|

Stocks to watch Thursday

|

|

April 26, 2000: 6:08 p.m. ET

Pizza Hut owner posts strong 1Q; iVillage revenue soars, CFO resigns

|

NEW YORK (CNNfn) - Companies continued reporting earnings after the bell Wednesday, with such big names as Amazon.com beating expectations. Halliburton Systems met expectations, while MicroStrategy posted a first-quarter loss.

(CLICK HERE for more earnings news)

In other news after the bell, AT&T Wireless said it raised $10.6 billion in its initial public offering, the largest ever U.S. IPO.

Tricon Global Restaurants Inc.

Tricon Global Restaurants Inc., owner of Pizza Hut, Taco Bell and KFC, reported first-quarter earnings that trampled Wall Street expectations on the strength of growing international markets, reduced operating costs and Pizza Hut sales.

For the quarter ended March 18, the Louisville, Ky.-based company reported first-quarter earnings of $96 million, or 64 cents a share, compared with earnings of $81 million, or 50 cents a share in the year-ago quarter.

The results outstripped analysts' composite forecast of 55 cents a share.

Additionally, the company bought back 3.9 million shares of its outstanding common stock for $135 million. The company reduced administrative costs by $36 million and expects to continue reducing costs, officials said.

The earnings reflected strong sales from the company's international business, which comprises a third of Tricon's worldwide sales. International sales grew 9 percent.

In the U.S., Pizza Hut sales were better than expected despite a 2 percent decline for the quarter. That reflects the continued popularity of the Big New Yorker pizza, which drove same store sales up 14 percent in the year-ago quarter.

Sales at Taco Bell rose slightly thanks to consumers who picked up the Chalupas and other new products.

KFC same-store sales declined 3 percent as expected.

The company said it expects to achieve 23-27 percent earnings per share growth in the current fiscal year and that it expects minimal impact from the bankruptcy of one of its major suppliers, AmeriServ.

Shares of Tricon (YUM: Research, Estimates) gained 1-3/16 to close at 34-7/16 on the New York Stock Exchange Wednesday.

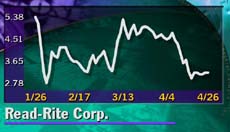

Read-Rite Corp.

Read-Rite Corp., a disk and tape-drive equipment maker, reported a much wider than expected second quarter loss primarily because of a charge related to the consolidation of operations.

Excluding one-time items, the Milpitas, Calif.-based company posted a net loss for the quarter ended Apr. 2 of $44.7 million, or 89 cents a share, compared with a net loss of $7 million or 39 cents a share in the year-earlier period.

Analysts polled by earnings tracker First Call/Thomson Financial had projected a net loss of 51 cents a share for the quarter.

The company reported an increase in shipments of magnetic recording heads to 17.4 million compared with 11.1 million heads shipped in the previous quarter.

Including a one-time gain of $158.7 million from the exchange offer of its 6-1/2 percent convertible notes for 10 percent convertible notes and an $88.3 million consolidation charge, Read-Rite reported a quarterly net income of $25.7 million, or 51 cents a share.

Revenue for the quarter fell to $154.5 million from $206.2 million in the year-earlier period.

The company attributed the bulk of the loss to an $88.3 million charge stemming from the consolidation of its wafer fabrications and headstack operations.

Shares of Read-Rite (RDRT: Research, Estimates) remained unchanged at 3-3/16 on the Nasdaq Stock Exchange Wednesday.

iVillage Inc.

iVillage Inc., operator of the online women's network iVillage.com, on Wednesday reported a much narrower than expected first-quarter loss on the strength of sales that more than tripled for the first-quarter reflecting an increase in membership and media sales.

The New York-based company, which provides articles and information on women's issues in addition to shopping opportunities, also announced that its chief financial officer, Craig Monaghan, resigned to take a similar job at Autonation Inc., one the largest U.S. auto retailers with $20 billion in annual revenue.

For the quarter ended March 31, iVillage reported a net loss of $25.2 million, or 85 cents a share, compared with a net loss of $17.6 million, or 96 cents a share in the year-ago quarter.

In spite of the loss, iVillage exceeded the consensus forecast of analysts who expected a net loss of 94 cents a share.

However, iVillage's revenue for the quarter soared to $20.8 million from $6.5 million in the year-ago quarter.

Online memberships more than doubled to 4.9 million from 1.6 million in the same period a year ago. Traffic to iVillage.com grew 72 percent to 155 million average monthly page views.

The better-than-expected quarter also reflects revenue from three new Internet channels on the iVillage.com site, Working Diva, a garden channel and a beauty channel.

The company also announced an expanded agreement with America Online (AOL: Research, Estimates) in which Astrology.com will become an anchor tenant in the largest Web portal's new horoscopes area, officials said.

In the wake of Monaghan's resignation, Scott Levine, iVillage's vice president, controller and chief accounting officer, will serve as interim CFO until a permanent replacement is hired.

Shares of iVillage Inc. (IVIL: Research, Estimates) gained 1/8 to close at 10-11/16 on the Nasdaq Stock Exchange Wednesday.

Landry's Seafood/Rainforest Café Inc.

Landry's Seafood Restaurants Inc. announced Wednesday that it canceled a proposed merger with Rainforest Café Inc. because of the failure of all Rainforest shareholders to approve the deal.

Landry's said that although a majority of voting shareholders approved the merger, Minnesota law requires an affirmative vote by an absolute majority.

Landry's first proposed to merge with Rainforest Café, a specialty theme restaurant with $259.4 million in annual revenue, in February in a $125 million combined stock and cash deal.

Shares of Rainforest Café (RAIN: Research, Estimates) remained unchanged at 3-3/4 on the Nasdaq Stock Exchange Wednesday.

Landry's (LNY: Research, Estimates) shares slipped 3/16 to 7-15/16 on the New York Stock Exchange.

VerticalNet Inc.

VerticalNet Inc., the operator of a network of business-to-business Web sites, announced a first-quarter loss that was narrower than expected thanks to a giant leap in sales.

For the quarter ended March 31, the Horsham, Pa.-based company reported a net loss of $2.2 million, or 16 cents a share, compared to a net loss of $5.6 million, or 9 cents a share in the year-earlier quarter.

Analysts had expected a net loss of 27 cents a share, according to First Call/Thomson Financial.

Revenue for the quarter jumped to $27.5 million from $1.9 million in the year-ago quarter. Advertising revenue accounted for 43 percent of the total.

Shares of VerticalNet (VERT: Research, Estimates) gained 7/8 to close at 46 on the Nasdaq Stock Exchange.

After-hours quotes on CNNfn

Check S&P futures trading on Globex

Two key economic reports are due out Thursday. The Commerce Department is scheduled to release the Gross Domestic Product for the month for the first-quarter.

The GDP, which measures the cost of goods and services produced in the United States, grew at a 7.3 percent annual rate in the fourth-quarter, the government reported last month. That marked its fastest rate of growth in nearly 16 years.

Additionally at 8:30 a.m., the Labor Department is expected to release the first-quarter employment cost index, a gauge believed to be watched closely by Federal Reserve Board Chairman Alan Greenspan. It is expected to gain 0.9 percent.

Also due from the Labor Department is the number of initial claims for unemployment for the week ended April 22.

For the week of April 15, the number of initial jobless claims fell to 257,000 from 266,000 the previous week, the Labor Department reported earlier this month.

|

|

|

|

|

|

|