|

Bookham speeds to the top

|

|

June 7, 2000: 10:47 a.m. ET

UK maker of high-tech parts aims to pep up the Web; stock added to FTSE

By Staff Reporter Abid Ali

|

LONDON (CNNfn) - Cyber surfers know the reality of the Internet can fall short of the dream - with frequently slow connections and hard-to-load graphics marring the online experience. Many dot.coms, too, have tripped up in their plans to jazz up Websites with more images, sound and video, because old copper telephone lines can bring users' screens grinding to a halt.

That's where optical fibers come in, right? The optical cables that send signals at light speed permit a huge increase of the volume and speed of data transmission. But building such networks, and upgrading older ones to perform at greater speeds, is an expensive and time-consuming business, with laboriously manufactured components in short supply.

The answer, for many network operators, could lie in linking their optical fibers with next-generation devices from upstart U.K. component maker Bookham Technology (BHM), which is attracting attention and financial support from an impressive array of technology industry big-hitters. The answer, for many network operators, could lie in linking their optical fibers with next-generation devices from upstart U.K. component maker Bookham Technology (BHM), which is attracting attention and financial support from an impressive array of technology industry big-hitters.

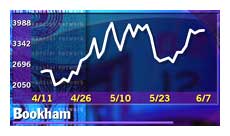

The presence of companies such as Intel (INTC: Research, Estimates) and Cisco Systems (CSCO: Research, Estimates) on Bookham's shareholder register may help explain how the company in April succeeded in defying the bearish mood among tech investors. In a triumphant initial public offering, Bookham's shares surged more than 150 percent on April 11, their first day of trading, from the offer price of £10.

The IPO, accompanied by a listing of American Depositary Receipts on Nasdaq, came at a time when other high-tech shares were falling through the floor - including several Internet-related companies that had only recently held their own IPOs, such as the U.K.'s travel booking site lastminute.com (LMC) and Dutch Web service provider World Online.

Perhaps more remarkably, the newcomer's shares not only held onto their first-day gain, but extended it to trade this week at more than £37, giving the company a market value of £4.5 billion ($6.8 billion). That makes the loss-making company more valuable than British Airways, Europe's biggest airline, and this week propelled Bookham into London's benchmark FTSE 100 at the index's quarterly review, just two months after Bookham's IPO. Perhaps more remarkably, the newcomer's shares not only held onto their first-day gain, but extended it to trade this week at more than £37, giving the company a market value of £4.5 billion ($6.8 billion). That makes the loss-making company more valuable than British Airways, Europe's biggest airline, and this week propelled Bookham into London's benchmark FTSE 100 at the index's quarterly review, just two months after Bookham's IPO.

Companies entering the FTSE may see renewed demand for their stock as managers of funds that track the index have to buy the shares. Recent experience, however, suggests that in some cases where investors anticipate a share's promotion to the index, the extra demand may come before the official announcement, and tail off once the stock is part of the FTSE.

Bookham's initial public offering made a billionaire of president and chief executive Andrew Rickman, who founded the company 11 years ago and still owns just over 25 percent. His achievements at Bookham this week even got royal recognition, when Queen Elizabeth awarded Rickman the Order of the British Empire, a civil order of merit.

Breakthrough promises technological advance

Based in Oxfordshire, England, the company's breakthrough is in devising components based on silicon - the stuff of computer microchips -- that integrates the functions of several optical components currently used in fiber networks. These optical integrated circuits, which can be used to create, guide, amplify, combine and separate light signals, can replace an array of older-fashioned components including lasers, lenses and filters, and can combine several functions on a single chip. As the demand for data carriage capacity - or bandwidth - mushrooms, the need for such nimble components is expected to soar.

"Bookham (BKHM: Research, Estimates) is operating in a high-growth area," says Paul Kavanagh, a partner at London stockbroker Killik & Co. "The market will be worth some $20 billion a year by 2003 - the stock is worth every bit of its valuation."

Kavanagh recommends the stock as a "buy", advising investors to tuck it away for at least three years, explaining: "The technology they have developed has been a long time in the making - that makes it difficult for regular component manufacturers to replicate."

Bookham's approach of putting a range of optical functions onto a silicon wafer - which can be relatively cheaply made, using mass-production techniques standardized in the semiconductor industry -- contrasts with the current state of the art among makers of fiber-optic components.

"Component manufacturing is experiencing extreme supply bottlenecks," wrote analysts at Goldman Sachs, which acts as investment banker to Bookham, in a recent research report on the U.K. company. "The industry is currently made up of engineers with tweezers laboring under microscopes to produce optical components." Such inefficiency not only keeps component prices high, but is producing pent-up demand for the devices needed to fire up the Internet's speed and capacity.

High growth rates in prospect

Goldman predicts that Bookham's sales of £3.5 million last year will turn into £25.5 million in 2000 and £62.9 million in calendar 2001. For the four-year period from 1999 to 2003, the analysts predict a growth rate averaging 260 percent a year. That, they say, would justify a share price of £50, because the forecast rate of annual sales growth is about five times the pace Goldman expects to see at makers of conventional components, such as Silicon Valley-based JDS Uniphase (JDSU: Research, Estimates) and SDL (SDLI: Research, Estimates).

Profit will take a little longer to emerge, but Bookham is forecast to move into the black in 2001. Last year's loss was £16.1 million, and the Goldman Sachs report sees that widening to more than £17 million in 2000 while the costs of investing and expanding output outweigh commercial revenues.

Although Bookham has already vaulted into the FTSE 100 index, it is still in its start-up phase in many ways. Founded in 1989, it launched its first product as recently as 1997, a year before Cisco and Intel together invested £20 million to help fund the company's development, with U.S. cable-TV equipment maker Scientific-Atlanta (SFA: Research, Estimates) pitching in as a shareholder last year.

With the major expansion of production still to come, analysts warn that the company's ability to transform itself from a startup with a bright idea into a mass producer of components for global customers is still to be proven. How well CEO Rickman and his team manage that growth will dictate whether the shares live up to their lofty valuation.

|

|

|

|

|

|

Bookham

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|