|

Bass lifted by hotel gains

|

|

May 25, 2000: 12:07 p.m. ET

UK hotel and beer firm posts 6% rise in first-half profit; eyes sale of brewing unit

|

LONDON (CNNfn) - British hotel and brewing firm Bass posted a 5.9 percent increase in first-half earnings on Thursday, and said it was in talks to sell its beer division.

Bass, which runs the Holiday Inn and Inter-Continental chains, announced restructuring plans in February which may include the sale of Britain's second-largest brewing business, allowing it to focus on its hotel and leisure interests. The brewing unit has been valued by analysts at around £1.9 billion ($2.81 billion).

The company is Britain's largest hotel player and acquisitions have pushed it into first place in the Asia-Pacific region.

Analysts said that slowing European beer sales have dragged on the valuations of diversified leisure and brewing firms over the past year. Rival Whitbread (WTB) is also seeking to offload its own beer business and last week said it was in talks with Belgium's Interbrew.

Bass reported net profit of £216 million for the six months to Apr. 16 compared to £204 million a year earlier, in line with market expectations.

Revenue climbed 11.2 percent to £2.5 billion. The hotel operation posted a 14 percent rise to £598 million, with operating earnings up 21 percent at £406 million. Brewing sales climbed 1.5 percent to £932 million, generating an operating profit of £73 million, up 3 percent.

Bass' bar business posted the best growth performance, with revenue up 21 percent and operating earnings climbing 31 percent to £173 million. Bass' bar business posted the best growth performance, with revenue up 21 percent and operating earnings climbing 31 percent to £173 million.

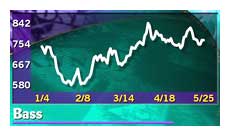

Bass (BASS) shares were 1.4 percent lower at 759 pence having earlier climbed as high as 856 pence.

Bass didn't say who might buy its brewing business, but Denmark's Carlsberg and Heineken of the Netherlands have expressed interest.

|

|

|

|

|

|

Bass

Whitbread

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|