|

Vivendi, Seagram nearing deal

|

|

June 18, 2000: 6:12 p.m. ET

French conglomerate confirms that merger with Canada's Seagram close

|

NEW YORK (CNNfn) - French conglomerate Vivendi confirmed Sunday that it is in the "final stage" of negotiations to purchase Seagram Co. and the remainder of the pay-TV company, Canal Plus, that it doesn't already own.

The deal is valued at 50 billion euros ($47.5 billion), a source close to the matter said Friday.

Vivendi and Canadian drinks and entertainment company Seagram issued a joint statement and a Vivendi spokesperson confirmed Sunday that both companies were conducting board meetings. Both boards are expected to vote on the merger Monday and an official announcement could come as early as Tuesday.

"A news conference, in the presence of (Seagram Chief Executive) Edgar Bronfman could take place on Tuesday, June 20 at 11:30 (local time, in Paris). Until then, the three groups will refuse any comment," Vivendi said in the statement.

Details of the planned three-way merger emerged after Bronfman told BusinessWeek magazine that the deal is nearly done, acknowledging that he would play the No. 2 role to Vivendi's chief, Jean-Marie Messier, at a combined Vivendi Universal, as the company would be called.

On Wednesday, Seagram -- which has long been said to be courting a buyer - Vivendi, a media-to-utilities conglomerate, and its 49-percent owned subsidiary, Canal Plus, said they have been holding talks about a merger. The source said talks have been ongoing since April and that final completion of the merger - although not an announcement of the deal - would await a planned listing of Vivendi shares on Wall Street.

A stock exchange 'collar' foreseen

As part of the all-stock transaction, Vivendi is expected to offer more than 0.7 of its shares for every Seagram share but the exchange rate would not be fixed - rather, the French company would let the value of the deal vary based on an exchange rate band known as a "collar," the source said. Complete details about the collar weren't immediately available.

Since news of the talks, shares of the Canadian spirits, music and cinema company have gained almost 20 percent. But, Seagram (VO: Research, Estimates) fell 1-15/16 to 61-7/16 Friday on the New York Stock Exchange.

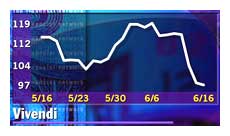

In Paris Friday, shares of Vivendi closed up 0.6 percent to 99 euros, but down from 115.10 euros at Tuesday's close before the news of talks was confirmed. Canal Plus (PAN) closed virtually unchanged at 201 euros.

Based on Vivendi's stock price at Friday's closing in Paris, the deal would value Seagram at 70 euros a share -- or a total of 30.5 billion euros ($29.1 billion). Seagram also has about $6 billion in outstanding debt, the source said.

A no-premium buyout by Vivendi of the 51-percent of Canal Plus it does not own would require payment of another 13 billion euros ($12.4 billion), based on its total value at the close Friday. The pay-TV company is virtually debt-free.

Under French law, no company can own more than 49 percent of a terrestrial TV channel, although there are no such restrictions on digital broadcasting. A three-way Vivendi, Canal Plus and Seagram tie would have to be structured to reflect this.

Analysts had expected Seagram, the Montreal-based owner of brands from Chivas Regal whiskey to Motown records, to fetch $70 to $75 per share.

At the Fortune Global Forum in Paris Friday, Messier said the new entity would have greater international exposure than the company to be created by the purchase of Time Warner by Internet access provider, America Online. Time Warner is the parent company of CNNfn.com. Messier described the merged AOL-Time Warner as "a U.S.-centric group."

Messier said he plans to create a "fully integrated group, which has majority control of all its content."

Scotch and water ... and more

The combined company would regroup their interests in movie-making and electronic media, Vivendi's mobile telecommunications, publishing and water business and Seagram's theme park and music holdings. Messier said the company would sell Seagram's liquor and wine business - the business that Bronfman's grandfather built.

Messier has said he expects to collect more than $9 billion from the sale of that spirits business.

Vivendi's original activity and its main revenue source for years has been its water-supply-and-waste-services business, but the company plans later this year to separate the environmental operation from the media and telecom units and list it as a separate entity.

The Bronfman family is expected to become the new company's largest shareholder, with an 8 percent stake, Bronfman told BusinessWeek, adding that Seagram will control 5 of 18 board seats.

The Seagram CEO, whose grandfather Samuel Bronfman founded the company, told the newspaper the decision to sell was "difficult for my family and certainly for me personally."

Messier's designs on music, new media

A person familiar with the transaction said the merger would take into account different national cultures, but that it is likely one person would be tapped to head Vivendi's film operations on both sides of the Atlantic. Vivendi is said to be accelerating plans for a U.S. stock market listing, which could be a key to completion of the purchase of Seagram shares.

Messier covets Seagram's music assets -- which Bronfman boosted in 1998 with its $10 billion buyout of Dutch group Polygram NV -- because he wants to offer music to customers who subscribe to Vivendi's new "Vizzavi" mobile-phone service that it runs jointly with Britain's Vodafone. The partners are expected to roll out the service in France on Monday, with other countries in Europe slated to soon follow.

As well as its Canal Plus holding, Vivendi is a 25-percent shareholder in British pay-TV company BSkyB (BSY), which is controlled by Rupert Murdoch's News Corp. Industry sources have said Murdoch coveted Seagram's media businesses but did not want its spirits line.

Such a merger would mark a watershed union between two of the world's most recognized - and often hostile - cinematic cultures. Canal Plus, a pay-TV company, is also one of Europe's largest movie studios, while Seagram's Universal Studios is a Hollywood institution.

Messier foresees a "great opportunity" for better development of French cinema through the merger, the source said, by putting Universal's network of distributors to work for Canal Plus-produced movies.

Loss-making Universal has had its fair share of cinematic flops in recent years, but a rebound may be in sight after such recent successes as the Julia Roberts' movie, "Erin Brockovich," and "U-571," a wartime flick starring Matthew McConaughey and Harvey Keitel.

|

|

|

|

|

|

Vivendi

Seagram

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|