|

Lucent buys Chromatis

|

|

May 31, 2000: 2:05 p.m. ET

Leading phone equipment maker pays $4.5B in stock in latest fiber-optic deal

|

NEW YORK (CNNfn) - Lucent Technologies agreed Wednesday to purchase the remaining shares of optical equipment maker Chromatis Networks that it doesn't already own for about $4.5 billion, accelerating the company's push to supplant rival Nortel Networks as the industry leader in the optical networking products.

Lucent Technologies (LU: Research, Estimates), the world's largest telecommunications equipment maker, is buying approximately 93 percent of Chromatis' outstanding shares for roughly 78 million shares of its own stock. The company already holds a 7 percent stake in the privately held company.

The deal gives Lucent access to Chromatis' chief product, Metropolis -- which speeds multi-service traffic, such as voice, data and video, onto optical wavelengths across optical networks in cities -- a product rival Nortel cannot currently match.

"The acquisition of Chromatis will enable us to bring the bandwidth-expanding power of optical technology directly to our business customers, and gives Lucent a leadership position in the fastest-growing segment of the optical networking market," Lucent Chairman and Chief Executive Richard McGinn said.

"Nortel doesn't have this particular piece, which gives Lucent a leg up," said Paul Sagawa, an analyst with Stanford Berstein.

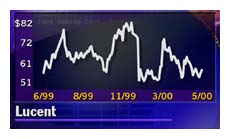

Still, investors remained less enthused. Lucent shares fell in early afternoon trading, dropping 9/16 to 57-3/16. Still, investors remained less enthused. Lucent shares fell in early afternoon trading, dropping 9/16 to 57-3/16.

Harry Bosco, Lucent's group president of optical networking, estimates that the metro optical networking market will generate revenue of $8 billion by 2004.

The Chromatis acquisition will produce "several hundred million of dollars in revenue next year," he said. The Metropolis product recently successfully completed its first phase of trials with Qwest Communications (Q: Research, Estimates).

That revenue boost, analysts noted, significantly improves Lucent's competitive position.

For calendar 2000, optical products will generate about $10 billion in revenue for Nortel, according to analyst Michael Neiberg of Chase H&Q. Before this acquisition, Lucent was expected produce about $6 billion in sales from such products while Cisco Systems will be a distant third, he said.

"Chromatis takes Lucent one step closer to bringing wavelengths to the desktop," Bosco said. "This puts us squarely in the leadership position."

Sagawa said the Chromatis deal is similar to Cisco Systems' (CSCO: Research, Estimates) August acquisition of Cerent, a maker of boxes that allow data and voice to switch quickly between copper lines and fiber-optic cables, for $6.9 billion. However, Sagawa said Lucent's deal has several advantages.

"Chromatis is a product that is six months more recent than Cerent so it has its advantages," Sagawa said. "Nortel doesn't have anything like this."

In the optical environment sector, the Chromatis deal puts Lucent ahead of Cisco and on par with Cisco in regards to network pieces, Sagawa said.

In addition, the merger may spur Nortel, a leader in optical technology primarily for long distance networks, to find an acquisition of its own, possibly looking at startups like Astral Point Communications, a provider of optical equipment for the carrier market, or Cyras Systems, a provider of optical switching technology, Sagawa said.

Terms of the deal

The value of the Chromatis deal is based on the closing price of 58-1/8 for Lucent stock on May 30.

Certain key Chromatis employees may receive an additional 2.5 million shares worth an additional $145 million based on Lucent's closing price if Chromatis meets certain performance-based goals, Lucent said.

Chromatis CEO Bob Barron will remain with Lucent in an unspecified role, as will all five co-founders of the company, including Rafi Gidron and Orni Petruschka. Chromatis will become part of Lucent's optical networking group.

The deal, which will be accounted for as a purchase, is expected to close June 30, Lucent spokesman William Price said.

Lucent said the acquisition would dilute pro forma earnings per share for ongoing operations by about 2 cents in fiscal 2000 and about 5 cents in fiscal 2001. Analysts polled by First Call expect Lucent to produce EPS of $1.27 for fiscal 2000 and $1.56 cents for 2001.

The optical network race

Lucent's Chromatis acquisition follows a deal in February to buy high-capacity fiber-optic maker Ortel Corp. for $2.95 billion. That deal gave Lucent access to Ortel's valuable laser and fiber optic technology used to expand the bandwidth of existing cable networks

Within the past 10 months, Cisco Systems (CSCO: Research, Estimates) has made three acquisitions in the fiber-optics sector. In addition to the Cerent acquisition, Cisco in May bought Qeyton Systems, a privately held Swedish company, for $800 million and ArrowPoint Communications Inc., a maker of Internet switches, for $5.7 billion.

Brampton, Ontario-based Nortel Networks spent $1.43 billion to buy optical component maker CoreTek last month. CoreTek components use tiny moveable mirrors to alter the wavelength of light emitted by semiconductor lasers, allowing networks to monitor and reroute traffic.

In early afternoon trading, shares for Cisco Systems were falling 1 to 58-7/8 while Nortel dropped 1 to 54-1/2.

|

|

|

|

|

|

|