|

Baby Bells' 1Q profits up

|

|

April 25, 2000: 11:11 a.m. ET

SBC, Bell Atlantic cite strong wireless revenue for driving core earnings

|

NEW YORK (CNNfn) - SBC Communications Inc. and Bell Atlantic Corp., two of the nation's largest regional telephone companies, posted strong first-quarter earnings Tuesday, citing explosive growth in their wireless divisions.

San Antonio-based SBC (SBC: Research, Estimates) reported a 12 percent jump in first-quarter earnings, driven by rapid expansion of its data communications and wireless operations, helping the company easily surpass Wall Street's expectations.

Excluding one-time items, the company, which recently joined forces with BellSouth Corp. (BLS: Research, Estimates) to form the nation's No. 2 wireless carrier, earned $1.91 billion, or 56 cents per share, during the quarter, exceeded the $1.71 billion, or 49 cents per share, it earned a year earlier.

Analysts polled by research firm First Call Corp. were expecting a profit of 52 cents per share.

Including one-time items, the company posted net income of $1.82 billion, down from $1.98 billion a year earlier. However, because it had fewer shares outstanding, net earnings per share increased to 53 cents from 51 cents a year ago. Including one-time items, the company posted net income of $1.82 billion, down from $1.98 billion a year earlier. However, because it had fewer shares outstanding, net earnings per share increased to 53 cents from 51 cents a year ago.

Revenue jumped 8.4 percent to $12.58 billion, driven by a 40.8 percent increase in data revenue, attributable mainly to a surge in digital subscriber line sales, which nearly doubled from a year ago.

SBC also recorded 30.1 percent increase in domestic wireless subscriber revenues in advance of its alliance with BellSouth and now boasts 11.7 million wireless customers nationwide.

International revenue increased 56 percent to $1.9 billion.

SBC Chairman and CEO Edward Whitacre reiterated the company's goal of delivering double-digit revenue growth and earnings growth in the mid-teens beginning next year.

SBC shares climbed 11/16 to 42-15/16 in early trading Tuesday.

Bell Atlantic profits in-line

The New York-based Bell Atlantic earned $1.3 billion, or 80 cents a diluted share excluding special items, during the same period, up from the $1.2 billion, or 73 cents a share, a year earlier. Analysts surveyed by First Call forecast the company would earn 80 cents a share.

Bell Atlantic recorded a 34-cent a share charge for an accounting adjustment related to the exchange of notes into shares of Cable & Wireless Communications PLC during the period. Bell Atlantic recorded a 34-cent a share charge for an accounting adjustment related to the exchange of notes into shares of Cable & Wireless Communications PLC during the period.

Including that charge, net income for the quarter came to $731 million, or 46 cents per share, compared with $1.1 billion, or 72 cents per share, a year earlier.

The company, which expects to close its merger with GTE Corp. (GTE: Research, Estimates) later this quarter, saw revenue rise 7.1 percent to $8.5 billion from $8.0 billion. The greatest increase came from wireless communications sales, which gained 30.5 percent to $1.3 billion. The company recently formed a wireless joint venture, Verizon Wireless, with Vodafone AirTouch PLC.

Core local service revenue rose 5 percent to $3.6 billion. In addition, the company added 428,000 long-distance customers in New York State during the quarter, the first time it has offered long-distance service.

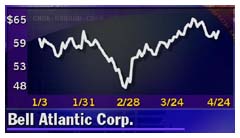

Shares of Bell Atlantic (BEL: Research, Estimates) rose 1-11/16 to 61-15/16 in trading Monday.

|

|

|

|

|

|

|