|

Oil firms' 1Q profits jump

|

|

April 26, 2000: 9:58 a.m. ET

Higher oil prices result in profit boosts at Chevron and Unocal Corp.

|

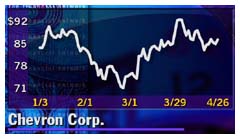

NEW YORK (CNNfn) - Chevron Corp. on Wednesday became the latest oil company to post a bigger-than-expected jump in first-quarter profits as higher oil prices during the period lifted results.

Chevron (CHV: Research, Estimates), the nation's third-largest oil company after Exxon Mobil Corp. (XOM: Research, Estimates) and Texaco Inc. (TX: Research, Estimates), earned $1.1 billion, or $1.61 a diluted share, excluding one-time items and the impact of currency exchange rates.

According to a survey by earnings tracker First Call, analysts predicted the company to earn $1.46 a share in the quarter. In the year-earlier quarter, earnings totaled $263 million, or 40 cents a share, on the same basis.

Earnings from exploration and production were almost seven times greater than a year ago, rising to $1 billion from $151 million. But earnings from refining, marketing and transportation fell almost two-thirds to $63 million from $184 million, as the higher oil prices were not completely recaptured at the gasoline pumps. Chemicals contributed $25 million to earnings, compared with a $54 million loss a year earlier. Earnings from exploration and production were almost seven times greater than a year ago, rising to $1 billion from $151 million. But earnings from refining, marketing and transportation fell almost two-thirds to $63 million from $184 million, as the higher oil prices were not completely recaptured at the gasoline pumps. Chemicals contributed $25 million to earnings, compared with a $54 million loss a year earlier.

Including special items, net income was $1 billion, or $1.59 a share, up from $329 million, or 50 cents a share, a year earlier.

Revenue rose 75 percent to $11.7 billion from $6.7 billion.

Many of the oil company stocks have lagged, even in the face of strong earnings reports, due to the recent downward trend in oil prices. Chevron shares were up 3/4 to 85-9/16 in trading Wednesday.

Unocal sees strong earnings gain

Oil exploration company Unocal Corp. reported earnings, excluding one-time items, of $139 million, or 57 cents a diluted share, in the first quarter, up from $20 million, or 8 cents a share, a year earlier.

First Call's analysts' forecast called for the company to earn 55 cents a share, but according to First Call the estimate may not be comparable with the company's per-share figure due to accounting variables.

Net income was $133 million, or 55 cents a share, up from $7 million, or 3 cents a share, a year earlier.

Revenue from continuing operations rose 61 percent to $1.9 billion from $1.2 billion a year earlier.

Shares of Unocal (UCL: Research, Estimates) rose 9/16 to 30-15/16 in trading Wednesday.

|

|

|

|

|

|

Chevron Corporation

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|