|

Worry-free Web shopping

|

|

June 21, 2000: 5:52 a.m. ET

Credit card companies entice online shoppers by eliminating liability

|

NEW YORK (CNNfn) - To entice consumers into buying more products and services online, credit card companies such as Visa International and MasterCard International Inc. are beefing up fraud protection and switching to zero liability -- meaning that if someone fraudulently uses your card and racks up a big bill, you don't have to pay a penny of it.

Not too long ago, consumers were responsible for the first $50 of illicit charges. Now Foster City, Calif.-based Visa, the largest credit card network, and Purchase, N.Y.-based MasterCard, the No. 2 credit card company, have waived such charges -- in part to encourage cardholders to shop 'til they drop on the Internet.

Visa was the first to drop the $50 charge in the beginning of the year. MasterCard followed suit in May.

Zero liability, not zero responsibility

Although prompted by the revenue opportunities offered by electronic shopping, most of these policies extend to both off-line and online purchases. Most credit card companies have enacted similar policies, although the details may vary with the specific company.

Discover has what it calls "100% Fraud Protection," which states that its cardholders are not responsible for unauthorized online charges. American Express has had an online fraud protection guarantee since 1998, and "we rarely charge for unauthorized purchases offline, although we do have the ability to charge $50," said an American Express spokesperson.

In addition to reducing liability to zero, Visa and MasterCard also eliminated the 24-hour reporting requirement: A cardholder was required to inform his card issuer about fraudulent activity on his account within a day in order to be eligible for the $50 cap.

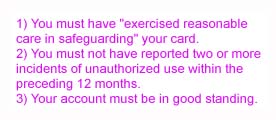

Of course, it pays to read the fine print. Zero liability doesn't mean zero responsibility. Most of these policies say they won't reimburse careless cardholders for fraudulent purchases -- so if you think you can just leave your card unattended on a park bench for a couple of hours, think again. For example, in order to qualify for zero-dollar liability protection as a MasterCard holder, you need to meet the following requirements:

There are also other details that you'll need to check with your credit card company. In the case of Visa, its zero-liability policy only applies to consumer cards issued in the U.S. It also doesn't cover ATM transactions or PIN transactions that are not processed by Visa.

Spreading the word

Members of both card networks -- Visa and MasterCard -- are publicizing the change in policy. For example, AT&T Universal Card, a member of MasterCard's network, trumpeted its "AT&T Universal Card Online Guarantee" in a recent mailing to cardholders. The letter said: "If your account number is ever compromised on the Internet, you won't be liable for online transactions charged to your card by a person who is not an authorized user."

While it's easy to see that the credit card companies wouldn't mind consumers buying more on the Internet -- after all, the main payment vehicle for such buying is a credit card charge -- the stated reason for the new, consumer friendly policies is to simply give card holders better service and protection.

As Ruth Ann Marshall, president of the North American Region for MasterCard International, put it in the company's official announcement of the changes: "MasterCard has long been considered a leader in providing consumer protection to cardholders, and we are committed to working with member financial institutions to educate consumers regarding these policies. We will continue to examine ways to further protect the interests of consumers as MasterCard cards are used over a growing array of purchasing environments including the Internet."

So don't shop on the Internet without your credit card -- and relax. Chances for fraud are low and, at the worst, you'll have to shell out nothing for any unauthorized purchases.

-- by bankrate.com for CNNfn

|

|

|

|

|

|

|