NEW YORK (CNNfn) - Regardless of how much the Fed raises rates on Tuesday, you still need to make smart bets with your investments. And that means looking for good long-term fund winners.

Any mutual fund expert will say you can't predict which funds will do best amid rising interest rates. "It's a total guess," said Morningstar analyst Kunal Kapoor.

Also in this column, net redemptions in funds last week indicate investors may still be betting on a rally; SchwabFunds launches four focus funds; plus, see which fund company's Web site gets top honors.

Given the market's heightened volatility of late, a buy-and-hold strategy may be just the thing. CNNfn.com looked for some good long-term winners that have delivered strong year-to-date returns, according to figures tracked by Morningstar.

- The five-star health fund Eaton Vance Worldwide boasts a 35.1 percent return through May 12. On a five-year annualized basis, it has delivered a 32 percent return.

- The mid-cap, socially screened blend fund Parnassus rose 20.9 percent year to date and 19.3 percent on a five-year basis.

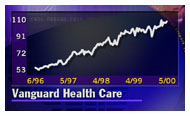

- Vanguard Health Care, meanwhile, climbed 20.33 percent through May 12, and 30.12 percent on average over five years. It was ranked by Money magazine as one of the best 100 mutual funds.

- Investors in the large-cap Smith Barney Aggressive Growth Fund have seen a 7.9 percent return on their money so far this year and a 31.6 percent return for the past five years.

- The mid-cap value Strong Opportunity Fund, another Money 100 pick, has also held its own in a tough market, rising 7.29 percent year to date and 23.07 percent on a five-year annualized basis.

If you're looking for a fund to weather a rate hike better than others in the short-term, your money might be better served in a fund heavy on healthcare and consumer durables rather than financials, Kapoor said.

He nevertheless noted that financials can hold up quite well in the long-term.

You also might consider short-term bond funds, which tend to hold their ground better than other types of bond funds amid rising rates, said Morningstar analyst Sarah Bush. She added that inflation-indexed bond funds are another possible option since they can be less sensitive to interest rate fluctuations. That's because the principals of the bonds they invest in are adjusted to account for inflation, the very thing a rate hike is intended to combat.

Three rocky days in May

Investors may be whipsawed by volatility, but they seem to be keeping their collective chin up in the face of steep downturns on Wall Street, at least judging from redemption numbers compiled by mutual fund researcher Trim Tabs.

Between May 8 and May 10, the Nasdaq threw off a whopping 11.3 percent, while the S&P 500 lost 3.5 percent and the Dow shed about 2 percent. U.S. equity funds as a group felt the pinch, experiencing a total of $7.6 billion in redemptions in the three days ended May 11, according to Trim Tabs.

Check how your mutual funds are faring

But, said the firm's research director Carl Wittnebert, the fact that emerging growth funds -- a barometer of investor optimism -- lost a mere $1 million in that three-day period is some indication the public is not overly concerned about the sell-off.

"That's a vote of confidence in the market to me," Wittnebert said, noting that more than $19 billion are invested in the funds, which bet heavily on small, rapidly growing companies.

What's more, he added, outflow from equities was a modest $1.6 billion on Thursday -- one day after the net asset value in equity funds declined 3.1 percent.

Nevertheless, "the volatility has taken its toll," he said, at least when it comes to new cash flow. If the entire month of May follows the pattern set in the first 11 days of the month, equity funds will only see $7.4 billion in new cash, far below the average monthly flow of $43.4 billion in the first quarter, Wittnebert said.

But investors might still prove more bullish than bearish. If the first two weeks of the month are any indication, high-risk aggressive growth funds would see $9.1 billion in net inflows for May while the more conservative growth and income funds would lose $2.4 billion in net outflows, Wittnebert said.

Schwab gets focused

If you're feeling cutting edge but don't want to bet the bank on just a few sexy but volatile sector darlings, SchwabFunds wants to help.

The 14th largest mutual fund family said Monday it is introducing four focus funds -- in communications, technology, health care and financial services. Each has an expense ratio of 0.89 percent and requires a minimum investment of $5,000.

Early birds get a price incentive: If you sign up before June 30, you can get into a fund at the subscription offering price of $10 per share.

Focus funds, which let you invest in a highly select mix of stocks within a sector, are not for the poorly diversified or faint of heart. They can experience big swings in performance, and experts recommend you include them in your portfolio only if they augment -- not replace -- your core fund holdings.

More bragging rights

As if competing for high returns isn't hard enough, now there is another way fund companies can jockey for position.

Financial services research firm Dalbar Inc. has just released its quarterly Top 10 Mutual Fund Consumer Web Sites. It graded sites in terms of ease of use, editorial content and functionality.

For the first quarter of 2000, INVESCO took the No. 1 spot. Vanguard came in a close second, followed by Strong and AIM. American Century and Fidelity tied for 5th place; Oppenheimer came in seventh; and Scudder, T. Rowe Price and Van Kampen all shared the No. 8 spot.

|