distributor of the Linux operating system, which many see as an emerging rival to Microsoft's network operating system software, finished 1/2 higher at 26-3/4, a 1.9 percent gain on the day.

On the downside among Microsoft rivals Monday: VA Linux (LNUX: Research, Estimates) shares slipped 13/32 to 37-5/8; Sun Microsystems (SUNW: Research, Estimates) edged down 1/8 to 87-5/8; Corel (CORL: Research, Estimates) slipped 1-5/16, or 16.5 percent, to 6-5/8; and Be (BE: Research, Estimates), which makes its own computer operating system aimed at consumers, slipped 3/4 to 7-1/8, a 9.5 percent decline on the day.

Elsewhere among software makers Monday: BMC Software (BMCS: Research, Estimates) fell 4-3/16 to 37-15/16, a 9.9 percent slide; Siebel Systems (SEBL: Research, Estimates) fell 4-13/16, or 4.2 percent, to 111; Verisign (VRSN: Research, Estimates) shares ended the session 19-1/8 lower at 99-3/8, a 16.1 percent slide; and Citrix Systems (CTXS: Research, Estimates) fell 5-5/16, or 11.4 percent, to 45-5/16.

Losses spread throughout the sector

Elsewhere, shares of large-cap technology names, such as computer networking equipment-maker Cisco Systems, also took a turn for the worse Monday as well. Cisco (CSCO: Research, Estimates) fell 1-11/16, or 2.6 percent, to 63-7/16. The company on Monday signed an agreement with the Egyptian government to help develop its software export industry by providing networking equipment to two new companies in Cairo.

Cisco competitor Lucent Technologies (LU: Research, Estimates) fell 2-7/16, or 3.9 percent, to 60-9/16. The company on Monday named Deborah Hopkins, the chief financial officer of aerospace giant Boeing (BA: Research, Estimates), as its own CFO.

Nortel Networks (NT: Research, Estimates) slipped 3-3/4 to 98-3/4, a 3.7 percent decline on the day. Juniper Networks (JNPR: Research, Estimates) fell 11-9/16 to 174-9/16, a 6.2 percent decline in the day.

Among PC makers: Compaq (CPQ: Research, Estimates) slipped 1-3/16 to 26-1/4, a 4.3 percent decline; Dell (DELL: Research, Estimates) shares fell 2, ending the session 4 percent lower at 47-3/4; Gateway (GTW: Research, Estimates) fell 1-13/16 to 53-1/16, a 3.3 percent decline. Hewlett-Packard (HWP: Research, Estimates) shares ended the session 7-3/16, or 5.2 percent, lower at 132-5/16.

Computer makers gaining ground Monday included Apple (AAPL: Research, Estimates), which finished 1-5/8 higher at 120-1/2, a 1.4 percent rise; and IBM (IBM: Research, Estimates), which added 2-1/2, closing 2.4 percent higher at 106-1/2.

The Goldman Sachs computer hardware index slipped 14.75 to 549.08, a 2.6 percent decline on the day.

Semiconductor-related issues also headed mostly lower Monday. The Philadelphia Stock Exchange's semiconductor index, or Soxx, ended the session down 30.64 at 993.64, a 3 percent slide.

Intel (INTC: Research, Estimates) was among the day's few chip winners, adding 3/4 to finish at 116-1/8. The microprocessor giant said Monday it is planning to start up a new center in Beijing to promote wireless communication in China. The center will be called the Intel Wireless Competence Sector and work with leading companies in the Chinese cell phone business. Intel (INTC: Research, Estimates) was among the day's few chip winners, adding 3/4 to finish at 116-1/8. The microprocessor giant said Monday it is planning to start up a new center in Beijing to promote wireless communication in China. The center will be called the Intel Wireless Competence Sector and work with leading companies in the Chinese cell phone business.

Intel rival Advanced Micro Devices (AMD: Research, Estimates) also gained Monday, ending the session 1-7/8 higher at 80, a 2.4 percent rise on the day.

Among Monday's chip losers: Broadcom (BRCM: Research, Estimates) dipped 10-5/8, or 7 percent, to 141-7/8; QLogic (QLGC: Research, Estimates) fell 4-17/32 to 70-3/4, a 6 percent decline on the day; and Sandisk (SNDK: Research, Estimates) slipped 8-1/2, or 8.7 percent, to 89-1/8.

Dot.coms in the dumps

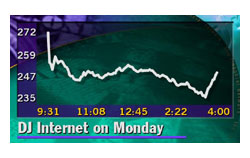

Internet stocks continued their downward slide Monday as well, pulling the Dow Jones composite Internet index down 25.66 to 249.21, a 9.3 percent slide on the day.

Exodus Communications (EXDS: Research, Estimates) was among the day's biggest decliners, falling 25-3/16, or 24 percent, to 82-1/2. The company, which specializes in Internet system and network-management technology, on Thursday reported an operating loss of 23 cents per share, versus analyst estimates of a 26 cent-per-share loss.

Though the company's loss was narrower than expected, its revenue growth was only 32 percent, which is below the 40 percent level that most analysts have come to expect. The company also posted positive cash flow for the first time, but warned that it was stepping up investments in new computer centers to meet demand.

"The accelerated plans could hamper EBITDA growth - earnings before interest, taxes, depreciation and amortization - in 2000, but should accelerate cash flow generation in 2001," Chase H&Q analyst David Levy said in a research note Monday.

Of 18 analysts who responded to a First Call poll, 17 increased the loss they said they expect Exodus to post in 2000, according to research director Chuck Hill.

"But for the following year, they have narrowed the loss and in some cases gone to profitability," Hill said.

Better-than-expected earnings did nothing to help Priceline.com(PCLN: Research, Estimates) either. Shares of the company, where users name their own price for products ranging from airline tickets to groceries, fell 6-1/8 to 61-3/4, a 9 percent decline on the day.

Priceline on Monday posted an operating loss of $7.3 million, or 4 cents per share, compared with Wall Street's expectations for a loss of 6 cents a share, according to First Call estimates.

Merrill Lynch reinstated coverage of Internet advertising form TMP Worldwide. with an "accumulate" rating. Merrill cited TMP's Monster.com, an online career Web site, for making strategic alliances, adding services and strengthening its brand. TMP (TMPW: Research, Estimates) fell 4-13/16, or 6.8 percent, to 65-5/8.

Network Solutions (NSOL: Research, Estimates) also saw a steep decline, tumbling 15-13/16, or 12.3 percent, to 112-3/8.

Internet bellwether Yahoo! (YHOO: Research, Estimates) also fell sharply, ending the session 9-1/4 lower at 113-7/8, a 7.5 percent decline on the day.

-- from staff and wire reports

|