|

SEC targets Veba denials

|

|

May 2, 2000: 4:53 a.m. ET

US regulator probes statements made before $14B merger with Viag

|

LONDON (CNNfn) - U.S. regulators are inspecting whether German utility Veba misled investors by denying it was in talks on combining with counterpart Viag before the companies announced their  14.3 billion ($13.7 billion) merger, a Veba spokesman confirmed Tuesday. 14.3 billion ($13.7 billion) merger, a Veba spokesman confirmed Tuesday.

The Securities and Exchange Commission is looking into statements by Veba public relations officials in mid-August last year in which they denied the company was in any talks, Veba spokesman Josef Nelles said Tuesday.

"This is not a formal investigation, but it is correct that [the SEC is] investigating statements made by Veba last August," Nelles said, adding that the discussions with U.S regulators were taking place on a "voluntary basis."

The German company last year made the denials three days after Veba and Viag met jointly with Germany's antitrust regulators, the Wall Street Journal reported Tuesday. Large utility companies planning to merge would typically want to garner as much information as possible about the stance competition authorities might take to a merger.

The companies continued to deny talks until they announced the framework  for a merger on Sept. 1, 1999, the paper said. Viag and Veba unveiled detailed plans to merge Sept. 27. for a merger on Sept. 1, 1999, the paper said. Viag and Veba unveiled detailed plans to merge Sept. 27.

The paper said it was not clear whether the probe will lead to a complaint, but cited people familiar with the matter as saying the SEC wants to send a message to overseas companies with shares listed on a U.S. stock exchange that they are subject to U.S. regulation.

The investigation brings to light the differences between regulatory requirements in Europe and the United States. Under U.S. law, a company in talks about a merger or takeover may choose to decline to comment about the discussions, but if it opts to comment, it must tell the truth. In contrast, publicly denying merger talks does not violate any German law even if such talks are taking place.

"Under German law, there is no problem," said Nelles.

A Veba spokeswoman told the Journal last autumn that in German financial circles, saying "no comment" about a possible deal was regarded as giving confirmation that there are talks. Veba consulted with its lawyers prior to issuing its public statements about the matter and made the denials while fully aware of the SEC's requirements, the spokeswoman told the paper.

The SEC could not be reached for comment early Tuesday.

|

|

|

|

|

|

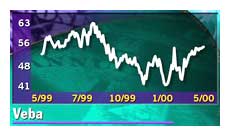

Veba

Viag

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|