|

Bonds advance pre-FOMC

|

|

May 15, 2000: 3:04 p.m. ET

Gains considered technical ahead of Fed meeting; dollar climbs vs. yen, euro

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury securities ended moderately higher Monday, benefiting from oversold conditions one day ahead of the Federal Reserve's much-anticipated decision on interest rates.

In the currency markets, the dollar rose against both the yen and the euro. Analysts forecast the U.S. currency to continue to gain strength due to expectations of rising interest rates from the Fed.

Analysts said the Treasury market's advance was largely technical on the heels of last week's losses. "What you're seeing is a technical bounce back from an oversold environment," said Bill Sullivan, senior economist at Morgan Stanley Dean Witter.

But trading activity was extremely quiet, as many participants were sidelined awaiting the Fed results.

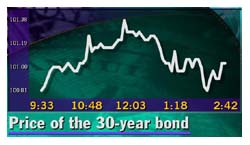

Shortly before 3 p.m. ET, the 30-year Treasury bond rose 11/32 of a point in price to 101-1/32. The yield, which moves inversely to price, fell to 6.17 percent from 6.20 percent Friday. Shortly before 3 p.m. ET, the 30-year Treasury bond rose 11/32 of a point in price to 101-1/32. The yield, which moves inversely to price, fell to 6.17 percent from 6.20 percent Friday.

The 10-year note, which now is considered by many as the market benchmark, gained 11/32 to 100-7/32, its yield retreating to 6.46 percent from 6.50 percent.

Awaiting the Fed

The decision on interest rates from the Federal Open Market Committee (FOMC), the Fed's policy-making arm, is expected Tuesday afternoon. Analysts said the market has already priced in a half-percentage point (50 basis point) rate increase.

"Everyone knows they're going to raise rates 50 basis points," said Vinnie Verterano, director of government trading at Nomura Securities. "There's no surprise."

In an effort to slow the economy and curb inflation, the FOMC has hiked  interest rates five times since June, each time by a quarter-percentage point. The gradual tightening has brought the federal funds rate, the rate banks charge each other for borrowing money, to 6 percent. interest rates five times since June, each time by a quarter-percentage point. The gradual tightening has brought the federal funds rate, the rate banks charge each other for borrowing money, to 6 percent.

Despite the hikes, the economy continues to heat up, and the belief is widespread that the Fed will boost rates by half a percentage point. If this increase occurs, it will be the first time since 1995 that the Fed has hiked rates by that much.

Investors also will pay close attention to any policy statement that accompanies the Fed action, which may provide clues about the Fed's willingness to tighten further. Morgan Stanley Dean Witter's Sullivan said if the statement indicates the hike will be the last for a while, Treasurys may rally.

But any hints of aggressive tightening going forward may impact upon the market negatively. Bill Cunningham, chief bond strategist at Chase Securities, told CNN's Before Hours investors should expect the statement to show that the Fed remains vigilant on inflation. (315K WAV) (315K AIFF)

Along with the Fed, investors face a key economic report Tuesday - the April Consumer Price Index (CPI), a measure of inflation at the retail level.

Analysts polled by Briefing.com forecast a 0.1 percent increase in CPI, and a 0.2 percent gain in the core rate, which excludes food and energy prices.

Meanwhile, the latest economic news weighed in favor of an aggressive rate boost, according to analysts. U.S. industrial production, which measures production at mines, factories and utilities, rose 0.9 percent in April compared with a revised 0.7 percent increase in March, according to the Federal Reserve. Capacity utilization rose to 82.1 percent from 81.7 percent in March.

(Click here for a look at Briefing.com's economic calendar.)

Analysts said longer-dated maturities, such as 30-year bonds, also received support ahead of this week's buyback operation. The buyback, or reverse auction, is the fifth leg of the Treasury's ongoing program to retire some longer-term maturities.

The government will announce the terms of its next repurchase Wednesday and will conduct the operation Thursday. So far this year, the Treasury has repurchased $7 billion in longer-dated securities.

The government said earlier this month it will conduct the buybacks twice a month until the next quarterly refunding in August. In order to trim outstanding debt, the Treasury announced plans in January to repurchase up to $30 billion of older, longer-term debt securities.

Dollar rises vs. yen, euro

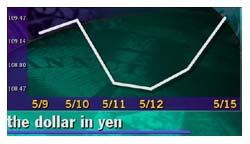

The dollar advanced against both the yen and the euro Monday with the FOMC meeting also the key focus among currency traders. With expectations of credit tightening in the United States, the Fed is viewed as being on a path that other central banks, such as the European Central Bank and the Bank of England, are unable to match.

As a result, Paul Podolsky, strategist at FleetBoston in Boston, said he expects the dollar to strengthen in the months ahead against the major currencies.

The dollar recovered some of its recent losses against the yen, hitting a high of 109.59 yen, near the psychologically significant 110-yen level. Shortly before 3 p.m. ET, the dollar traded at 109.47 yen, up from 108.74 yen Friday, a 0.7 percent gain in its value. The dollar recovered some of its recent losses against the yen, hitting a high of 109.59 yen, near the psychologically significant 110-yen level. Shortly before 3 p.m. ET, the dollar traded at 109.47 yen, up from 108.74 yen Friday, a 0.7 percent gain in its value.

Meanwhile, the euro was at 91.25 cents against the dollar, down from 91.83 cents Friday.

|

|

|

|

|

|

|