|

Bestfoods in merger talks

|

|

May 23, 2000: 4:29 p.m. ET

Food company said it is talking with several suitors, including U.K.'s Diageo

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Diversified U.S. food company Bestfoods is talking to a number of potential partners, including U.K. food and drink company Diageo, about possible merger opportunities but remains content to let spurned suitor Unilever make the next move, according to industry sources.

Several publications, including the Financial Times and the New York Times, reported Tuesday that Bestfoods was in discussions to sell all or part of its businesses, most likely its bakery unit, to Diageo, which produces Pillsbury baked goods, Johnnie Walker whisky and Haagen-Dazs ice cream.

Sources close to the negotiations confirmed that the two companies had discussed a handful of possible scenarios, including Bestfoods acting as a buyer, but that the talks were in the early stages and not likely to progress anytime soon. One source also said it is unlikely Bestfoods will unveil a "defense strategy" later this week, as was reported in some publications.

A Bestfoods spokeswoman declined to comment on the report, as did a Diageo spokeswoman.

However, the sources said, Bestfoods, the Englewood Cliffs, N.J.-based maker of Skippy peanut butter, Hellmann's mayonnaise and Knorr soups, continues to explore a number of possibilities in the wake of Unilever's $18.3 billion bid for the company earlier this month, including assuming the role of an acquirer.

"Just because Unilever has an offer out there doesn't mean they are going to sit pat," one source said.

Hot stove league heats up

Indeed, the food industry has been rife with discussions between potential merger partners in the last two months, with Bestfoods, Nabisco Group Holdings (NGH: Research, Estimates) and Keebler Foods (KBL: Research, Estimates) all reportedly entertaining possible buyouts.

"With some deals already on the table and others supposedly on the table, food company managers suddenly have a reason to have an open mind," said Jaine Mehring, a food industry analyst with Salomon Smith Barney.

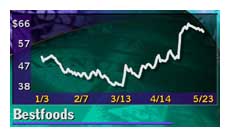

Bestfoods Chairman C.R. Shoemate has routinely maintained that he will not reconsider Unilever's $66 per share offer, which the company's board dismissed as too low earlier this month. In a meeting with analysts and investors at a New York consumer goods conference last week, he stood his ground on that point despite an unrelenting stream of questions to the point, according to several in attendance, deflating investors' optimism that a deal might be forthcoming with the Anglo-Dutch consumer products company. Bestfoods Chairman C.R. Shoemate has routinely maintained that he will not reconsider Unilever's $66 per share offer, which the company's board dismissed as too low earlier this month. In a meeting with analysts and investors at a New York consumer goods conference last week, he stood his ground on that point despite an unrelenting stream of questions to the point, according to several in attendance, deflating investors' optimism that a deal might be forthcoming with the Anglo-Dutch consumer products company.

"Clearly, the gulf that has developed between those guys has widened a little bit," one investor who attended the conference said.

Bestfoods (BFO: Research, Estimates) stock has reacted accordingly. After vaulting to 61-1/4 on May 3, the day Unilever made its unsuccessful offer, the company's stock has teetered between $61 and $65 per share, reaching Unilever's $66-per-share offer level only a handful of times.

But the stock has slid recently amid investor concern that the company is far from reaching a deal with anyone. Bestfoods shares tumbled nearly 4 percent to 60-15/16 Tuesday before recovering slightly to close down 1-1/4 at 62. Diageo (DEO: Research, Estimates) American Depositary Receipts lost 1/16 to close at 32-15/16.

Unilever previously has said it would not make a hostile offer for Bestfoods, but it also has shown no indication of walking away after its first approach was rebuffed.

Industry executives and analysts said that what Unilever does next will determine how quickly the industry consolidates.

"Unilever is setting the timetable for consolidation here," said one source with knowledge of the Bestfoods/Diageo talks.

Ball in Unilever's court

Analysts agree, maintaining the pressure remains on Unilever to make the next move. With most predicting Bestfoods could garner more than $70 per share, and few shareholders thus far clamoring for a sale, few believe the pressure is on Bestfoods to initiate a round of talks.

"Clearly the ball is in Unilever's court," said Terry Bivens, a food industry analyst with Bear Stearns.

Some speculated a deal with Diageo (DGE) might sour Bestfoods' attractiveness for Unilever, or perhaps influence a higher buyout price. It also would trigger speculation that Diageo might spin off Pillsbury as an independent entity. Analysts have long questioned Pillsbury's strategic fit with Diageo's other units - Burger King fast-food restaurants and spirits distilling. Diageo is the world's largest spirits company.

Bestfoods' baking division revenue rose 2.3 percent in 1999 to $1.7 billion, and operating profit rose 14 percent to $126 million. Bestfoods had total revenue of $8.64 billion and operating income of $1.33 billion.

|

|

|

|

|

|

Bestfoods

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|