NEW YORK (CNNfn) - Treasury bonds ended sharply lower Thursday, their fourth consecutive session decline, on concern the Federal Reserve will hike rates aggressively in order to cool the booming economy.

In the currency markets, the dollar was dragged lower against the Japanese yen due to the yen's strength against both the euro and the British pound.

Bill Sullivan, senior economist at Morgan Stanley Dean Witter, said weakness among Treasury bonds was a reflection of negative sentiment prevailing at this time. "The market is trading very defensively. That is putting downward pressure on bond prices," he said.

Shortly before 3 p.m. ET, the 30-year Treasury bond fell 28/32 of a point in price to 101. The yield, which moves in the opposite direction to price, rose to 6.17 percent from 6.12 percent late Wednesday.

The 10-year note, which many now consider the market benchmark, dropped 13/32 to 100-10/32, its yield rising to 6.45 percent from 6.41 percent.

Indeed, with recent strong economic reports pointing to economic strength, market participants were defensive ahead of Friday's key April employment report. The data were expected to suggest continued tightness in the labor market.

Analysts surveyed by Briefing.com forecast non-farm payrolls to have  increased by 325,000 workers compared with 416,000 in March, and the unemployment rate to have dipped to 4 percent from 4.1 percent the previous month. increased by 325,000 workers compared with 416,000 in March, and the unemployment rate to have dipped to 4 percent from 4.1 percent the previous month.

"We're just marking time for tomorrow's jobs number," said Mike McGlone, analyst at IBJ Lanston Futures.

The latest economic news did little to alleviate concerns about surging interest rates. U.S. worker productivity, a measure of output, rose 2.4 percent in the first quarter, compared with a revised 6.9 percent growth in the fourth quarter, according to the Labor Department.

In a separate report, U.S. weekly jobless claims rose 20,000 to 303,000, still indicating a tight labor market.

Many analysts anticipate a half-percentage point hike at the upcoming Federal Open Market Committee (FOMC) meeting, scheduled May 16. The FOMC, the Fed's policy-making arm, has already tightened interest rates five times since June in a gradual manner.

But the economy continues to sizzle, and signs of inflation appear to be accelerating. Numerous Fed officials have signaled the Fed would hike rates until it sees signs of a slowdown.

Investors breathed a sigh of relief early in the session after Federal Reserve Chairman Alan Greenspan, addressing a banking conference in Chicago, made no comments about the economy or monetary policy.

Many had speculated the Fed chief would signal the possibility of a half-percentage point hike.

Despite the market's weakness, shorter-dated maturities, such as two-year notes ended little changed to slightly lower. Analysts said these issues benefited from the Treasury's announcement Wednesday that it would reduce the supply of two-year notes.

(Click here for a look at Briefing.com's economic calendar.)

Dollar slides vs. yen

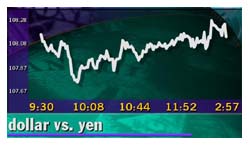

The dollar fell against the Japanese yen Thursday, trading in a large range between 107.70 yen to 109.61, as the Japanese currency strengthened  against both the euro and the British pound. against both the euro and the British pound.

Shortly before 3 p.m. ET, the dollar traded at 108.15 yen, down from 109.07 yen Wednesday, a 0.8 percent loss in the dollar's value.

However, price movement was exaggerated due to limited trading activity with the Japanese market closed in observance of the Golden Week holiday.

Meanwhile, the euro continued its plight against the dollar, falling to a record low at 88.45 cents in overnight trade, surpassing its previous low of 88.87 cents set Wednesday.

After bouncing back, it consolidated above the 89-cent level throughout the day. Analysts said traders were spooked by rumors that the European Central Bank bought euros to prop the ailing currency provided underlying support.

The euro traded at 89.09 cents, down from 89.53 cents Wednesday.

|