NEW YORK (CNNfn) - A merger of two major airlines and a key Congressional vote on trade relations with China will vie for U.S. equity investors' attention Wednesday.

Earnings reports from some high profile software companies, and the latest round in Microsoft's antitrust battle are also in the news the day after the tech-heavy Nasdaq composite index dove to a new low for the year.

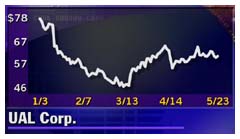

UAL Corp. (UAL: Research, Estimates), the employee-owned corporate parent of United Airlines, confirmed early Wednesday it is offering $11 billion, including assumed debt, for US Airways (U: Research, Estimates) -- a move that would increase the size of the world's largest airline and would represent aviation's largest merger ever. UAL Corp. (UAL: Research, Estimates), the employee-owned corporate parent of United Airlines, confirmed early Wednesday it is offering $11 billion, including assumed debt, for US Airways (U: Research, Estimates) -- a move that would increase the size of the world's largest airline and would represent aviation's largest merger ever.

The offer is expected to be $60 a share, plus assumption of $7.3 billion in debt and aircraft leases. That would be a 131 percent premium on US Airways' closing price Tuesday, when its shares gained 1-1/16 to 25-5/16, while UAL shares rose 13/16 at 60-1/16.

Industry observers say the deal faces many problems, not just from regulators but from the airline unions, whose members own UAL and who have representative on the company's board of directors. United pilots blocked an earlier proposed deal between these two carriers in 1995.

"The hurdles are so many I don't think they can even count them right now," Michael Miller, editor in chief of Aviation Daily, said in an interview on CNNfn's Ahead of the Curve Wednesday. "The unions have had a habit of disrupting any deals the management of airlines have wanted to make for the last decade." (101KB WAV) (101KB AIFF)

The House of Representatives is set to vote Wednesday on whether it should grant permanent normal trade relations with China. While supporters say they have the votes they need to pass the administration-backed measure, other counts say the key vote is too close to call. A defeat would be seen as a major setback for many business interests, who have lobbied hard for the measure.

Early indications suggest U.S. stocks will open mixed.

The Nasdaq 100 futures rose 4 points to 3,016.50 early Wednesday. But the futures were about 20 points below fair value, a benchmark set daily by traders based on future contracts and their underlying stocks, meaning traders expect a lower open for the Nasdaq market.

S&P futures, the most widely watched futures contract, gained 2.90 points to 1,385.50 on the Globex trading system, and they were about 7 points above its fair value, suggesting a higher open for that broad measure. The S&P futures are also watched as an indicator of the Dow Jones industrial average, with one point of difference between the futures index and fair value equal to about eight points on the Dow Jones industrial average. So the S&P futures suggested the Dow would open up about 57 points Wednesday.

The Dow Jones industrial futures themselves were unchanged at 10,485.

On Tuesday, U.S. stocks finished lower. The Nasdaq dropped 199.66 points, or 5.9 percent, to 3,164.55, its lowest point since early November and more than 37 percent below its high for the year set in early March. On Tuesday, U.S. stocks finished lower. The Nasdaq dropped 199.66 points, or 5.9 percent, to 3,164.55, its lowest point since early November and more than 37 percent below its high for the year set in early March.

The Dow Jones industrial average lost 120.28 points, or 1.1 percent, to 10,422.27, while the S&P 500 declined 26.86 points, or 1.9 percent, to 1,373.86.

Sell-off continues in most overseas markets

The sell-off of tech stocks continued in Asia Wednesday. Tokyo's benchmark Nikkei index dropped 274.29 points, or 1.7 percent, to an 11-month low of 16,044.44. Hong Kong's Hang Seng index lost 323.20 points, or 2.3 percent, to a six-month low of 13,933.98, while Singapore's Straits Times index declined 33.84 points, or 1.8 percent, to 1871.94.

Most major markets were lower in morning trading in Europe Wednesday. London's benchmark FTSE 100 fell 39.80 points, or 0.7 percent, to 6,047, while the Paris CAC 40 dropped 104.91 points, or 1.7 percent, to 6,043.65. Frankfurt's Xetra Dax index lost 120.40 points, or 6,807.29. The exception was Zurich's SMI, which edged up 1.30 points to 7827.

In the Treasury market, the 30-year bond was unchanged in price early Wednesday, leaving its yield at 6.16 percent. Meanwhile the 10-year note, which some observers now consider their Treasury benchmark, slipped 2/32 of a point, although its yield stayed virtually unchanged at 6.44 percent.

In the currency market, the dollar weakened versus the euro but gained on the yen in early trading Wednesday. The euro was worth 90.99 cents, up from 90.62 cents in trading Tuesday afternoon. Meanwhile, the dollar rose to 107.14 yen from 106.63 yen.

Click here for Tuesday's after-hours news.

Click here for Tuesday's after-hours trading.

Click here for Morning Call page.

Click here for after-hours trading quotes

Click here for current world markets

Mixed results in software earnings

Financial software leader Intuit (INTU: Research, Estimates), maker of the popular Quicken accounting and Turbo Tax programs, posted better-than- expected results late Tuesday for its fiscal third quarter. Excluding special items, the company earned $76.3 million, or 36 cents a diluted share. Analysts surveyed by earnings tracker First Call forecast the company earned 33 cents in the period ended in April. It posted earnings before special items of 25 cents a share a year earlier.

Shares of Intuit stock lost 1-1/4 to 27-1/16 in regular-hours trading ahead of the report, then rebounded 1-15/16 to 28-3/8 in after-hours trading.

Earnings news was not as good at Novell (NOVL: Research, Estimates), a provider of network and Internet directory software and services. Earnings in its fiscal second quarter, excluding special items, dropped to $31 million, or 2 cents a diluted share, compared with year-earlier results of $39 million, or 11 cents a share. Novell beat forecasts of 1 cent a share, but fell well below earlier estimates of 16 cents a share in profit before a warning from the company earlier this month.

Novell also announced a reorganization of its business into four new units, and the departure of its sales head after just four days on the job.

Shares of Novell gained 13/16 to 9-3/4 in regular-hours trading Tuesday, then fell in active after-hours trading, losing 21/32 on Island ECN and 5/8 on MarketXT.

VA Linux Systems (LNUX: Research, Estimates), which develops software and products for the Windows-competitor Linux operating system, posted a smaller-than-expected loss for its fiscal third quarter. Excluding special items, the company lost 13 cents a share, compared with a forecast of a 23 cents a share loss forecast by First Call. Revenue rose to $34.6 million from $4.3 million a year earlier.

Shares lost 5-3/4 to close Tuesday at 38-1/2, then gained 3 in after-hours trading.

Attorneys for Microsoft, federal anti-trust regulators and officials from 19 states head back to court Wednesday to begin arguments on the penalty phase of the landmark antitrust case. The hearing will be watched for clues about whether the judge overseeing the case is leaning toward regulators' proposed breakup of the software giant. Microsoft vehemently opposes the breakup proposal.

Shares of Microsoft (MSFT: Research, Estimates) lost 1 to 63-5/16 in trading Tuesday, then slipped another 5/16 in after-hours trading.

|