|

U.S. sees China bonanza

|

|

May 22, 2000: 11:06 a.m. ET

Enticed by Chinese market, U.S. businesses press for trade pact

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - As a sharply divided U.S. Congress prepares to vote on a landmark bilateral trade pact with China, Indiana pig farmer John Hardin sees the bitter debate boiling down to one key issue: For American farmers, he says, the prospect of cracking the elusive Chinese market represents a golden opportunity.

China, a country of nearly 1.3 billion people that for years has entranced U.S. businesses hoping to boost exports of everything from cars to computers to cell phones, accounts for roughly half of the world's total pork consumption, according to an industry trade group. But despite the potential bonanza, Beijing's high tariffs on imports have put the Chinese market virtually off-limits for U.S. pork manufacturers.

"This is the kind of thing that we need to do to keep faith with the American farmer," said Hardin, whose farm outside Danville, Ind., produces about 10,000 pigs a year.

"And I think for me -- if you look at it as a citizen of the United States, instead of just as a pig farmer -- we should either engage the Chinese and bring them into the world system, or we keep them isolated," he said. "I'd certainly rather have the Chinese play by our rules rather than by some others."

From the American heartland to Silicon Valley to the Hollywood hills, the vast majority of U.S. businesses are gunning for Congress to ratify the deal, which is the biggest trade vote to face lawmakers since the North American Free Trade Agreement (NAFTA) in 1993. The House of Representatives is expected to vote on the pact Wednesday. From the American heartland to Silicon Valley to the Hollywood hills, the vast majority of U.S. businesses are gunning for Congress to ratify the deal, which is the biggest trade vote to face lawmakers since the North American Free Trade Agreement (NAFTA) in 1993. The House of Representatives is expected to vote on the pact Wednesday.

Under the Clinton administration-brokered agreement, the United States would accord permanent normal trade relations (PNTR) status -- previously called "most-favored-nation" status -- on Beijing. The measure would replace a 20-year-old policy of annual reviews that provided a yearly forum for China's critics to attack the Communist country's human rights and environmental record, as well as its stance toward Taiwan and Tibet.

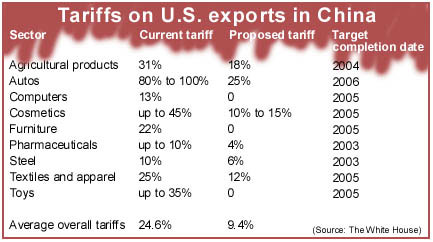

In return for permanent normalized trade relations, China would open up its markets for agriculture, telecommunications, banking, entertainment and a slew of other sectors, reducing high tariffs on U.S. products and eliminating arcane trade policies that have made it tough for American firms to do business there.

Passage of the bill also would help pave the way for China's accession to the World Trade Organization, the 136-nation, Geneva-based group that sets and enforces international trade policy. China, struggling to modernize its economy and create new jobs, has tried unsuccessfully for the past 14 years to join the WTO and its predecessor, the General Agreement on Tariffs and Trade. Passage of the bill also would help pave the way for China's accession to the World Trade Organization, the 136-nation, Geneva-based group that sets and enforces international trade policy. China, struggling to modernize its economy and create new jobs, has tried unsuccessfully for the past 14 years to join the WTO and its predecessor, the General Agreement on Tariffs and Trade.

Critics say the legislation would reward China while providing no incentive for the country to improve human rights. Labor unions charge that U.S. corporations will be enticed to shift operations to low-wage plants in China, endangering U.S. jobs and triggering a flood of cheap Chinese imports - such as apparel, shoes and toys - on the U.S. market.

"This is a bill that's written to benefit technology and media and retailers, and has very little to do with people who make things," argues Chris Chafe, national political director of the Union of Needle Trades, Industrial and Textile Employees (UNITE).

Organized labor, determined not to see a repeat of its loss over NAFTA, has lobbied Congress heavily to defeat the China pact.

Supporters, however, say the agreement represents a boon for American business and that expanding free trade in China will encourage the country to become more responsive to Western concerns.

"The bottom line is that the bilateral agreement is the proverbial one-way deal," said Calman J. Cohen, president of the Emergency Committee for American Trade, a Washington-based lobbying group backed by General Motors (GM: Research, Estimates), Boeing Co. (BA: Research, Estimates), Chase Manhattan Bank (CMB: Research, Estimates), Bestfoods Inc. (BFO: Research, Estimates) and other big U.S. companies. "The U.S. opens its markets no further than they are, while the Chinese open their markets from A to Z."

The House vote is considered too close to call, with neither side having the necessary 218 votes needed to approve or defeat the measure, according to recent published surveys. Last week, however, a deal was reached on companion legislation to monitor human rights in China, a move that could sway some undecided Democrats to vote for the bill.

The bill is expected to sail through the Senate.

Strong corporate backing

Corporate America is salivating at the prospect of gaining greater access to the Chinese market, which is cultivating a new stratum of middle-class consumers eager for a wide range of Western products. Already, China is the United States' fourth-largest trading partner, after Canada, Japan and Mexico, but the transactions are heavily one-sided: Chinese exports to the U.S. totaled about $81.8 billion last year, while U.S. exports to China totaled about $13.1 billion, according to Commerce Department figures.

The roster of blue-chip businesses supporting the trade pact is voluminous - including Motorola Inc. (MOT: Research, Estimates), Intel Corp., (INTC: Research, Estimates) Citigroup (C: Research, Estimates), Caterpillar Inc. (DAT: Research, Estimates) and American International Group Inc. (AIG: Research, Estimates) to name a few. The roster of blue-chip businesses supporting the trade pact is voluminous - including Motorola Inc. (MOT: Research, Estimates), Intel Corp., (INTC: Research, Estimates) Citigroup (C: Research, Estimates), Caterpillar Inc. (DAT: Research, Estimates) and American International Group Inc. (AIG: Research, Estimates) to name a few.

"We believe that with PNTR, we will be better able to do business," said Linda Ulrey, a spokeswoman for Procter & Gamble (PG: Research, Estimates), the Cincinnati-based consumer products maker, which currently does about $1 billion worth of business in China each year, out of total revenue of $38 billion. "What we would expect to see are improvements in trading and distribution rights, safeguards on our investments and the removal of technical barriers to trade."

The deal calls for China to reduce the average tariff on U.S. products from about 24.6 percent to 9.4 percent over the next five years, with the biggest reductions coming in the automobile and agriculture sectors. On some goods, such as computers and other high-tech products, tariffs would be eliminated entirely.

A boon for high-tech

For the high-tech industry, the Chinese market is seen as particularly attractive.

China is expected to become the third-largest market for semiconductors by next year, after the United States and Japan, while it already ranks second in cellular phone usage, according to the U.S. High-Tech Industry Coalition on China, which has called the bilateral trade pact the "single most important priority" facing the high-tech industry.

Many U.S. high-tech companies, such as Texas Instruments (TI: Research, Estimates) and Intel, already have operations in China, but trade barriers handed down by the Chinese government have stymied their business. Before they can invest in China, many are required to enter joint ventures with state-owned companies and they face sharp restrictions on distribution and product servicing rights. Many U.S. high-tech companies, such as Texas Instruments (TI: Research, Estimates) and Intel, already have operations in China, but trade barriers handed down by the Chinese government have stymied their business. Before they can invest in China, many are required to enter joint ventures with state-owned companies and they face sharp restrictions on distribution and product servicing rights.

"It's a tough vote for many members, but we do want them to know that it is our number one priority, bar none," said Jim Whittaker, director of international government affairs at Hewlett-Packard (HWP: Research, Estimates) and chairman of the high-tech coalition. "It's a tough vote for many members, but we do want them to know that it is our number one priority, bar none," said Jim Whittaker, director of international government affairs at Hewlett-Packard (HWP: Research, Estimates) and chairman of the high-tech coalition.

Internet companies - such as America Online Inc. (AOL: Research, Estimates) (which is buying CNNfn parent company Time Warner Inc.) and Yahoo! Inc. (YHOO: Research, Estimates) -- also are itching at the prospect of getting a greater foothold into China's nascent Web industry.

There were nearly 9 million Internet users in China in 1999, only a fraction of the country's population. That figure is expected to easily double this year. High-tech companies say that the Internet, perhaps more than any other industry, has the potential to revolutionize Chinese society, unleashing a flood of information and a forum for debate on the country's policies that the government will be unable to ban.

"China is expected to be the third-largest Internet economy by 2003. That certainly behooves any company in the Internet industry to have China on its radar for its worldwide expansion plans," said Wei-Tai Kwok, president of Dae Interactive, a San Francisco-based company that designs multilingual Web sites for U.S. businesses. "It's certainly widely anticipated that they will enter the WTO ... and all of us in the business will look forward to that."

However, not all U.S. businesses support the pact.

The American Textile Manufacturers Institute, which represents companies such as Burlington Industries Inc. (BUR Research, Estimates) and Springs Industries Inc. (SMI: Research, Estimates), says the agreement would do little to reduce illegal smuggling of textiles and apparel into the U.S. by China, the world's largest textile producer.

Instead, institute president Carlos Moore says, the trade pact would reward China for its flouting of previous international trade agreements, giving it a mere four years until it can begin exporting textiles without duties, compared with a 10-year ban for all other WTO countries.

"Most other industries look at China as a market opportunity, but unique to our industry, our government is actually giving China greater access to our market than they did to any other WTO-member country," he said.

A lost opportunity

Advocates of the deal say that if Congress votes down the bill, then China will extend to other countries the market-opening measures denied by Washington.

"China is going to become a member of the WTO, whether we grant PNTR or not," said Steven Cohen, a spokesman for the National Pork Producers Council. "There are other countries that are just poised to service that market if we don't."

The European Union last week reached a trade accord with China after four months of on-again, off-again negotiations. Like their U.S. counterparts, businesses in Europe and elsewhere in Asia are pushing for opportunities to gain access to the Chinese market.

Meanwhile, advocates say, the benefits of the trade deal won't just be for big business.

While major U.S. corporations seeking to operate in China face major difficulties, at least they currently can get in there to some extent, says Eric Biel, deputy undersecretary for international trade at the Commerce Department, which has spearheaded the Clinton administration's lobbying efforts for the bill. He said smaller companies that have no operations in China at all stand to benefit greatly from reduced tariffs.

"A lot of people think China, and they think that this is a forbidding market," he said. "One of the key benefits is that this really hits home on Main Street, and not just in corporate board rooms."

One company that has operated in China since 1981 says that the deal will help improve the lives of individual Chinese, making the country a greater participant in the international community. One company that has operated in China since 1981 says that the deal will help improve the lives of individual Chinese, making the country a greater participant in the international community.

Windmere-Durable Holdings Inc., a household appliance manufacturer now known as Applica (APN: Research, Estimates) Inc., operates a plant in Guangdong province, on the Chinese mainland about 40 miles from Hong Kong.

The company, which makes toasters and steam irons under the Black & Decker label, employs about 13,000 workers in China. The firm says it will not be affected directly by the terms of the trade bill because it sells most of its products in Western countries rather than in China itself, but says that it supports the measure because the expected influx of Western investment resulting from expanded trade ties should improve overall economic conditions there.

"From my experience, their lives have improved drastically - they might make 10 times a month or more what their parents would make working for the government," CEO David Friedson said of the company's workers.

Calman Cohen, of the Emergency Committee for American Trade, added that the debate should not be seen as "a choice between trade and values."

"As Americans we want to see China move in a democratic direction," he said. "The market has a tremendous force for breaking down barriers and giving the Chinese a more open life."

|

|

|

|

|

|

|