|

Stock picks by the pros

|

|

June 16, 2000: 3:47 p.m. ET

Sprint PCS, TriQuint, Kodak, Providian, Global Marine, Ciena, Ensco selected

|

NEW YORK (CNNfn) - The tech, semiconductor and retail sectors as well as an optical networking stock hit the top slots in portfolio managers' A-lists Friday.

As the financial sell-off on the Dow continued to pull markets lower in early afternoon trading, recent guests on CNNfn commented on the stocks they are buying, and why.

"It's clear that the economy is decelerating. The question is from where," said Jack Kelly, analyst, Goldman Sachs & Company. "My sense of it is we are slowing, but to a very healthy level. I don't think as I look at my companies [that] we are going over the edge in terms of a slowdown. We have seen this a lot in the last five years with the economy accelerates and then decelerates." "It's clear that the economy is decelerating. The question is from where," said Jack Kelly, analyst, Goldman Sachs & Company. "My sense of it is we are slowing, but to a very healthy level. I don't think as I look at my companies [that] we are going over the edge in terms of a slowdown. We have seen this a lot in the last five years with the economy accelerates and then decelerates."

In the imaging sector, in lieu of Xerox's earnings expectation announcement, his pick is for Kodak (EK: Research, Estimates).

"Our view on Kodak is positive. The stock is currently 60; our price objective is 75." He said that he had two issues with them: "How successful are they going to be in the digital world versus their traditional film area? I think they did an excellent job meeting yesterday, kind of mapping out that path, and giving us a good feel for where they are going to be, particular in terms of profitability, by 2002 -- about $350 million in operating income versus 20 last year."

"One of the major swings from 20 to 350 over that several-year period is consumer cameras, that digital still cameras that we all know about, lost about $75 million last year and we can see that moving into break even to a profitable phase over the next couple of years," he said. "So I think their digital strategy looks good."

"Secondly, I think they reaffirmed their confidence in their traditional film business," he said. "They indicated this year, between now and the end of this year that they'd spent over a billion dollars on a stock repurchase. It is our view, next year that that could move up to $1.5 to $2 billion. So they have basically taken all their excess cash flow for this year and next, and said we are going to buy back our company. And that suggests to me they feel very good about their traditional film business."

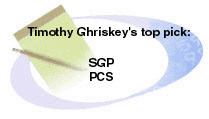

"This seems to be a period where the market is very unsettled. There's really no leadership and that's because there's a lot of uncertainty, not only about the Fed, but in terms of where the economy is going and how that will affect corporations," said Timothy Ghriskey, senior equity portfolio manager, Dreyfus Corporation. "This seems to be a period where the market is very unsettled. There's really no leadership and that's because there's a lot of uncertainty, not only about the Fed, but in terms of where the economy is going and how that will affect corporations," said Timothy Ghriskey, senior equity portfolio manager, Dreyfus Corporation.

"We think it's a good time to actually make sure you are very well diversified across the economic spectrum -- own a little bit of everything," he said. "If you want to concentrate in certain areas, it's probably better to be a little bit defensive. The pharmaceuticals are probably a great area. The telephone stocks are probably another great area."

In pharmaceuticals, his pick is Schering-Plough (SGP: Research, Estimates). In telecoms, his pick is Sprint PCS (PCS: Research, Estimates).

"Schering-Plough, their big drug is Claritin, the allergy medicine," he said, "And they have a great strategy for extending that drug and extending its patent and its dominance of the market, for a number of years."

"Unfortunately, PCS just had a major management change this morning. The head of the company stepped down for really no apparent reason, seems like he's the type of person who likes to build up a company and then move onto something else. Evidently, he's going to go overseas actually and take a job. So we don't think that is an issue at all," he said. "Fundamentally, that company is firing on all cylinders. And the churn rate, the loss of customers is very low and so we like that stock."

"Actually, there is good leadership developing in the marketplace. It's the semiconductor manufacturers and telecommunications equipment that is where the focus is right now. I think the theme is the build out of the Internet infrastructure. We've gone from the Internet pure play stocks, e-commerce, the ISP content providers, to those companies that will help us to better access the Internet, and to do it more efficiently as well," said Greg Kuhn, managing director, Kuhn Capital Management. "Actually, there is good leadership developing in the marketplace. It's the semiconductor manufacturers and telecommunications equipment that is where the focus is right now. I think the theme is the build out of the Internet infrastructure. We've gone from the Internet pure play stocks, e-commerce, the ISP content providers, to those companies that will help us to better access the Internet, and to do it more efficiently as well," said Greg Kuhn, managing director, Kuhn Capital Management.

"I'm bullish, at least over the intermediate term, defined at this point maybe through the summer time, because I am seeing a lot of stocks setting up technically that have the right fundamental characteristics that I look for.

Three of the names that I like are SDL (SDLI: Research, Estimates), Corning (GLW: Research, Estimates), and a semiconductor manufacturer, TriQuint Semiconductor (TQNT: Research, Estimates). They make chips for the wireless communications industry. That's again another major part of what's going on in the world economy today.

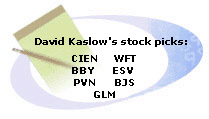

"I'd like to see a summer rally. I guess there's no guarantee. But overall, I think we're still pretty bullish. The economy is still very strong, and global growth continues to be pretty solid, and the companies that we focus on I think can do well, even if we see some moderate slowdown in the economy," said David Kaslow, portfolio manager, Banc of America Capital Management. "I'd like to see a summer rally. I guess there's no guarantee. But overall, I think we're still pretty bullish. The economy is still very strong, and global growth continues to be pretty solid, and the companies that we focus on I think can do well, even if we see some moderate slowdown in the economy," said David Kaslow, portfolio manager, Banc of America Capital Management.

"Ciena (CIEN: Research, Estimates) is a leader in optical networking equipment space. They're really in the sweet spot. There's an insatiable demand for bandwidth, and they're one of the pioneers of the dense wave division multiplexing. Also, the addressable market for Ciena is enormous and so while valuation for a lot of these communications equipment names appears to be on the rich side, I think that the opportunities are still really tremendous for Ciena and some of its peers," Kaslow said.

"In the retail sector, Best Buy (BBY: Research, Estimates) is a name we have liked for several months and it's pulled back, and I think it's a nice opportunity here. Best Buy is driven by the digital product cycle, which we think will provide strong growth for years to come. And that is a secular growth story as opposed to one that is dependent upon a booming economy. Best Buy is a 20 percent grower. They've got lots of opportunities to expand their store base, and take market share of new product introduction. It's really a great story. Providian (PVN: Research, Estimates) is one of the best opportunities in financial services. Really strong growth. Providian has 25 percent earnings growth, at 13 to 14 times earnings. It was extremely cheap, and now it's rebounded somewhat, and it's just cheap."

"Global Marine is in the drilling group, and we think that the approach to this group is probably a basket of stocks, with names like Global Marine (GLM: Research, Estimates) and Ensco (ESV: Research, Estimates). Also in the services company, Weatherford (WFT: Research, Estimates), BJ Services (BJS: Research, Estimates), these companies are all really well positioned to take advantage of what looks like two more years of solid earnings growth, as this group really rebounds strongly."

--Compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|