|

Inktomi's new Yahoo! role

|

|

June 26, 2000: 4:27 p.m. ET

Search-engine provider loses on consumer side, gains on corporate

|

NEW YORK (CNNfn) - Inktomi on Monday lost its place as the search engine for one of the most popular Web portals, but executives and analysts said the move will have very little, if any, financial impact on the company.

Yahoo!, one of Inktomi's most visible customers, said Monday that technology from privately-held Google will replace Inktomi's as the underlying search engine for its popular Web directory and navigational guide.

At the same time, Yahoo! said Inktomi will become the main provider of search and navigation technology for "Corporate Yahoo!," a new service that will allow business customers to create customized Intranet portals combining company information with Yahoo!'s other content and services.

Although analysts' estimates vary, most agree that the enterprise information portal market is set to take off. Merrill Lynch forecasts that it will grow from $4.4 billion in 1998 to $14.8 billion in 2002.

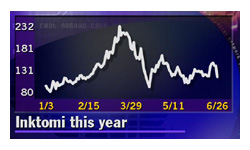

Even so, investors punished Inktomi (INKT: Research, Estimates) shares, which were off 25-5/16, or more than 18 percent, to close at 115-1/16 in Nasdaq trading Monday.

Executives at Inktomi in Foster City, Calif., said the business it is losing to Google on the consumer side represented a very small part of its total revenue, and that the enterprise business is an important part of its future. Analysts on Wall Street said Monday's sell-off was largely overdone. Executives at Inktomi in Foster City, Calif., said the business it is losing to Google on the consumer side represented a very small part of its total revenue, and that the enterprise business is an important part of its future. Analysts on Wall Street said Monday's sell-off was largely overdone.

"Yahoo! represented less than 2 percent of our total revenues, and if you look at the potential of the enterprise space and enterprise information portals, that market is very large," Richard Pierce, Inktomi's chief operating officer, said in an interview with CNNfn.com.

"This is a huge thrust for us in conjunction with Yahoo!'s enterprise thrust, and we're really happy about that relationship," Pierce added.

CIBC World Markets analyst Martin Pyykokkonen, who is maintaining his "strong buy" recommendation on Inktomi's shares, said the lost business is likely to be offset by the enterprise portal business as well as other strengths in the company.

"I don't think we'll see anybody cutting numbers as a result of this," Pyykokkonen said. "But naturally if you have Yahoo! saying something negative on a stock that really has had no negative news, it's understandable that it will sell off. For it to be sold off this much is an overreaction to it."

Alan Adler of Friedman Billings Ramsey agreed, noting that network products have been an increasingly important part of Inktomi's overall business.

Inktomi divides its business into two parts: network products and portal services. Currently, the portal services side, comprised of search, directory and commerce engine, represents roughly 35 percent of the company's business and has been decreasing as a percentage of total revenue, Adler said.

"The real driver here for the company is the network products side," he said

"The stock is taking a beating, but I think that's an overreaction to the news," Adler added. "I think it's more the perception of the fact that they lost the general Yahoo! business. I think the corporate Yahoo! business is going to emerge as a promising opportunity for the company; but in the near term it is going to have a difficult time replacing the general Yahoo! business."

Friedman Billings Ramsey has a "buy" rating on Inktomi, and Adler said he does not expect Monday's news to change the company's revenue or earnings forecasts for the company. The company is expecting revenue of $53.9 million in the current quarter, and $197 million for the fiscal year. They expect earnings of 2 cents per share for the current quarter and 3 cents per share for the year.

The Google search engine will replace Inktomi's on Yahoo's consumer Web portal in 30 days.

So far, Yahoo! said that Alcatel, Inktomi, Network Appliance, and the State of North Carolina in conjunction with Andersen Consulting have signed agreements to deploy Corporate Yahoo! in their organizations.

Yahoo! (YHOO: Research, Estimates) shares were down 6, or nearly 5 percent, to close at 119-5/16 in Nasdaq trading Monday.

|

|

|

Inktomi

Yahoo!

Google

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|