|

IP raises Champion bid

|

|

May 10, 2000: 2:53 p.m. ET

U.S. paper firm gains upper hand in takeover battle; UPM still may respond

|

NEW YORK (CNNfn) - International Paper, the world's largest forestry and paper products firm, substantially raised its acquisition offer for Champion International Corp. Wednesday, trumping a sweetened bid from Finnish rival UPM-Kymmene and, analysts said, giving the Dow component the upper hand in the takeover battle.

IP raised its bid late Tuesday to about $9.6 billion in cash, stock and the assumption of debt. The new offer would give Champion (CHA: Research, Estimates) stockholders $75 for each of their shares, up from $64 under its original offer, while IP also would take on $2.3 billion in Champion debt.

The Purchase, N.Y.-based company said it raised its proposal after learning UPM had decided to boost the original all-stock deal agreed to by Champion in February to $70 a share cash, valuing the company at roughly $9.1 billion.

Champion said the IP (IP: Research, Estimates) bid - which equates to $50 a share in cash and the remainder in stock - is "superior" to the latest offer from UPM. However, UPM said it reserves the right to submit a fresh bid by the end of New York trading Friday  , as per its original agreement with Champion. , as per its original agreement with Champion.

A UPM spokeswoman said Wednesday that the company did not anticipate making any further announcements until at least Thursday, but some analysts doubted it would continue to try and top the deep-pocketed IP.

"We think that it may still be possible for UPM to return, but the $75 per-share price is getting near the top of the range that we considered fair considering other [merger] transactions in this sector, as well as the do-ability of making such a deal work financially," said Frances Loo, a forestry and paper analyst with UBS Warburg. "UMP definitely pauses [at this price] because it only gets a little more painful from there."

UPM surprised analysts by boosting its original stock-only offer, which had been worth $6.5 billion when Champion accepted the bid in February, although it had fallen in value to $5.5 billion as UPM's shares declined. IP last month responded to the UPM-Champion deal by launching an unsolicited $6.2 billion cash and stock bid of its own.

Analysts had criticized UPM's original offer as expensive -- a 30 percent premium to Champion's pre-offer price -- and have said it would not be able to generate such synergy from the takeover as a combination of the two U.S.-based companies.

"I would be very surprised if UPM came back again with a higher bid here," said Ann Torma, an analyst with Merrill Lynch. "I think they would just have a more difficult time generating the necessary synergies."

However, UPM officials maintained Wednesday they expected to generate a little more than $300 million in annual cost savings from the transaction by 2002.

IP, meanwhile, said its proposal would result in annual savings of $425 million, even with the addition of $1 billion to its bid. The company also announced plans earlier this year to shed $3 billion in non-core assets, a number many analysts said could now rise along with the sweetened Champion bid.

Analysts said Champion represents a nice strategic fit for both companies, particularly it has slimmed down in recent years and refocused its resources on its core paper operations. Analysts said Champion represents a nice strategic fit for both companies, particularly it has slimmed down in recent years and refocused its resources on its core paper operations.

But while analysts said IP would likely sell off some of Champion's vast timberland to wring even more cost savings out of the deal, such sales are more difficult for UPM, which still boasts no sizable North American presence.

"Strategically, this is more important for UPM than it is for International Paper," said Kathryn McAuley, an analyst with Browns Brother Harriman. "But it would be pretty hard for UPM to top this. They would really have to put up more than $75 in cash."

"I think $75 is a full price for Champion ... but we're dealing with the paper industry and we've seen companies go past the outer limits before," said Linda Lieberman, an industry analyst with Bear Stearns. "For UPM, this is about getting on continent and getting into the [paper] coating business, so there's a long-term strategic fit for them.

"Still, I have never seen IP lose assets for a dollar [per share] or two."

Analysts largely agreed that the only conceivable way for UPM to top IP's bid is to make a competitive all-cash offer, allowing the company to structure a slightly lower per-share bid and avoid Champion investors' concerns about swapping their shares for a foreign stock.

IP's $75 per share offer would add roughly 3 cents to this year's earnings and about 20 cents to next year's profit before amortization of goodwill, Loo said. After amortization, it would dilute IP's 2000 profits by about 20 cents this year, but add about 7 cents next year.

Although exact estimates were not immediately available for UPM's bid, analysts said the company would likely have a harder time selling a higher price to its shareholders.

"I think it's about an even-money proposition that UPM will come back with another offer," said Mark Wilde, an analyst with Deutsche Banc Alex. Brown. "The concern in the market is that either side is going to end up stretching it to $80 per share, and then it becomes a little more difficult to justify."

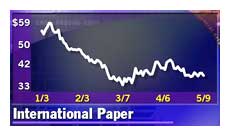

IP shares retreated 15/16 to 36-5/16 by mid-afternoon Wednesday, while Champion shares soared 5-7/8 to 72-3/16. The revised IP bid includes a collar guaranteeing Champion shareholders stock valued at no less than $34.50 per share, but does not include the $200 million break-up fee due UPM should its merger deal fall apart.

UPM (UPM: Research, Estimates) shares rose 1 percent higher to  31.30 in Helsinki Wednesday, after earlier rising as much as 4 percent in the wake of Champion's move to increase its terms. The company's American depository receipts rose 1-1/4 to 29-5/8 in afternoon trading on the New York Stock exchange. 31.30 in Helsinki Wednesday, after earlier rising as much as 4 percent in the wake of Champion's move to increase its terms. The company's American depository receipts rose 1-1/4 to 29-5/8 in afternoon trading on the New York Stock exchange.

|

|

|

|

|

|

|