|

Mickey Mouse roars in 2Q

|

|

May 3, 2000: 5:06 p.m. ET

Walt Disney posts 31% rise in profits, boosted by media operations

|

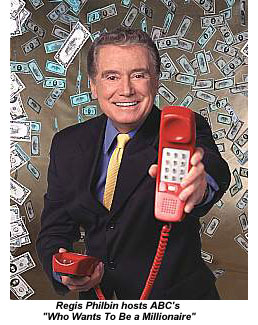

NEW YORK (CNNfn) - The Walt Disney Co. reported Wednesday a better-than-expected fiscal second-quarter profit that was up 31 percent due to strength at its media division, led by ABC television and its blockbuster game show "Who Wants To Be a Millionaire."

Disney (DIS: Research, Estimates), an entertainment conglomerate with holdings ranging from film and radio to cruises and theme parks, reported a second-quarter profit of $369 million, or 18 cents a share, excluding its stake in the GO.com Internet service. Net income, including GO.com, totaled $316 million, or 15 cents a share.

The Burbank, Calif.-based company's second-quarter profit compares with a pro forma profit of $281 million, or 13 cents a share, in the year-ago period. Revenue rose 14 percent to $6.2 billion, up from $5.4 billion. The Burbank, Calif.-based company's second-quarter profit compares with a pro forma profit of $281 million, or 13 cents a share, in the year-ago period. Revenue rose 14 percent to $6.2 billion, up from $5.4 billion.

According to First Call, analysts had expected Disney to earn 14 cents a share before taking into account the company's stake in GO.com. The results beat the most optimistic expectations, which had ranged from 12 cents to 17 cents a share.

Analysts had also forecast revenue of about $5.8 billion.

"These are unbelievably strong earnings," said Wit SoundView analyst Jordan Rohan. "This may be the strongest quarter that I've seen Disney put out in the last two years."

Disney said its Media Networks revenue for the quarter increased 30 percent to $2.4 billion, and operating income was $537 million, an increase of 48 percent. Broadcasting results for the quarter were driven by increases at the ABC television network and Disney-owned television stations due to a strong advertising market, the continued success of "Who Wants to Be a Millionaire," and higher overall ratings on network programming.

Profits and revenue grew at most other segments, including Theme Parks and Resorts, and Consumer Products. But earnings at Disney's Studio Entertainment division fell due to declines in domestic home video and theatrical motion picture distribution.

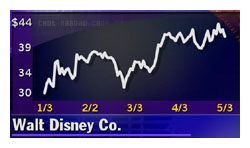

The results were released after the close of trading Wednesday. Disney stock ended the regular session at 41-1/4 a share, off 1-3/4.

Millionaire's Magic

Disney's stellar results symbolize the transformation and resurgence the company has undergone in the past year. Indeed, one year ago, Wall Street soured on Disney after it reported a 41 percent drop in second quarter earnings that were bruised by a drop in home video and merchandising sales despite strength in its theatre, television and theme park divisions.

The company's fortune took a sharp positive turn last August when it debuted "Millionaire," a ratings juggernaut that now airs as many as five times a week and - when aired head-to-head -- has easily beaten its rivals top rated shows.

"If I had told you a year ago that a single innovative quiz show would be a catalyst to bring ABC back to dominance, you would probably thought I was sprinkling a little too much pixie dust," Disney Chairman and Chief Executive Officer Michael Eisner told analysts in a conference call.

Robert Iger, president of Disney, noted that "Millionaire" has been a lightning rod to other segments of Disney's empire, helping to lift ratings of other shows on the network, and even spurring sales of related products, such as "Millionaire"-based computer games.

The results come one day after Disney and rival media company Time Warner (TWX: Research, Estimates), the parent of CNNfn.com, agreed to a temporary truce over transmission rights. Some 3.5 million Time Warner Cable customers could not see Disney's ABC-TV network on Monday and Tuesday, after the signal was absent from Time Warner's systems for about 39 hours.

Federal regulators ruled Wednesday that Time Warner violated broadcasting rules in removing ABC shows from its cable systems. The Federal Communications Commission said it would later consider appropriate enforcement action against Time Warner.

The temporary agreement lasts only though July 15. Disney President Robert Iger told analysts that Disney was ready to start negotiations again with Time Warner, in hopes of avoiding another ugly incident.

"We at least have an agreement to keep (ABC) on through mid-summer and we would hope not to face the kind of situation we faced earlier this week," he said.

Optimism about the future

Looking ahead, Disney's Eisner said the company would make an effort to revitalize its consumer products and home video segments and continue to cut costs across all corporate lines.

Answering questions about the company's ability to keep its momentum, Eisner noted that its strong results benefited from programs other than "Millionaire," and discussed hope for a strong showing when "Dinosaur," Disney's newest computer animated film, is released this month.

"The reaction to (the film) has been extraordinary (in previews)," Eisner told analysts regarding the film, which reportedly cost as much as $200 million to produce. "Don't count on Lion King but we think it will be a successful movie. I am very encouraged."

The animated film Lion King debuted in theaters in 1994, and earned over $1 billion in worldwide ticket receipts in less than one year.

The company added that it expects sales on the television side to remain strong in the fiscal third quarter and possibly straight through to the 2001 first quarter, which ends in December.

Regarding "Millionaire," Merrill Lynch analyst Jessica Reif Cohen recently commented that the series has the potential to achieve long-term success, on par with TV favorites Jeopardy and Wheel of Fortune, syndicated game shows whose popularity and financial return remain strong after decades on the air.

|

|

|

|

|

|

Walt Disney Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|