|

Bonds continue climb

|

|

May 10, 2000: 3:13 p.m. ET

Stock weakness, solid 10-year note auction lift prices; euro rises vs. dollar

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury bonds ended higher Wednesday, extending gains from the previous session as a further retreat in technology stocks and a successful 10-year note auction fueled buying.

In the currency markets, the euro rose against the dollar amid fears of central bank intervention, which should support the single currency.

With a lack of key economic news, the Treasury market was influenced by a weak stock market. In late trading, all three major stock indexes were sharply lower, including the Nasdaq composite index, which fell more than 4 percent. Investors often shift money into the relative safety of government securities when stock markets are weak.

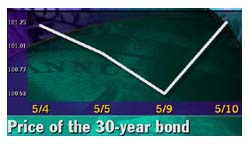

Shortly before 3 p.m. ET, the 30-year Treasury bond rose 15/32 of a point in price to 101. The yield, which moves in the opposite direction to price, fell to 6.17 percent from 6.22 percent Tuesday. Shortly before 3 p.m. ET, the 30-year Treasury bond rose 15/32 of a point in price to 101. The yield, which moves in the opposite direction to price, fell to 6.17 percent from 6.22 percent Tuesday.

The 10-year note, which many now consider the market benchmark, gained 18/32 to 100-11/32, its yield retreating to 6.44 percent from 6.53 percent.

Analysts said the results of the Treasury's auction of $8 billion of 10-year notes were solid. In the second part of its quarterly refunding, the notes were sold at a rate of 6.475 percent and drew a bid-to-cover ratio -- which is the number of bids received compared with the number of bids accepted -- of 2.62 to 1.

Tuesday's sale of $12 billion in five-year notes went smoothly.

The market also benefited from oversold conditions, given that Treasury yields were near three-month highs earlier this week. "It doesn't take much to turn  the market around when technical conditions are oversold," said Josh Stiles, senior bond strategist at IDEAglobal.com. "That in itself is going to attract buyers." the market around when technical conditions are oversold," said Josh Stiles, senior bond strategist at IDEAglobal.com. "That in itself is going to attract buyers."

Nevertheless, many investors were cautious ahead of Tuesday's Federal Open Market Committee (FOMC) meeting. Most analysts expect the FOMC, the Fed's policy-making arm, to hike interest rates by a half-percentage point to slow the economy.

The central bank has boosted interest rates five times since June, each time by a quarter-percentage point. But the economy remains strong and its gradual tightening approach has had little impact.

Mike Ryan, senior fixed income strategist at PaineWebber, said the Fed should be more vigilant in its effort to curb inflation. He told CNN's "Before Hours" a quarter-percentage point (25 basis point) hike would be considered a "half measure." (291K WAV) (291K AIFF)

Michelle Girard, strategist at Prudential Securities, told CNN's "Ahead of the Curve" investors were already looking ahead to the next FOMC meeting in June. (292K WAV) (292K AIFF)

Investors also face another hurdle -- Thursday's retail sales report. Analysts polled by Briefing.com forecast retail sales to have increased 0.5 percent in April compared with a 0.2 percent gain in March. Sales excluding autos are expected to increased 0.5 percent against a 0.9 gain in the previous month.

(Click here for a look at Briefing.com's economic calendar.)

Euro rises against dollar

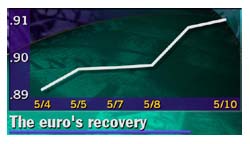

The euro continued to strengthen against the dollar Wednesday. In the absence of economic news, the advance was driven primarily by increased speculation of central bank intervention, which may boost the currency.

Ben Strauss, vice president of foreign exchange at Bank Julius Baer, said he saw good euro buying not only against the dollar, but against other European currencies and the yen.

However, analysts questioned how sustainable the euro's gains were, given there was no change in economic fundamentals. "We are entering a pre-FOMC lull," said Alex Beuzelin, senior market analyst at Ruesch International. "Rumors and speculation are what's driving the market at this point in time."

Beuzelin expects the euro to succumb to selling pressure once the Fed meeting is over.

Shortly before 3 p.m. ET, the euro traded at 90.96 cents, up from 90.78 cents Tuesday, a 0.2 percent loss in the dollar's value. Last week, the euro set an all-time low at 88.45 cents. Shortly before 3 p.m. ET, the euro traded at 90.96 cents, up from 90.78 cents Tuesday, a 0.2 percent loss in the dollar's value. Last week, the euro set an all-time low at 88.45 cents.

The British pound also garnered attention after it hit a four-year low against the dollar. Analysts attributed the decline to a Bank of England quarterly inflation report, which increased the likelihood interest rates will remain steady in Britain in the near term.

Meanwhile, the dollar traded mostly in a narrow range against the yen, changing hands at 109.42 yen from 109.27yen Tuesday.

|

|

|

|

|

|

|