|

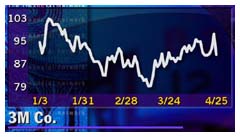

3M 1Q beats estimates

|

|

April 25, 2000: 1:27 p.m. ET

Manufacturing and technology company raises earnings target for 2000

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Minnesota Mining & Manufacturing Co. posted first-quarter results Tuesday that surpassed analysts' estimates.

The manufacturing and technology company earned $455 million, or $1.13 a diluted share, excluding a one-time gain. Analysts surveyed by earnings tracker First Call predicted that the Dow component would earn $1.08 a share for the quarter.

The one-time $50 million pre-tax gain brought net income to a record $487 million, or $1.21 a diluted share. In the year-earlier quarter, the company posted net income of $384 million, or 95 cents a diluted share. The one-time $50 million pre-tax gain brought net income to a record $487 million, or $1.21 a diluted share. In the year-earlier quarter, the company posted net income of $384 million, or 95 cents a diluted share.

3M raised its earnings and revenue growth targets for the year, saying unit sales should grow more than 10 percent this year, though change in currency valuations would reduce overall revenue.

The company said earnings per share should increase 12 to 14 percent this year, although that would include an 8 cent a share gain it posted in the first quarter. Since 1999 net income was $1.7 billion, or $4.21 a share, the new range for 2000 would be $4.64 to $4.72 a share excluding the gain, compared with the First Call forecast of $4.68 for the year.

"When you do take the 8 cents into account, it could lead some people to lower estimates a little bit for the rest of the year," said Peter Enderlin, analyst with Ryan Beck, who had forecast the company to earn $4.76 a share for the year.

3M warned it now expects currency exchange rates will reduce earnings for the year by about 10 cents a share, due primarily to a weaker-than-anticipated euro. It also said raw materials prices, which it began the year anticipating would be flat, would rise about 2 percent for the year.

But company officials sought to assure analysts that they still will meet or exceed their expectations. Robert Burgstahler, the company's new chief financial officer, told analysts near the end of the call that he was comfortable with the target of $3.60 a share in earnings over the next three quarters, which would bring earnings for the year above current consensus forecast to $4.73, even excluding the special gain.

"Despite these challenges, I am confident we can deliver the results that you expect due to solid volume gains and good productivity," Burgstahler said. "Despite these challenges, I am confident we can deliver the results that you expect due to solid volume gains and good productivity," Burgstahler said.

But his comments may not have assured investors, as shares of 3M (MMM: Research, Estimates) fell 7-1/4, or 7.4 percent, to 91-1/8 in relatively heavy trading Tuesday, although that was up from a low of 88-1/2 earlier in the day.

"The guidance is why the stock got hit, although I think it was somewhat of an overreaction," said Enderlin.

3M makes such well-known products as Scotch tape and Post-it notes, but its best gains were in its transportation, graphics and safety division, where operating profit rose 41 percent to $209 million as revenue gained 12.2 percent to $872 million. Strong sales of optical films for liquid-crystal displays for computers, electronic organizers, cell phones and other electronic devices led that sector.

Consumer and office products operating income rose 19.3 percent to $105 million on an 8 percent revenue increase to $687 million.

Overall revenue rose 7.3 percent to $4.1 billion from $3.8 billion a year earlier.

|

|

|

|

|

|

3M

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|