|

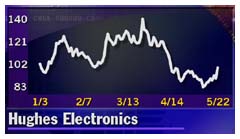

GM limits Hughes swap

|

|

May 22, 2000: 2:10 p.m. ET

Demand gives GM shareholders only 25% of the exchange they sought

|

NEW YORK (CNNfn) - General Motors Corp. said its offer to swap shares of its Hughes Electronics tracking stock for its own common shares was oversubscribed, forcing it to limit shareholders to exchanging 25 percent of the GM shares they had hoped to replace.

The offer, announced in February, gives shareholders 1.065 shares of the Hughes (GMH: Research, Estimates) tracking stock for each share of GM �(GM: Research, Estimates) stock accepted in the tender offer. The offer closed Friday.

The news of the over subscription sent shares of Dow component GM down sharply in early trading, as GM shareholders dumped shares they had hoped would get them Hughes stock at a bargain price.

Analysts said the value of the GM stock had been inflated and Hughes stock depressed since the ratio between the two shares was set April 20, and that the completion of the offer unlocked the two issues to return to their underlying valuation. Analysts said the value of the GM stock had been inflated and Hughes stock depressed since the ratio between the two shares was set April 20, and that the completion of the offer unlocked the two issues to return to their underlying valuation.

While GM had strong earnings in the first quarter while Hughes posted a net loss, Hughes, with its core satellite television business, is seen as having a much stronger growth opportunity than its parent.

"It speaks loudly about the value of the Hughes assets," said Ty Carmichael, analyst with Credit Suisse First Boston. "It had been unduly depressed due to arbitrage. A primary driver will be continued expansion of DirecTV subscriber base, which shows no signs of weakening."

Analysts said they don't believe that more investors were selling GM shares to purchase Hughes shares. Rather they believe that investors were paring their GM holdings that they had held in hopes of getting the lower-priced Hughes shares through the swap.

"I'm not surprised the stock is down. We all expected that," said Jonathan Lawrence, analyst with Dain Rauscher Wessels. "There are some people out there who expected to get more Hughes shares than they were able to get, and are trying to lighten their position with GM."

Both stocks saw early swings moderate in early afternoon trading. GM stock fell 7-15/16, or 9.1 percent, to 79 in afternoon trading, although that was up from an earlier intra-day low of 76. Meanwhile Hughes shares gained 5-3/4, or 6.4 percent, to 95-5/8. That's off from an earlier high of 106.

The deal will work somewhat like a share repurchase of GM stock, with the Hughes stock being used rather than cash in what is a tax-free transaction.

The stock swap will reduce the shares outstanding of GM to 534.8 million from 621.2 million at the end of the first quarter, a drop of nearly 14 percent. It also reduces GM's economic interest in Hughes' tracking stock to 43 percent from 62 percent. The stock swap will reduce the shares outstanding of GM to 534.8 million from 621.2 million at the end of the first quarter, a drop of nearly 14 percent. It also reduces GM's economic interest in Hughes' tracking stock to 43 percent from 62 percent.

GM also plans to contribute up to $7 billion of its Hughes holdings to various employee benefit plans during the current quarter, which will further reduce its economic interest in Hughes. But since Hughes remains a tracking stock, the division continues as a wholly owned subsidiary of the world's largest automaker.

|

|

|

|

|

|

|