|

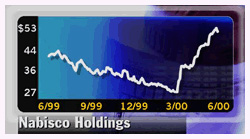

Philip Morris to buy Nabisco

|

|

June 25, 2000: 7:56 p.m. ET

Tobacco giant wins war for food unit for $14.9B, RJR grabs holding unit for $9.8B

|

NEW YORK (CNNfn) - Tobacco giant Philip Morris announced Sunday an agreement to purchase Nabisco Holdings Corp., the maker of Oreo cookies and Ritz crackers for $14.9 billion, while R.J. Reynolds Tobacco Holdings said it will buy Nabisco parent Nabisco Group Holdings for $9.8 billion.

New York-based Philip Morris, the parent of Kraft Foods and the world's largest tobacco company is offering $55 per share in cash for all the outstanding shares of Nabisco Holdings (NA: Research, Estimates) and will also assume $4.0 billion in debt, bringing the total value of the transaction to approximately $18.9 billion. Included in the purchase is the 80 percent stake in Nabisco Holdings owned by Nabisco Group Holdings.

Upon completion of that merger, R.J. Reynolds �(RJR: Research, Estimates) will then acquire Parsippany, N.J.-based Nabisco Group Holdings (NGH: Research, Estimates for $9.8 billion or $30 per share. The sole asset of Nabisco Group Holdings after it sells Nabisco foods will be about $11.8 billion in cash from the deal. Upon completion of that merger, R.J. Reynolds �(RJR: Research, Estimates) will then acquire Parsippany, N.J.-based Nabisco Group Holdings (NGH: Research, Estimates for $9.8 billion or $30 per share. The sole asset of Nabisco Group Holdings after it sells Nabisco foods will be about $11.8 billion in cash from the deal.

The holding company last year spun off the RJR tobacco business and changed its name from RJR Nabisco Holdings. �This deal will reunite the No. 2 U.S. tobacco company with its former subsidiary.

The $30 offer from RJR, in line with expectations, is a 17.3 percent premium over NGH's closing price of 25-9/16 Friday on the New York Stock Exchange. The holding company has traded at a discount because of fears of tobacco liabilities from RJR. �

Philip Morris, which owns Kraft foods, also said it will spin off less than 20 percent of the newly-combined food group in an initial public offering to retire part of the debt incurred in the purchase. The IPO is expected to occur in early 2001.

The agreements end a more than two-month, two-tiered bidding war for Nabisco that was ignited by financier Carl Icahn, who owns 9.5 percent of Nabisco Group Holdings. Icahn originally bid $16 per share for NGH and last week said he could raise his offer to $31 per share. In addition to Philip Morris, Britain's Cadbury Schweppes and France's Groupe Danone also submitted a joint bid for Nabisco Holdings when final offers were due June 21.�

The sale of Nabisco is the latest in a series of deals in the food industry and comes on the heels of last week's $1.6 billion purchase of International Home Foods by ConAgra. Earlier this month, Anglo-Dutch firm Unilever agreed to buy Bestfoods for $24.3 billion.

Sunday's deal by Philip Morris (MO: Research, Estimates), considered the favorite all along, cut off the auction for Nabisco Holdings sooner and at a lower price than some had expected. One analyst told CNNfn.com last week that Nabisco would make a public statement to set off another round of higher bids while others expected the food unit would eventually fetch $60 per share or $16 billion.

The $55 offer from Philip Morris represents a 6.5 percent premium over Nabisco Holding's closing price of 51-5/8 Friday on the New York Stock Exchange.

The combination of Nabisco and Kraft gives Philip Morris, the maker of Miller beer and Marlboro cigarettes, one of the largest snack food lineups in the world. The combined companies will own a 13 percent share of the world cookies and crackers market. The merger will unite such well-known brands as Life Savers and Chips Ahoy with Kool-Aid and Jello. The combination of Nabisco and Kraft gives Philip Morris, the maker of Miller beer and Marlboro cigarettes, one of the largest snack food lineups in the world. The combined companies will own a 13 percent share of the world cookies and crackers market. The merger will unite such well-known brands as Life Savers and Chips Ahoy with Kool-Aid and Jello.

Philip Morris expects the merger will positively impact reported earnings by 2002. The two food brands had combined 1999 pro-forma revenue of $34.9 billion and operating income of $5.5 billion. The combination will lead to a cost savings of $400 million in 2002 and $600 million in 2003, the company said.�

Philip Morris will formally announce its intentions at a press conference Monday at 10 a.m. EDT in New York.

|

|

|

|

|

|

|