|

Europe slumps at close

|

|

May 3, 2000: 12:42 p.m. ET

Telecom, technology issues pace selloff; London's FT-100 plunges 3%

|

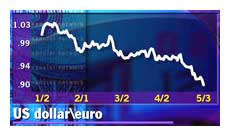

LONDON (CNNfn) - Europe's major equity markets dropped sharply Wednesday on weakness in telecom and technology shares -- reflecting similar activity in the U.S. Nasdaq market -- while the euro slipped below 90 cents for the first time.

The FTSE-100 benchmark index in London fell 189 points, almost 3 percent to 6,184.8, its biggest one-day point loss in more than 12 months.

The CAC-40 index in Paris shed 2 percent to reach 6,425.68, the Xetra Dax in Frankfurt dropped 2.5 percent to 7,366.34, and the SMI in Zurich slipped 0.4 percent.

The FTSE Eurotop 300, a broader measure of the region's largest stocks, fell 1.3 percent to 1,646.28, with its technology and telecom sub-indexes both losing more than 2 percent. But the biggest loser was the food and drugs sector, down 3.1 percent as its biggest component Unilever (ULVR) retreated.

Declines in Europe initially began after a 4.4 percent slump on the Nasdaq composite index Tuesday. The tech-heavy index continued falling in midday trading Wednesday, declining 3.2 percent to 3,664.57 after network software maker Novell Inc. (NOVL: Research, Estimates) warned its quarterly profit would miss expectations by a wide margin. The Dow Jones industrial average slipped 1.7 percent, to 10,552.42.

In the currency markets, the euro fell to 88.92 cents from its New York close Tuesday of 90.93 cents. The dollar advanced to 109.09 yen from 108.40 yen the previous day. In the currency markets, the euro fell to 88.92 cents from its New York close Tuesday of 90.93 cents. The dollar advanced to 109.09 yen from 108.40 yen the previous day.

London's FTSE index was depressed by a 6.7 percent drop in its largest component, mobile phone operator Vodafone AirTouch (VOD), while British Telecommunications (BT-A) fell 4.8 percent.

Business telecom operator Thus (THUS) was the FTSE 100's biggest decliner, falling 11.3 percent after posting a bigger-than-expected pretax loss of 63.1 million pounds ($99 million) for the year ended March 31. Rival telecom operator Energis (EGS) dropped 7.5 percent and Kingston Communications (KCOM) lost 2.7 percent.

Among technology stocks, hand-held computer maker Psion (PSON) was the worst performer, falling 9.9 percent, and chip designer ARM Holdings (ARM) lost 6.4 percent.

Media shares also lost ground, with financial information provider Reuters Group (RTR) down 5 percent, broadcaster Carlton Communications shed 4.9 percent and Pearson (PSON), the owner of the Financial Times, declining more than 6.6 percent.

Anglo-Dutch Unilever (ULVR), Europe's largest consumer-goods maker, fell 9.4 percent in London, a day after its unsolicited $18.4 billion offer for BestFoods (BFS: Research, Estimates) was rejected by the U.S. company.

Mining companies were the main beneficiaries in the declining market. Billiton (BLT) was the index's leading gainer, rising 6.7 percent, while rival Anglo American (AAL) added 3.3 percent and Rio Tinto (RTO) rose almost 1 percent.

Casino slides on merger bid

In Paris, computer chip maker STMicroelectronics (PSTM) was the worst performer, dipping 2.2 percent. Data network operator Equant (PEQU) lost 3.8 percent and technology consultant Cap Gemini (PCAP) dropped 3 percent.

France Telecom (PFTE) dropped 3.7 percent, construction-to- telecommunications firm Bouygues (PEN) slipped 3 percent, while Europe's largest pay-TV company, Canal Plus (PAN), fell 4 percent and missiles-to-media concern Lagardere (PMMB) slipped 3.4 percent.

Retailer Casino (PCO) fell 2.8 percent, the day after it announced plans to raise its stake in supermarket operator Monoprix to 50 percent by buying shares from department store retailer Galeries Lafayette (PGL). Rival Carrefour (PCO) lost 3.8 percent and luxury goods firm LVMH (LVMH) dropped 2.7 percent. Retailer Casino (PCO) fell 2.8 percent, the day after it announced plans to raise its stake in supermarket operator Monoprix to 50 percent by buying shares from department store retailer Galeries Lafayette (PGL). Rival Carrefour (PCO) lost 3.8 percent and luxury goods firm LVMH (LVMH) dropped 2.7 percent.

TotalFina (PFP) fell almost 3.5 percent after Goldman Sachs removed the oil and gas firm from its "recommended" list.

In Frankfurt, automaker BMW (FBMW) lost 2.3 percent as it continued to struggle to offload its British unit Rover. Deutsche Telekom (FDTE) dipped 6.7 percent ahead of the announcement of details of its planned share offering scheduled for the summer. Software publisher SAP [FSE:FSAP3] slipped 4.5 percent, and electronics and engineering giant Siemens (FSIE) lost 3.6 percent.

In Amsterdam, software developer Baan fell 13.4 percent amid renewed worries about its financial position. Finnish mobile-phone maker Nokia dropped 3.4 percent in Helsinki, while rival Ericsson fell almost 5 percent in Stockholm.

--from staff and wire reports

|

|

|

|

|

|

|