|

Pfizer shareholders OK deal

|

|

April 27, 2000: 2:08 p.m. ET

Regulatory review of Warner-Lambert merger 'on track,' CEO says

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Pfizer Inc. shareholders overwhelmingly approved the pharmaceutical company's acquisition of fast-growing rival Warner-Lambert Co. Thursday, a deal that would create the world's second-biggest drug maker.

Holders of about 98.7 percent of Pfizer (PFE: Research, Estimates) shares approved the pact, which was reached Feb. 7 after an acrimonious, three-month takeover fight. The vote was held at Pfizer's annual meeting in New York. Pfizer makes the popular male impotence remedy Viagra as well as antidepressant Zoloft and Norvasc, a blood pressure medication.

The all-stock deal was valued initially at about $90 billion, but has risen to about $103.7 billion as Pfizer's stock price has climbed. Under the deal, Warner-Lambert stockholders will receive 2.75 Pfizer shares for each W-L share they own.

In reaching the deal, Pfizer squired a reluctant Warner-Lambert (WLA: Research, Estimates) away from a $58 million merger pact with American Home Products Corp. (AHP: Research, Estimates). The new company would be the world's second biggest pharmaceutical company, after the planned merger of Britain's Glaxo Wellcome PLC (GLX: Research, Estimates) and SmithKline Beecham.

Morris Plains, N.J.-based Warner-Lambert makes the lucrative cholesterol-lowering drug Lipitor, which Pfizer said is expected to post sales of $5 billion this year. Pfizer, based in New York City, currently co-markets the drug with Warner-Lambert.

Warner-Lambert shareholders will vote May 12 on the proposed deal, a pact that required W-L to pay American Home a $1.8 billion break-up fee. The Federal Trade Commission and the European Union also must approve the deal, which is expected to close by the end of May.

The regulatory reviews are "on track," Pfizer CEO William C. Steere Jr. told about 2,000 shareholders who attended the meeting. "We think there's no major issues" standing in the way of approval, he said. Steere will head the combined company.

Pfizer officials said the merger should begin to boost earnings in its first full year of operation in 2001, and should generate about $31 billion in annual revenue. The new company will have a research and development budget of about $4.7 billion and is expected to result in cost savings of about $1.6 billion by 2002.

"It is important to emphasize that the new Pfizer will be not just bigger, but better," said Henry A. McKinnell, the company's president and chief operating officer.

Pfizer officials also discussed products in late-stage development, including Relpax, a drug to treat migraine headaches that is expected to receive final approval later this year, and an inhaled insulin treatment for diabetes, which the company plans to submit for regulatory review next year.

Pfizer and G.D. Searle & Co., the pharmaceutical unit of Pharmacia Corp. (PHA: Research, Estimates), also are developing a "second-generation" Cox-2 inhibitor treatment - an entry in a potent new class of painkillers - called Valdecoxib. Pfizer said the proposed treatment should be submitted for regulatory review later this year. The two companies already co-market the blockbuster Cox-2 inhibitor Celebrex.

Protest erupts

During the meeting at New York's Grand Hyatt hotel, about a dozen AIDS activists chanting "Pfizer's greed kills!" tried to burst into the gathering. But security guards prevented the shouting activists from entering the meeting room.

The activists were protesting what they called the "exorbitant prices" in Africa and Latin America of the company's anti-fungal treatment, Diflucan. The drug, used to treat AIDS patients with cryptoccal meningitis, a brain infection, had sales of about $1 billion last year. It normally sells for about $13 to $17 for a day's treatment.

The activists want Pfizer to cut the price of the drug or allow countries that cannot afford it to produce a generic version. Earlier this month, the company agreed to donate the drug to AIDS patients in South Africa. Critics, however, say that the company is ignoring need for the drug in Central America and elsewhere.

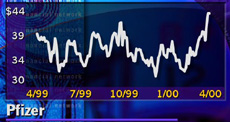

In afternoon trading, Pfizer stock slipped 7/8 to 42-5/8. Shares have traded in a range of 30 to 50-1/32 over the past year.

Warner-Lambert shares traded down 2-3/8 at 115-5/8.

|

|

|

|

|

|

Pfizer

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|