NEW YORK (CNNfn) - U.S. Treasurys posted modest gains Monday in an abbreviated holiday session, buoyed by a weaker-than-expected economic report reinforcing expectations that the economy is slowing.

In the currency markets, the dollar slid against the yen ahead of a key quarterly report on Japanese business sentiment, slated for release Tuesday.

Shortly after 1 p.m. ET, the 10-year Treasury note, which many consider the market benchmark, rose 10/32 of a point in price to 103-22/32. The yield fell to 5.98 percent from 6.03 percent Friday, as yields move inversely to price.

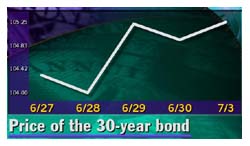

The 30-year bond gained 10/32 to 105-8/32, its yield retreating to 5.87  percent from 5.90 percent. percent from 5.90 percent.

Treasurys drew support from the latest economic news, suggesting the Fed may not need to hike interest rates in the coming months.

The National Association of Purchasing Management (NAPM) index, a key measure of manufacturing activity, fell to 51.8 in June, its lowest level since January 1999. The number was below the 53.0 reading forecasted by economists polled by Briefing.com.

In addition, the prices paid component, a measure of inflation, fell to 61.2 in June from 65.8 in May. "The NAPM report is another piece of information that fits the market's mindset that the Fed's tightening is close to being done," said Joe  LaVorgna, senior U.S. economist at Deutsche Bank Securities. LaVorgna, senior U.S. economist at Deutsche Bank Securities.

In an effort to contain inflation and slow the economy, the Federal Reserve hiked short-term interest rates six times in the last year. Recent economic reports suggest the tightening has had some impact, and the central bank kept rates unchanged at 6.5 percent last week. The Federal Open Market Committee, its policy-making arm, meets again on Aug. 22.

Nevertheless, trading activity was light ahead of the Fourth of July holiday, and analysts noted any price movement was exaggerated. U.S. financial markets are closed Tuesday.

In other economic news, the Commerce Department said U.S. construction spending rose 0.1 percent in May, compared with a revised 1.1 percent decline in the prior month.

The market's main focus is Friday's key U.S. June employment report. Analysts polled by Briefing.com forecast payrolls to have risen to 250,000 in June compared with a 231,000 gain in May, and the unemployment rate to decline to 4 percent from 4.1 percent in the prior month.

(Click here for a look at Briefing.com's economic calendar.)

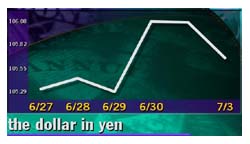

Dollar weakens vs. yen

The U.S. dollar fell against the yen as traders focused on Tuesday's Japanese Tankan survey for the second quarter, a key report on business sentiment. Analysts said the report should shed light as to whether Japan may soon end its current zero interest rate policy.

Many market participants expect the survey to show Japanese companies are positive in their outlook for the economy. "Traders are buying yen in  anticipation of a strong Tankan report," said Joe Francomano, foreign exchange trader at Erste Bank. anticipation of a strong Tankan report," said Joe Francomano, foreign exchange trader at Erste Bank.

Shortly after 1 p.m. ET, the dollar traded at 105.65 yen compared with 106.07 Friday, a 0.4 percent loss in the dollar's value. Meanwhile, the dollar rose slightly against the euro. The euro was at 95.10 cents, down from 95.26 cents Friday.

|