|

U.S. stocks sour

|

|

June 29, 2000: 4:56 p.m. ET

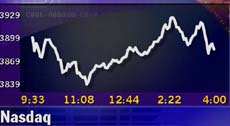

Profit warnings prompt skittish investors to sell; Dow and the Nasdaq slump

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks took a beating Thursday as investors became increasingly concerned about corporate quarterly earnings missing expectations.

But some light buying late in the day kept losses in check as portfolios started being adjusted ahead of the end of the second quarter, which ends Friday.

"For some reason, today we're painting the whole picture with a broad brush and a few profit warnings are really damaging that landscape for the companies that are good (performers)," said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum.

Profit warnings from Unisys and SCM Microsystems triggered selling throughout the technology sector. Some of the losses were pared by gains in pharmaceuticals, such as Eli Lilly, Johnson & Johnson and Merck.

The Nasdaq composite index shed 63.11 points, or more than 1 percent, to 3,877.23. The Dow Jones industrial average lost 129.75 to 10,398.04, and the S&P 500 slipped 12.43 to 1,442.39. The Nasdaq composite index shed 63.11 points, or more than 1 percent, to 3,877.23. The Dow Jones industrial average lost 129.75 to 10,398.04, and the S&P 500 slipped 12.43 to 1,442.39.

The selling comes just one day after the Federal Reserve left interest rates unchanged for now, which analysts say normally would lend support. "But he (Fed chairman Alan Greenspan) also said they're still worried and they're not through tightening," said Phil Dow, equity strategist at Dain Rauscher Wessels.

Analysts said this could signal some investor concern that earnings may not be as healthy during the second half of the year, although they expect second-quarter results to remain strong. Analysts said this could signal some investor concern that earnings may not be as healthy during the second half of the year, although they expect second-quarter results to remain strong.

Market breadth was negative. On the New York Stock Exchange, decliners nudged out advancers 1,484 to 1,458, as more than 1.1 billion shares changed hands. Losers also outnumbered winners on the Nasdaq 2,188 to 1,814, as more than 1.5 billion shares were traded.

In currency markets, the dollar rose against the yen and the euro. Treasury securities were mostly higher.

Warnings and window dressing on Wall Street

While the influx of profit warnings spurred much of the selling as the second quarter of 2000 comes to a close, analysts said some "window dressing" and portfolio repositioning was helping keep losses in check. Window dressing occurs when banks and companies try to make their accounts more attractive as each fiscal quarter nears its close.

"I think it's just people doing some positioning ahead of the end of the quarter and taking advantage of the pullback," said Bill Meehan, chief market strategist at Cantor Fitzgerald.

Helping to keep losses from mounting on the Dow, Johnson & Johnson (JNJ: Research, Estimates) gained 1/2 to 98-9/16, and Merck (MRK: Research, Estimates) advanced 1/8 to 74-1/8.

In corporate news, Eli Lilly (LLY: Research, Estimates) surged 15-5/16 to 102-1/2 after the drug maker said it received encouraging results from a late-stage clinical study for an experimental medicine to treat severe sepsis, a disease resulting from the spread of bacteria in the body that can cause organ failure and death.

But concerns about quarterly results weighed on the market as investors punished those companies that issued profit warnings. But concerns about quarterly results weighed on the market as investors punished those companies that issued profit warnings.

Ted Weisberg, a New York Stock Exchange floor trader with Seaport Securities, told CNNfn's Market Call that investors have little patience for companies that don't measure up to earnings expectations. (317K WAV) (317K AIFF)

According to Briefing.com, 24 companies have issued profit warnings this week.

"Confession may be good for the soul, but not on Wall Street. The negative pre-announcements that have been with us for the past two weeks has begun to accelerate with 21 confessions yesterday (Wednesday) and a handful this morning," Prudential Securities market analyst Larry Wachtel wrote in a note to clients. "This sets up some fear and trembling about the wide range of reports to come through most of July."

Among those warning that their results won't be up to snuff, SCM Microsystems (SCMM: Research, Estimates) tumbled 35-11/16 to 53-5/8 after it said second-quarter earnings will be 7 to 11 cents per share -- well below the First Call consensus estimate of 22 cents -- due to "volatile" markets for some of its products.

Unisys (UIS: Research, Estimates) fell 8-5/16 to 14-13/16 after warning that profit would be about half of forecast levels during the second quarter. It blamed the delay of some large contracts and continued weakness of sales to the federal government and financial services sector.

Merrill Lynch analyst Steve Milunovich downgraded his intermediate rating for Unisys to "neutral" from "accumulate."

In other earnings warnings, Goodyear Tire and Rubber (GT: Research, Estimates) shed 2-1/16 to 21-1/4, after saying it expects to report second-quarter earnings before charges of 37 cents a share, about even with the year-earlier period. The results would be well below the First Call consensus estimate of 58 cents a share. In other earnings warnings, Goodyear Tire and Rubber (GT: Research, Estimates) shed 2-1/16 to 21-1/4, after saying it expects to report second-quarter earnings before charges of 37 cents a share, about even with the year-earlier period. The results would be well below the First Call consensus estimate of 58 cents a share.

Dow component DuPont (DD: Research, Estimates) slid 1-19/32 to 44-1/2, after saying it will take a $60 million after-tax charge in second-quarter results to increase litigation reserves associated with lawsuits over a recalled fungicide.

No rate hike, but investors still concerned

The Federal Open Market Committee, the Fed's monetary policy-making body, wound up its two-day meeting Wednesday with no surprises. Interest rates remain unchanged but inflationary concerns still persist.

"Maybe it's concern that the economy may have more of a hard landing," said Alan Skrainka, chief market strategist at Edward Jones. "The economy grew a little faster than expected, so people might be thinking we're not done as far as interest rate hikes are concerned."

Analysts said investors will now spend time digesting economic data and keeping a keen eye peeled for any corporate revenue growth warnings.

"We celebrated the fact that (the Fed) was much less stern on their rhetoric yesterday (Wednesday), but today the party is over and a slower economy may have an adverse effect on earnings," said Art Hogan, chief market analyst at Jefferies & Co.

|

|

|

|

|

|

|