|

Bell, GTE merger approved

|

|

June 16, 2000: 5:57 p.m. ET

FCC approval removes final regulatory roadblock to $64.7 billion merger

|

NEW YORK (CNNfn) - The Federal Communications Commission unanimously approved Bell Atlantic Corp.'s $64.7 billion deal to buy GTE Corp. Friday, clearing the way for the creation of the largest U.S. local telephone company.

The approval, which came only after GTE agreed to spin off its Internet backbone operations, comes nearly two years after the two regional telephone providers first struck their merger agreement. The companies expect to close the transaction, and rename the combined company Verizon Communications, by the end of this month.

In signing off on the deal, the FCC placed 25 conditions of approval on the merger, most of which are designed to ensure continued competition among local phone service providers within the new company's footprint.

"There will be those that will claim this merger brings us closer to a re-emergence of Ma Bell; however, my support is predicated on the applicants' enforceable commitments to open its traditional local markets to competitors, invest in new markets, and accelerate deployment of broadband technologies," said William Kennard, FCC chairman. "The end result should produce more competition, not less."

"This completes a major milestone," said Charles Lee, GTE's chairman and chief executive officer, who is slated to serve as chairman and co-CEO of Verizon. "Today, we complete almost two years of work in getting regulatory and merger approvals."

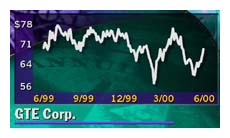

Bell Atlantic (BEL: Research, Estimates) shares lost 1-1/2 to close at 55-1/16 Friday, while GTE (GTE: Research, Estimates) shares shed 2-15/16 to close at 66-1/4.

Genuity offering slated for next week

GTE cleared the way for the FCC's final approval in April, when it agreed to spin off a roughly 90 percent stake in Genuity Inc., which handles the massive amount of Internet traffic that moves across the Irving, Texas-based company's telephone lines. From the FCC's standpoint, that traffic is considered long-distance service -- something local carriers are not permitted to offer without FCC approval.

The FCC has been wary of awarding such privileges to regional telephone companies unless they first prove their local markets are also open to competition. Late last year, Bell Atlantic became the first regional carrier to gain such approval when the FCC agreed to allow the New York-based company to sell long-distance services in its home state, becoming the first regional carrier to gain such approval.

Ivan Seidenberg, Bell Atlantic's chairman and CEO, said Friday the combined company hoped to officially file for similar authority in Massachusetts and New Jersey by the end of this year, and possibly in Pennsylvania by early next year. He said similar applications would then follow in Maryland and Virginia. Ivan Seidenberg, Bell Atlantic's chairman and CEO, said Friday the combined company hoped to officially file for similar authority in Massachusetts and New Jersey by the end of this year, and possibly in Pennsylvania by early next year. He said similar applications would then follow in Maryland and Virginia.

Genuity is slated to its price public offering, which is expected to raise roughly $2.3 billion, sometime next week. Verizon will only be permitted to hold a stake in Genuity of less than 10 percent, but can rebuild its holdings back up to 80 percent if it opens up 95 percent of its local telephone access lines within the next five years.

The FCC approval prohibits the new company from receiving economic benefit from the long distance services provided by Genuity.

An unparalleled local powerhouse

The merger will create an unparalleled local telephone powerhouse with more than 63 million local access lines in 38 states across the country, narrowly trumping the current No.1 local provider, SBC Communications, which boasts 61 million access lines.

Verizon will also rank as the No. 2 U.S. telecom company behind AT&T Corp. and feature the nation's top wireless operation, Verizon Wireless, which includes the wireless assets from Vodafone AirTouch. Verizon Wireless will reach 90 percent of the U.S. population and 96 of the 100 largest wireless markets in the country.

Seidenberg said the new company would roll out bundled service packages for customers within the next three or four months. Seidenberg said the new company would roll out bundled service packages for customers within the next three or four months.

"The immediate benefits over the next three or four months is to give customers bundled products, give them one bill and give them the kind of customer care they would expect from a national company," he said.

There has been some speculation that AT&T Corp. (T: Research, Estimates) might sue in an attempt to block this merger, claiming the combined company has done little to prove it will open its local access lines as promised. But executives from both companies dismissed that speculation Friday.

"We don't think there is a miniscule chance that this would be overturned," Lee said.

The approval comes more than a year after the U.S. Department of Justice gave its regulatory thumbs-up to the deal and nearly two years after the merger was first announced in July 1998. The DOJ required the two companies to sell overlapping wireless operations in nine states.

The merger was originally valued at $52.8 billion, but Bell Atlantic's stock has climbed more than 25 percent since the deal was announced.

|

|

|

|

|

|

Bell Atlantic

GTE Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|