|

Wednesday's after-hours trade

|

|

May 10, 2000: 9:40 p.m. ET

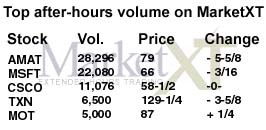

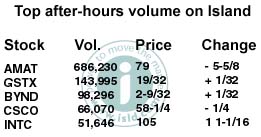

Applied Materials is hit hard; Cisco levels out; Motorola's plummet ebbs

|

NEW YORK (CNNfn) - Responding in equal measures to the recent instability in tech stocks and newly issued earnings reports, investors built on the trends of the regular session in after-hours trading.

Despite the news that Applied Materials (AMAT: Research, Estimates) had matched Wall Street's fiscal second-quarter earnings estimates, shares of the semiconductor equipment manufacturer continued their regular session slip in after-hours trading. The shares plummeted 5-5/8 to 79 and were the most heavily traded issue on both MarketXT and Island Ecn.

Cisco Systems (CSCO: Research, Estimates) saw its shares remain active, but mostly flat in after-hours trading. The data-networking equipment supplier saw its shares stabilize at 58-1/2 on MarketXT and drop 1/4 to 58-1/4 on Island. The company posted a fiscal third-quarter operating profit of 14 cents per share after the bell Tuesday, topping Wall Street's forecasts by a penny. Cisco Systems (CSCO: Research, Estimates) saw its shares remain active, but mostly flat in after-hours trading. The data-networking equipment supplier saw its shares stabilize at 58-1/2 on MarketXT and drop 1/4 to 58-1/4 on Island. The company posted a fiscal third-quarter operating profit of 14 cents per share after the bell Tuesday, topping Wall Street's forecasts by a penny.

Microsoft (MSFT: Research, Estimates) shares were active but nearly flat following its response to the government's proposed antitrust remedy that would break the software giant into two separate companies. Shares traded at 66, down 3/16 on MarketXT, where it was the second most active issue.

GST Telecommunications (GSTX: Research, Estimates) saw its shares stagnate on a warning that it is suffering a cash crunch that could lead it to seek bankruptcy protection. The provider of telecommunications products and services saw its shares rise 1/32 to 19/32 as the second most heavily-traded issue on Island.

Shares of Motorola (MOT: Research, Estimates) were mixed in after-hours trading, rising 1/4 to close at 87 on MarketXT. Shares of the world's second biggest mobile phone producer have lost $11.1 billion in market capitalization since Tuesday, Shares of Motorola (MOT: Research, Estimates) were mixed in after-hours trading, rising 1/4 to close at 87 on MarketXT. Shares of the world's second biggest mobile phone producer have lost $11.1 billion in market capitalization since Tuesday,

following an analyst downgrade by Salomon Smith Barney. The firm lowered its price target for Motorola to $120 from $200.

|

|

|

Island

MarketXT

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|