|

Wall Street rally caps week

|

|

May 5, 2000: 5:17 p.m. ET

Investors shop for bargains despite inflation woes; Dow and Nasdaq jump

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks rallied Friday, seemingly ignoring an April employment report showing surprising job growth and declining unemployment - signs that the surging economy refuses to slow down.

While the report suggested the economy is still soaring - news that in the past has triggered more than one sell-off -- analysts said Friday's buying spree could be a sign that investors have accepted the notion that the Federal Reserve will become more aggressive with its interest rate policy to manage the growth.

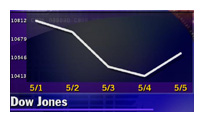

The Nasdaq composite index lost less than 1.1 percent this week, while the Dow Jones industrial average shed only 1.4 percent during the period. The choppy week yielded two straight session of record low volume on the Nasdaq as investors struggled to gauge what would happen with interest rates.

"If we got unemployment below 4 percent and average hourly earnings above 0.5 percent, I would have expected more selling," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "But we came in in the middle. The lack of volume this week indicated concern, and there have been people realizing a 50-point (one-half percent) rate hike might be coming, so that has been partially discounted."

The Nasdaq composite index gained 96.58 points, or 2.6 percent, to 3,816.53. The index fell around 43 points this week and is still 24 percent off from it March 10 high - a bear market by Wall Street's definition. The Nasdaq composite index gained 96.58 points, or 2.6 percent, to 3,816.53. The index fell around 43 points this week and is still 24 percent off from it March 10 high - a bear market by Wall Street's definition.

Meanwhile, the Dow jumped 165.37 points, or more than 1.5 percent, to 10,577.86. The blue chip index shed 156 points this week. The broader S&P 500 rose 23.25 to 1,432.63.

But the nation's two most closely watched indexes are still down for the year. The Nasdaq is off 6.2 percent in 2000, while the Dow has shed 8 percent.

Volume was light but market breadth remained modestly positive. Advancers beat decliners on the New York Stock Exchange 1,581 to 1,327, as more than 761 million shares changed hands. Winners topped losers on the Nasdaq by 2,232 to 1,702, on volume of more than 1.1 billion shares. Volume was light but market breadth remained modestly positive. Advancers beat decliners on the New York Stock Exchange 1,581 to 1,327, as more than 761 million shares changed hands. Winners topped losers on the Nasdaq by 2,232 to 1,702, on volume of more than 1.1 billion shares.

In currency markets, the dollar strengthened against the euro but slipped versus the yen. Treasury securities fell.

Investors absorb economic data

Analysts said investors have become more comfortable with the possibility that the Federal Reserve could act more aggressively on raising interest rates at its next policy meeting.

Economic indicators for the coming week include retail sales, and the Producer Price Index. While retail sales rarely move markets, the PPI shows prices at the wholesale level and could further cement the notion that interest rates are moving higher.

Bryan Poskorowski, market analyst at Prudential Securities, told CNNfn's Market Coverage that even with a half-point interest rate boost later this month, the markets will be choppy for the foreseeable future. (257K WAV) (257K AIFF)

The U.S. economy created 340,000 jobs in April, the government reported The U.S. economy created 340,000 jobs in April, the government reported

Friday, above the Briefing.com consensus forecast of analysts, while March's reading was revised upward, pointing to ongoing strength in the world's largest economy. The jobless rate fell to a 30-year low of 3.9 percent.

Average hourly earnings rose 6 cents an hour, or 0.4 percent, to $13.64, slightly higher than the expected 0.3 percent increase.

Federal Reserve Chairman Alan Greenspan warned U.S. bankers Thursday that they must not be lulled into complacency in managing risks, especially with sophisticated financial tools such as derivatives. But he otherwise refused to tip his hand on whether or not he and Fed policymakers meeting May 16 will boost interest rates -- and, if they do, whether they raise them by a quarter point or half point. Federal Reserve Chairman Alan Greenspan warned U.S. bankers Thursday that they must not be lulled into complacency in managing risks, especially with sophisticated financial tools such as derivatives. But he otherwise refused to tip his hand on whether or not he and Fed policymakers meeting May 16 will boost interest rates -- and, if they do, whether they raise them by a quarter point or half point.

While Greenspan declined to speculate, Federal Reserve Bank of San Francisco President Robert Parry said the Fed should follow its course of gradual rate increases to ease threats of inflation.

Bargain hunters find deals

Technology issues like Cisco Systems, Oracle, and Dell Computer led the Nasdaq composite index, while General Electric was the springboard for the rise on the Dow Jones industrial average.

"Investors feel that the Fed's action on Tuesday, May 16, has been priced into the market and it's safe to get back into the water," said Art Hogan, chief market analyst at Jefferies & Co.

But one analyst cautioned that the buying should not be viewed as a firm indication that the selling is over. "There are no signs here that give you the impression that the selling pressure has bottomed," said Richard Cripps, chief market analyst at Legg Mason Wood Walker. "There's just not a lot of conviction out there."

Still, technology stocks caught buyers' eyes. Cisco Systems (CSCO: Research, Estimates) jumped 4-1/8 to 67-3/4 after announcing it would acquire Internet software maker ArrowPoint Communications (ARPT: Research, Estimates) for roughly $5.7 billion in stock. ArrowPoint gained 5-3/8 to 140-3/16. Still, technology stocks caught buyers' eyes. Cisco Systems (CSCO: Research, Estimates) jumped 4-1/8 to 67-3/4 after announcing it would acquire Internet software maker ArrowPoint Communications (ARPT: Research, Estimates) for roughly $5.7 billion in stock. ArrowPoint gained 5-3/8 to 140-3/16.

Other technology leaders soared. Oracle (ORCL: Research, Estimates) gained 2-9/16 to 76-13/16, and Dell (DELL: Research, Estimates) soared 2-5/8 to 49-7/8. Cisco and Dell both report quarterly corporate earnings in the coming week.

The biggest Dow mover, General Electric (GE: Research, Estimates), surged 2-5/8 to 156-5/8 after announcing a 3-for-1 stock split. GE accounted for 27 of the Dow's points Friday.

Financial issues also advanced. Citigroup (C: Research, Estimates) gained 15/16 to 59-9/16 and American Express (AXP: Research, Estimates) rose 1-3/8 to 146-1/8.

R.J. Reynolds Tobacco (RJR: Research, Estimates) slipped 1/16 to 22-3/4 after reports that it may buy Nabisco (NGH: Research, Estimates), a move that would reunite companies that first joined during the 1980s flurry of corporate mergers. Nabisco rose 7/16 to 17-1/16.

BestFoods (BFO: Research, Estimates) advanced 1-1/2 to 63-9/16 after Unilever (UN: Research, Estimates) said it was ready to negotiate a buyout deal, lifting the deadline on its unsolicited $18.4 billion cash bid. BestFoods' brands include Hellmann's mayonnaise and Skippy peanut butter. Unilever shares gained 5/8 to 43-13/16.

Viruses not loved

The newly discovered "I Love You" virus swept through banks, securities firms and Web companies in the United States Thursday and later spawned copycat viruses.

McAfee.com (MCAF: Research, Estimates) gained 2-1/2 to 30-1/2 after releasing a software patch Thursday afternoon that can identify the virus. The makers of the best-selling VirusScan security software said that 60 to 80 percent of its Fortune 100 clients were infected by the virus.

Other companies associated with computer security were higher. Axent Technologies (AXNT: Research, Estimates) rose 1/8 to 19-7/8, Symantec (SYMC: Research, Estimates) fell 9/16 to 60-1/2, and British-based Baltimore Technologies (BALT: Research, Estimates) climbed 5 to 116-1/4.

|

|

|

|

|

|

|