NEW YORK (CNNfn) - Treasury securities ended mixed Tuesday, with longer-dated maturities posting solid gains on the back of the Federal Reserve's half-percentage-point rate hike.

However, shorter-dated maturities, such as two-year notes, were under pressure, reacting to speculation of more credit tightening in the near term.

In the currency markets, the dollar rose against the major currencies. One analyst said the Fed action enhances the U.S. currency's interest rate appeal relative to the euro, pound and yen.

The Federal Reserve increased the federal funds rate, the rate banks charge each other for borrowing money, by a half a percentage point to 6.5 percent, in line with expectations. The half-percentage-point boost is the largest hike in more than five years and represents a more aggressive stance.

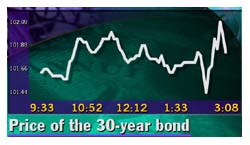

Shortly before 3 p.m. ET, the 30-year Treasury bond rose 22/32 of a point in price to 101-31/32. The yield, which moves in the opposite direction to price, fell to 6.10 percent from 6.17 percent. Shortly before 3 p.m. ET, the 30-year Treasury bond rose 22/32 of a point in price to 101-31/32. The yield, which moves in the opposite direction to price, fell to 6.10 percent from 6.17 percent.

The 10-year note, which many now consider the market benchmark, gained 10/32 to 100-20/32, its yield retreating to 6.41 percent from 6.46 percent.

Treasury securities advanced ahead of the Fed decision. Following the action, the central bank said in a statement it remained concern about inflation risks going forward.

"The Committee is concerned that this disparity in the growth of demand and  potential supply will continue, which could foster inflationary imbalances that would undermine the economy's outstanding performance," the Fed statement said in part. potential supply will continue, which could foster inflationary imbalances that would undermine the economy's outstanding performance," the Fed statement said in part.

"The Fed is remaining vigilant against inflation, which helps 10-year notes and 30-year bonds," said Jeff Palma, economist at UBS Warburg. "But two-year notes still have to deal with the likelihood of higher interest rates this year."

Shorter-dated maturities are more sensitive to changes in monetary policy.

Tuesday's rate increase marks the sixth hike since June in the Fed's credit tightening cycle. In addition, the Fed increased the discount rate, the rate it charges its member banks for loans, by a half a percentage point to 6 percent.

A tame inflation report released early in the day failed to alter the Fed's aggressive stance. The Consumer Price Index (CPI), a measure of inflation at the retail level, was unchanged in April, according to the Labor Department. The core rate, which excludes volatile food and energy prices, rose 0.2 percent.

Another economic report had little market impact. The Commerce Department said housing starts rose 2.8 percent in April to a 1.66 million annual rate. The figure was in line with Wall Street expectations.

(Click here for a look at Briefing.com's economic calendar.)

The market also shrugged off testimony from officials of quasi-government agencies including Fannie Mae and Freddie Mac. Earlier in the day, the executives spoke before a House banking subcommittee regarding their stance on proposed legislation that could overhaul the status of their organizations.

Analysts said the testimony provided no new information. Movements in the agency debt market have been closely watched since March, when Treasury official Gary Gensler said the government supported legislation to reduce the perception that agency securities are backed by the full faith and credit of the U.S. government.

Analysts forecast this week's buyback operation to be supportive for longer-dated securities. The government is expected to announce Wednesday the terms of its fifth repurchase in its ongoing program to repurchase up to $30 billion of longer-term debt this year.

Since its first buyback operation in early March, the Treasury has repurchased $7 billion in longer-dated securities. The next operation is expected Thursday.

Dollar rises vs. yen, euro

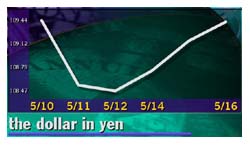

The dollar rose against the major currencies Tuesday. Although currency market participants did not react strongly to the rate hike, analysts said the Fed action was positive for the dollar.

"It enhances the dollar's interest rate appeal relative to the euro, pound and yen," said Alex Beuzelin, senior market analyst at Ruesch International.

The dollar recovered from early session losses against the yen, rising as much as 109.93 yen. The U.S currency once again tested the key 110-yen level, highlighting the gap between the United States and Japanese interest rates.

Shortly before 3 p.m. ET, the dollar traded at 109.43 yen, up from 109.14 yen Monday, a 0.3 percent gain in the dollar's value. Meanwhile, the euro was at 90.34 cents, down from 90.80 cents Monday. Shortly before 3 p.m. ET, the dollar traded at 109.43 yen, up from 109.14 yen Monday, a 0.3 percent gain in the dollar's value. Meanwhile, the euro was at 90.34 cents, down from 90.80 cents Monday.

|