|

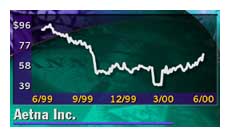

Aetna's stock finds a cure

|

|

June 1, 2000: 5:31 p.m. ET

ING talks spur shares for second day; investors, analyst reaction mixed

|

NEW YORK (CNNfn) - Speculation of a possible multi-billion dollar deal with Dutch insurer ING Group continued to serve as an antidote for Aetna Inc.'s ailing stock Thursday, even as analysts and investors expressed diverging reactions to the deal.

The Hartford, Conn.-based company's shares climbed as high as 69-15/16 Thursday before closing at 68-9/16, up 1-13/16, and now have risen more than 9 percent since the start of trading Wednesday.

The increase is being driven by word Aetna is negotiating with ING Group to sell its fast-growing financial services and/or international business. The company's stock is now trading at its highest levels since last September.

Analysts predict such a sale could bring anywhere from $8 billion to $10 billion and provide a much-needed infusion of cash for Aetna (AET: Research, Estimates), which has struggled to trim a weighty debt load and boost earnings in recent months.

It would also satisfy a handful of powerful investors who have clamored for the company to strike a deal, and who now believe the ING deal may precipitate a deal for Aetna's core health care operation as well.

"What ING did is put a compelling offer on the table," said Herbert Denton, president of Providence Capital Inc., which represents several Aetna shareholders. Denton has been pressuring Aetna's board to consider its strategic alternatives since its shareholder meeting last month. "What ING did is put a compelling offer on the table," said Herbert Denton, president of Providence Capital Inc., which represents several Aetna shareholders. Denton has been pressuring Aetna's board to consider its strategic alternatives since its shareholder meeting last month.

"Now that Aetna has such a high valuation, maybe WellPoint will come up a point or two from where they were a month ago."

WellPoint Health Networks Inc. (WLP: Research, Estimates) and ING proposed a $10 billion buyout of Aetna in March, a deal Aetna rejected because it believed it undervalued the company and raised too many integration concerns. Aetna subsequently unveiled plans to split its operations into two separate companies: one focusing on health care and the other on financial services.

But Denton believes WellPoint may renew its interest in Aetna's health care business if ING succeeds in purchasing the financial services unit.

"What you would have is a leaderless health care division and there are precious few folks that want to take that on, expect for [company chairman] Leonard Schaeffer and WellPoint," he said.

Analysts wary of tax implications

Analysts, however, aren't so sure. Any potential sale of one or more of its business units would likely trigger a massive tax bill equal to about one-fifth of the overall sale price, analysts said.

"Why would you want to send a $2 billion check to Washington?" said Ken Abramowitz, an analyst with Sanford Bernstein. "I'd rather they split into two companies. I think they are just toying around with what options they have out there."

But even if the financial services piece is sold, Abramowitz said the chances that the health care business would be sold as well were slim.

"No one is interested in making big acquisitions in health care anymore," he said. "Everyone is interested in running their own company right now."

A WellPoint spokesman declined to comment on the company's potential interest in Aetna's health care operation. Still, WellPoint shares rose 2-1/4 to 74-7/8 in mid-afternoon trading.

Two fast growing units

Aetna's financial services business, which sells products ranging from defined contribution plans to variable annuities and mutual funds, is considered by most to be the company's most valuable growth asset.

Last year, the unit generated $1.55 billion in revenue and saw its profits jump 22 percent to $227.3 million. The group's assets under management increased 32 percent during the same period, after climbing 23 percent in 1998.

The International unit, meanwhile, posted revenue of $2.15 billion during 1999, up 36 percent from the year before, and profits of $167.2 million, an increase of 23 percent. That division sells a variety of products, mostly life insurance, in Latin America and the Pacific Rim, primarily through joint ventures and partnerships.

|

|

|

|

|

|

|