|

Stock picks by the pros

|

|

July 6, 2000: 3:46 p.m. ET

RealNetworks, SDL, Xilinx, Intel, Nordstrom, and Verizon win mention

|

NEW YORK (CNNfn) - Portfolio managers chose from a variety of sectors for their stock picks Thursday, selecting such names as Applied Materials, Atmel, Verisign, Cell Genesys, Lucent, Cisco and Nokia.

While the markets remained mixed on Wall Street, recent guests on CNNfn commented on the stocks they are buying, and why.

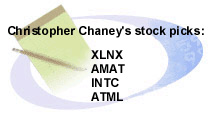

"This year is going to be a great year for the semiconductor sector in terms of revenue growth. And we think that next year is going to be good, but the revenue growth rate is going so slow," said Christopher Chaney, semiconductor analyst, A.G. Edwards. "I think we've known that for well over a year. And it's just that we're getting closer to that point so at what point do you start to let go of some of the gains that you've had over the past year and a half or two years?" "This year is going to be a great year for the semiconductor sector in terms of revenue growth. And we think that next year is going to be good, but the revenue growth rate is going so slow," said Christopher Chaney, semiconductor analyst, A.G. Edwards. "I think we've known that for well over a year. And it's just that we're getting closer to that point so at what point do you start to let go of some of the gains that you've had over the past year and a half or two years?"

"We saw momentum just fling from the stocks heading for the exit doors. A lot of people really overreact both on the upside and the downside because they are so volatile," he said. "You have very hot money coming in and out of the sector all of the time because the gains can be so huge in such a short amount of time."

"What's happened is you have people who have made a lot of money in this sector. Although we've not specifically seen any real signs of slowing yet, we do think that could happen in the future," Chaney said. "Whenever someone talks about it and begins to give warning signs about it, people will say that we're at the peak, things can only get worse from here and I will sell my stocks. And that is the mentality that people are using right now."

Regarding Salomon Smith Barney's downgrading of 10 semi-conductor stocks on Wednesday, he said, "We don't think it's time to sell. We think they're six months early."

"We'd be buying Xilinx (XLNX: Research, Estimates), Applied Materials (AMAT: Research, Estimates), Intel (INTC: Research, Estimates), and we would buy Atmel (ATML: Research, Estimates) that is a flash memory producer," Chaney said.

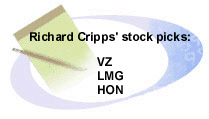

"I think if you are bullish here, you go back and look to the last time the Fed eased up on interest rates which was 1995, which, of course, was a good year for investors," said Richard Cripps, chief financial strategist, Legg Mason. "The S&P shot up almost 35 percent. So using that as a guide, some investor think that is what we're going to see." "I think if you are bullish here, you go back and look to the last time the Fed eased up on interest rates which was 1995, which, of course, was a good year for investors," said Richard Cripps, chief financial strategist, Legg Mason. "The S&P shot up almost 35 percent. So using that as a guide, some investor think that is what we're going to see."

"But I think that the global picture in 1995 was a little bit more murky than it is today," Cripps said. "Economy was slower than today. As we look at the world scene it is actually quite good. A lot of foreign economies are expected to grow a little bit faster than the U.S. economy this year. So that is a major difference. And again it probably keeps the Fed from decreasing or cutting interest rates anytime soon."

His picks are Verizon (VZ: Research, Estimates), Liberty Media (LMG: Research, Estimates) and Honeywell (HON: Research, Estimates).

"We know that we are in an economy which is in a transition from a rapid growth to a much slower growth. We thought that the initial impact would be felt by the cyclical companies, but all of a sudden we get three big bombs laid. Companies that are all in the software business are all blaming large-order cancellations at the last minute. I think that this puts, or casts, a pall over the technology stocks from now until the end of earnings season, or until some other bellwether company comes out and gives exactly the opposite direction. I think the bigger probability is that there will be a quiet period," said Jim Waggoner, market and technology strategist, Sands Brothers & Co. "We know that we are in an economy which is in a transition from a rapid growth to a much slower growth. We thought that the initial impact would be felt by the cyclical companies, but all of a sudden we get three big bombs laid. Companies that are all in the software business are all blaming large-order cancellations at the last minute. I think that this puts, or casts, a pall over the technology stocks from now until the end of earnings season, or until some other bellwether company comes out and gives exactly the opposite direction. I think the bigger probability is that there will be a quiet period," said Jim Waggoner, market and technology strategist, Sands Brothers & Co.

"I think it is going to be a 'show me' period for the next two or three weeks. I think the market and technology investors are going to be on pins and needles. If we get through the period, if we get through the earnings report season, I think we'll successfully have a relief rally," he said.

"We still like the Internet infrastructure area," said Waggoner. "RealNetworks (RNWK: Research, Estimates) is a company that is probably as immune as any. They're the de facto standard in streaming media. We think that that is a very strong area. We like Verisign. Verisign (VRSN: Research, Estimates) is doing more of the transaction-oriented business on the Internet, but we like that stock, and that stock has been beaten down, along with Entrust (ENTU: Research, Estimates), but not as severely. Also, SDL (SDLI: Research, Estimates), which is in the optical-networking component industry, very important growth area of the future. We like that area as well. So there are companies that have been brought down with the market that still offer excellent fundamental position and some pretty decent pricing as well."

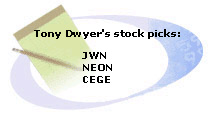

"We've gone from a psychology a month and a half ago that the economy is growing too quickly, and the Fed is going to have to raise rates, to we're going to go towards a recession because the economy's slowing too quickly. That's like turning around the JFK on the Hudson: it doesn't work that quickly," said Tony Dwyer, market strategist, Kirlin Holdings. "So you get fear coming into the market -- it just changes its nature. The fear was inflation. Now the fear is earnings. And it's going to end up somewhere in the middle. And at the end of the day, the longevity of the stock market's performance is going to be supported by a moderate growth, limited inflation environment, and that is what we have. It's not going to be robust growth -- 5.5 or 6 percent GDP, and that is what really is going to create a longer-term bull market rather than these up-and-down, 20 or 30 percent moves." "We've gone from a psychology a month and a half ago that the economy is growing too quickly, and the Fed is going to have to raise rates, to we're going to go towards a recession because the economy's slowing too quickly. That's like turning around the JFK on the Hudson: it doesn't work that quickly," said Tony Dwyer, market strategist, Kirlin Holdings. "So you get fear coming into the market -- it just changes its nature. The fear was inflation. Now the fear is earnings. And it's going to end up somewhere in the middle. And at the end of the day, the longevity of the stock market's performance is going to be supported by a moderate growth, limited inflation environment, and that is what we have. It's not going to be robust growth -- 5.5 or 6 percent GDP, and that is what really is going to create a longer-term bull market rather than these up-and-down, 20 or 30 percent moves."

"I think there's been a lot of damage done into the economically sensitive, the consumer cyclicals, such as the retailers. I think the retailers can do fine. The financials should be able to do pretty well in this environment. And I think tech is fine, too. There is movement in biotechnology too. These are momentum groups that have the best growth potential. And that is where investors' focus is. And that is probably going to continue to be that way, until they do show actual signs of peaking out," Dwyer observed.

"From the fundamental standpoint, Nordstrom (JWN: Research, Estimates) since1993 hasn't traded below 14 times earnings. So, again, a lot of the negative sentiment about what could happen to consumer spending in a slower economy has been discounted in the valuations of these stocks, and this is a quality high-end retailer. New Era of Networks' (NEON: Research, Estimates) stock has had a real good run, and I think when you're investing in tech, you have to look for those companies that have positive earnings surprises, upward earnings revisions, and a solid growth outlook. Biotechs are all turning around and starting to gain momentum. Cell Genesys (CEGE: Research, Estimates) is in the human genomes area, which is a momentum area right now," he said.

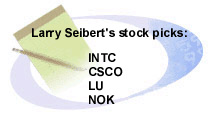

"We are long-term tech bulls. We did notice, like everyone else, that biotechs sort of tried to take over the lead yesterday, so people are looking for some other areas," said Larry Seibert, portfolio manager, Barrett Associates. "We are long-term tech bulls. We did notice, like everyone else, that biotechs sort of tried to take over the lead yesterday, so people are looking for some other areas," said Larry Seibert, portfolio manager, Barrett Associates.

"Tech companies in general are going to have a multiplier effect versus the GDP. So as long as the GDP stays relatively strong, tech earnings should be a multiplier of that," Seibert said. "If we see the GDP slow down markedly, then we could have a real problem in technology. But we don't see that yet."

"The PC area does seem to be one of the bright spots. We like Intel (INTC: Research, Estimates). Now, of course, there's some risk in that it does appear to be one of the bright spots, and one of the only bright spots. So we hope that that doesn't turn," he said. "But in general, PC growth should be 15 to 17 percent, and that's okay for a company like Intel. Cisco's (CSCO: Research, Estimates) most recent quarter was, again, another 50 percent. Internet infrastructure is one of the areas that we still like. They should do pretty well going forward. Lucent (LU: Research, Estimates) stumbled at the beginning of the year, but it's a very bright long-term prospect in the communications IC area. With Nokia (NOK: Research, Estimates) the most recent news, about 3G licenses for wireless data being a little too expensive, has hurt the stock a bit. They had an analysts' meeting and talked about how expensive it was in the 10-year payback, which is a little bit scary for some people. So we think again long-term data devices, wireless, are really powerful."

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|