|

Bonds continue advance

|

|

May 23, 2000: 3:34 p.m. ET

Late sell-off in technology stocks helps Treasurys; dollar slips vs. euro, yen

By Staff Writer Jill Bebar

|

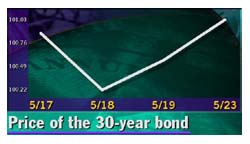

NEW YORK (CNNfn) - Treasury bonds ended higher Tuesday for the third consecutive session, continuing to receive support from a weak U.S. equities market.

In the currency markets, the dollar remained under pressure against the euro and the yen. But analysts say the euro's recent recovery has run out of steam.

Shortly after 3 p.m. ET, the 30-year Treasury bond rose 5/32 of a point in price to 101. The yield, which moves inversely to price, fell to 6.17 percent from 6.18 percent Monday. Shortly after 3 p.m. ET, the 30-year Treasury bond rose 5/32 of a point in price to 101. The yield, which moves inversely to price, fell to 6.17 percent from 6.18 percent Monday.

The 10-year note, which is considered by many to be the market benchmark, dipped 1/32 to 100-10/32, its yield rising to 6.45 percent from 6.43 percent.

The Treasury market was confined to narrow ranges throughout the day with movements on Wall Street having little impact. But a late sell-off among U.S. technology shares lifted 30-year Treasury bonds. When stocks decline, investors often shift money into the relative safety of government securities

Despite the late uptick, Tony Crescenzi, chief market strategist at Miller Tabak & Co., was bearish about bonds, noting the level of support in relation to stocks was small. "There's not a good appetite for bonds these days so long as the Fed cloud is overhead," he said.

With a lack of economic news to provide direction, analysts noted many  market participants stayed on the sidelines. The outlook for the economy and interest rates remained a key focus. Economic releases slated for later this week, such as Thursday's revision to first-quarter Gross Domestic Product, may shed light on upcoming policy. market participants stayed on the sidelines. The outlook for the economy and interest rates remained a key focus. Economic releases slated for later this week, such as Thursday's revision to first-quarter Gross Domestic Product, may shed light on upcoming policy.

The Federal Reserve has hiked short-term interest rates six times since last June in an effort to slow the economy and contain inflation. Many analysts expect more tightening in the months ahead. The Federal Open Market Committee, the Fed's policy-making arm, meets again on June 27-28.

But one analyst was bullish on the market from a long-term perspective. Gary Lenhart, fixed income strategist at Dain Rauscher Wessels, told CNN's Before Hours it is important for an investor to have exposure to Treasurys. (348K WAV) (348K AIFF)

Agency bonds in focus

The agency debt market garnered investors' attention. These securities issued by organizations such as Fannie Mae and Freddie Mac recovered from losses posted in overnight trading after a report in The Wall Street Journal said Fed Chairman Alan Greenspan criticized the government subsidies of these agencies.

In a letter Friday, the Fed chief said "these subsidies have important consequences for the structure and efficiency of the financial markets and the productive allocation of real resources," signaling there needs to be more clarification regarding these securities.

The agency debt market has been under scrutiny since March, when a Treasury official said the government-supported legislation that would reduce the perception that these issues are backed by the full faith and credit of the U.S. government.

In an afternoon speech to an American Enterprise Institute conference, Rep Richard Baker, R-La., the sponsor of the legislation, noted Greenspan's letter was helpful. Baker said he hoped to reach an agreement with the subsidies, but added that current support for reform is strong.

Wednesday's calendar includes the Treasury's $10 billion auction of two-year notes, the smallest since 1990.

The government is also expected to announce details of its next buyback operation, slated for Thursday. Last week's buyback removed $2 billion of longer-dated securities from the market, bringing the total amount of buybacks this year to $9 billion.

Faced with a budget surplus, the Treasury announced plans in January to retire up to $30 billion of some older, longer-term debt this year. It plans to conduct the buyback operations on the third and fourth week of each month through August.

Dollar down against euro, yen

The dollar declined against the euro and the yen Tuesday. With a lack of significant news or developments, activity in the currency market was limited.

The euro's recovery ran out of steam after pushing to a one-week high earlier in the day. After failing to break through a key technical level, analysts said sentiment for the currency remained negative.

"The euro's rebound the last few days was not grounded in any fundamental changes, and it remains susceptible to renewed tests to its downside," said Alex Beuzelin, senior market analyst at Ruesch International.

Shortly after 3 p.m. ET, the euro traded at 90.62 cents, up from 90.27 cents Monday. Meanwhile, the dollar held near its lows against the yen throughout the session. The U.S. currency was at 106.63 yen, down from 107.03 yen Monday, a 0.4 percent loss in the dollar's value. Shortly after 3 p.m. ET, the euro traded at 90.62 cents, up from 90.27 cents Monday. Meanwhile, the dollar held near its lows against the yen throughout the session. The U.S. currency was at 106.63 yen, down from 107.03 yen Monday, a 0.4 percent loss in the dollar's value.

|

|

|

|

|

|

|