|

Stocks to watch Thursday

|

|

May 10, 2000: 6:57 p.m. ET

Applied Materials, News Corp. beat estimates; Revlon names new CFO

|

NEW YORK (CNNfn) - After the bell Wednesday Rupert Murdoch's News Corp. announced that it exceeded Wall Street's expectations for the third quarter. And Applied Materials, which makes equipment used to manufacture computer chips, beat its second-quarter estimates.

Revlon Inc.

Cosmetics group Revlon Inc. said on Wednesday it appointed Douglas Greeff as chief financial officer and executive vice president, replacing Frank Gehrmann, who resigned.

The maker of Almay beauty products, which is based in New York and has annual revenue of $1.9 billion, also said it initiated three financial strategies for this year, which may help the company improve profits. Last week, Revlon reported a first quarter loss, its fourth consecutive quarterly shortfall, on rising costs and expenses.

A company spokesman could not be reached immediately.

Revlon's three-tier plan calls for redirecting funds to new, more productive marketing programs, improving both its cash flow and balance sheet, and aligning financial controls with its global business model, the company said.

Shares of Revlon (REV: Research, Estimates) slipped 1/4 to close at 7-13/16 on the New York Stock Exchange Wednesday.

SDL

Telecommunications equipment maker SDL Inc. on Wednesday said it has signed a definite agreement to acquire privately held Photonic Integration Research Inc. in a cash and stock deal valued at $1.8 billion.

In a statement, San Jose, Calif.-based SDL (SDL: Research, Estimates) said it is paying $31.25 million cash and about 10.2 million in its common shares for Photonic. The deal is expected to close by the end of the second quarter and be accretive to earnings from the date of closing.

Photonic, based in Columbus, Ohio, makes products that boost the performance of high-technology fiber optic communication systems. Adding its products to SDL will expand SDL's role in providing components for fiber optic systems, and give it technology that could boost performance and lower costs in next generation systems, SDL said.

Shares of SDL closed down 11 at 157-9/16 on the Nasdaq Wednesday.

Intellicorp Inc.

Business software provider Intellicorp Inc. on Wednesday posted a narrower third-quarter net loss than for the same period a year ago, but saw sales dip.

For the quarter ended March 31, the Mountain View, Calif.-based company reported a net loss of $2.8 million, or 17 cents a share, compared with a net loss of $1.6 million, or 12 cents a share in the year earlier quarter.

The loss includes the impact of one-time items. Excluding those items, Intellicorp reported a net loss of $2.7 million, or 16 cents a share compared with a net loss of $1.4 million, or 10 cents a share in the 1999 third-quarter.

Wall Street analysts did not issue a third-quarter 2000 earnings estimate for the company, according to earnings tracker First Call/Thomson Financial.

Revenue for the company fell to $4.5 million from slightly more than $5 million in the year-ago period.

Ken Haas, the company's chief executive officer, blamed the sluggish quarter on a general slowdown in demand for the kind of "back office" electronic business software it markets and a transition in the company's sales management.

However, sales of its CRM (customer relationship management) and eCRM business software systems and products rose in the quarter.

The company also announced a consulting agreement Wednesday with SAP America Inc. (SAP: Research, Estimates), a German-owned business systems support company to which Intellicorp will provide consulting support in setting up CRM business solutions systems.

Shares of Intellicorp (INAI: Research, Estimates) fell 3/16 to close at 1-11/16 on the Nasdaq Wednesday.

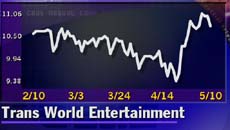

Trans World Entertainment Corp.

Music and video retailer Trans World Entertainment Corp. blew past Wall Street's first-quarter estimates Wednesday on the strength of a jump in overall sales.

The Albany, N.Y.-based owner of Record Town, Coconuts, The Wall and Saturday Matinee stores announced net income for the quarter ended April 29 excluding special items of $8.9 million, or 18 cents a share, compared with net income of $6.6 million, or 12 cents a share in the year-ago quarter.

Analysts surveyed by First Call/Thomson Financial had expected net income of 14 cents a share.

Revenue for the quarter rose to $310.1 million compared with the $287 million it posted in the year-earlier quarter.

Including a $25.7 million charge from last year's merger with Camelot stores, the company reported a net loss of $8.6 million, or 17 cents a share in the 1999 first-quarter.

The company also reported an 8 percent increase in same-store sales for the first-quarter of 2000.

Robert Higgins, Trans World's chairman and chief executive officer, attributed the strong quarter to operating improvements at Camelot stores. The company also reported the number of new visitors to its e-commerce Web site jumped to 2.6 million from 147,000 in the year-ago quarter. It also completed a $5 million stock repurchase program.

Shares of Trans World (TWMC: Research, Estimates) slipped 1/4 to close at 10-3/4 ahead of the earnings announcement Wednesday.

Power-One Inc.

Internet equipment manufacturer Power-One Inc., announced Wednesday a three-for-two split of its common stock.

The stock split for the Camarillo, Calif.-based company with $205.4 million in annual revenue, will take place in the form of a 50 percent stock dividend payable June 2 to stockholders of record May 24.

The company first told shareholders about the split at its meeting on Tuesday.

The dividend will increase the number of outstanding shares to about 36.4 million from 24.3 million.

Power-One employs more than 4,000 people worldwide.

Shares of Power-One (PWER: Research, Estimates) fell 6-7/16 to close at 71-1/4 on the Nasdaq Wednesday.

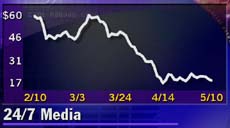

24/7 Media Inc.

24/7 Media Inc., one of the largest Internet advertising and technology companies, posted a much wider-than-expected first-quarter loss Wednesday.

For the quarter ended March 31, the New York-based company reported a net loss of $23.8 million, or 93 cents a share, compared with a net loss of $7.2 million, or 42 cents a share in the year-ago quarter.

Analysts surveyed by First Call had expected a net loss of 53 cents a share.

Excluding one-time items, the company's pro forma net loss was $11.2 million, or 44 cents a share, compared with a pro forma net loss of $5 million, or 29 cents a share in the year-earlier period.

Revenue for the quarter rose 25 percent to $46.2 million from $37.1 million in the year-ago period.

The company attributed the loss to costs associated with its merger with Exactis.com Inc. an e-mail marketing and communications company.

Shares of 24/7 (TFSM: Research, Estimates) fell 15/16 to close at 18-1/4 on the Nasdaq Wednesday.

After-hours quotes on CNNfn

Check S&P futures trading on Globex

At 8:30 a.m. Thursday, the Commerce Department is scheduled to release a report on retail sales excluding automobiles for the month of April. Automobile sales, which can be volatile, are reported separately.

Earlier this month, the government reported that retail sales grew 0.4 percent during March, down from the 1.8 percent reported in February, but still outpacing analysts' expectations of 0.2 percent.

The Labor Department will release a report on the prices of imported and exported goods for the month of April, also at 8:30 a.m.

Additionally at 8:30 a.m., the Labor Department is scheduled to release a report on the number of Americans filing for unemployment insurance for the first time for the week ended May 6.

For the week ended April 29, initial jobless claims rose to 303,000 from 283,000 the prior week, the government reported last week.

|

|

|

|

|

|

|