|

Audit reform on track

|

|

June 7, 2000: 2:49 p.m. ET

SEC to oversee self-examination by accounting firms of auditing violations

|

NEW YORK (CNNfn) - The country's top five accounting firms will voluntarily participate in a self-audit to determine whether they were in violation of rules that prevent senior officials from owning shares of companies they are examining, the U.S. Securities and Exchange Commission announced Wednesday.

PricewaterhouseCoopers, Deloitte and Touche, Ernst & Young, Arthur Anderson, and KPMG -- known as the Big Five - all will participate in what the Commission is calling a "voluntary look-back" program to ensure that accounting firms are sufficiently unbiased when they audit public companies.

The announcement comes in the wake of a review by the SEC last January, which revealed that many of the partners at accounting firm PricewaterhouseCoopers owned stock in the companies it was auditing, a no-no in the world of investing.

"This is a significant chapter in the commission's and the profession's efforts to reinforce the importance of auditor independence," SEC Chairman Arthur Levitt said. "This serious and comprehensive review will enhance investor confidence and lead to improved quality control systems going forward."

Hundreds of partners

Similar to large-scale law firms and brokerages, the Big Five each have hundreds of partners who oversee a broad range of services for their clients, ranging from complex accounting services to detailed audits that ensure those companies are in compliance with industry reporting standards.

Of concern to the SEC is that those hundreds of partners and their immediate families may have owned or still own stock in the companies that are being helped by the firm, giving them an unfair advantage of knowing the internal details of a company before it is public knowledge. As accounting firms lower their costs on audits and try to cross-sell other, more profitable services such as consulting, it becomes more difficult to define the line between what is considered a breach of disclosure and what is not, the SEC said. Of concern to the SEC is that those hundreds of partners and their immediate families may have owned or still own stock in the companies that are being helped by the firm, giving them an unfair advantage of knowing the internal details of a company before it is public knowledge. As accounting firms lower their costs on audits and try to cross-sell other, more profitable services such as consulting, it becomes more difficult to define the line between what is considered a breach of disclosure and what is not, the SEC said.

Also of concern is the accuracy of the financial statements themselves. Because partners and other senior officials at the Big Five are more and more delving into publicly traded companies' financial statements, there is a concern at the SEC that those statements could be sugar-coated to reflect the best investing interests of the partners, according to Richard Walker, director of the SEC's Division of Enforcement.

"Auditor independence in fact and in appearance is at the core of investor confidence in the accuracy of financial statements," he said. "The look-back program provides a constructive framework for addressing past independence violations and will help promote the integrity of the financial reporting process."

Implementing safeguards

The Big Five are required to begin participating in the program by June 15 by hiring independent auditors to determine exactly who held which publicly traded companies during a nine-month period ending March 31. The firms will then disclose any violations to the SEC and to the audit committees of their clients by July 15, 2001.

They also agreed to design and implement a variety of internal controls and safeguard procedures to ensure that its senior employees don't own stock in the companies they work closely with in the future, or at least disclose what they do own beforehand. They also agreed to design and implement a variety of internal controls and safeguard procedures to ensure that its senior employees don't own stock in the companies they work closely with in the future, or at least disclose what they do own beforehand.

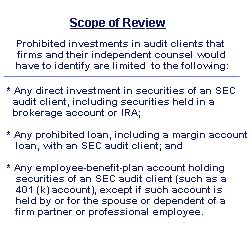

In exchange, the SEC has agreed to extend what it calls "safe-harbor" protection to provide assurances that it won't seek enforcement action against anyone who did violate the rules "for all but the most serious violations covered by the program."

Auditing currently generates about 30 percent of revenues for the largest accounting firms, down from 70 percent two decades ago, according to the SEC. By contrast, consulting and other management services now represent more than half of those firms' revenues, up from just 12 percent in 1977.

|

|

|

|

|

|

|