NEW YORK (CNNfn) - The Nasdaq composite index rose enough Thursday to wipe out most of the previous session's losses, as investors snapped up semiconductor makers, betting a recent sell-off was overdone.

Help by positive comments from a big brokerage, Intel, Applied Micro Circuits and PMC Sierra all gained on hope that the companies supplying technology's infrastructure will post strong earnings in the months ahead.

"We're seeing a real bounce in the semis," said Brian Finnerty, head of Nasdaq trading at C.E. Unterberg Towbin. "These are the guys that are supplying the Nortels, the Ciscos, the JDSUs (JDS Uniphase). That's where the good earnings are going to be."

The Dow Jones industrial average, meanwhile, ended little changed as Intel's gains offset a big tumble in IBM. The computer maker fell for fourth straight session on concern about earnings weakness. The Dow Jones industrial average, meanwhile, ended little changed as Intel's gains offset a big tumble in IBM. The computer maker fell for fourth straight session on concern about earnings weakness.

The mixed action comes hours ahead of Friday's jobs report for June. The government numbers, expected to show that labor markets remains tight, could offer clues into how much higher the Federal Reserve might raise the cost of borrowing.

Fears that higher interest rates will hurt profits sent technology stocks lower Wednesday. But tech investors returned Thursday.

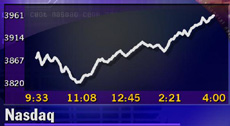

The Nasdaq rose 97.47 points, or 2.5 percent, to 3,960.57, reversing most of the previous session's 128-point slide.

The Dow, meanwhile, slipped 2.13 to 10,481.47 and the S&P 500 gained 10.44 to 1,456.67. The Dow, meanwhile, slipped 2.13 to 10,481.47 and the S&P 500 gained 10.44 to 1,456.67.

More stocks rose than fell. Advancing issues on the New York Stock Exchange beat declining ones 1,635 to 1,250 as trading volume reached 945 million shares. Nasdaq winners topped losers 2,072 to 1,872 as more than 1.4 billion shares changed hands.

In other markets, the dollar rose against the yen and euro. Treasury securities fell.

Chips ahoy

Semiconductor makers, pummeled Wednesday after Salomon Smith Barney raised concerns about growth rates, showed signs of life Thursday. The Philadelphia Stock Exchange semiconductor index rose 48.29 points to 1,119.10.

Intel (INTC: Research, Estimates), the biggest chipmaker, gained 4-15/16 to 136-9/16. Others followed suit, as investors revaluated Salomon's concerns about growth.

"I still think you'll have favorable growth this year and going into next," said Francis Gannon, fund manager at SunAmerica Asset Management.

Applied Materials (AMAT: Research, Estimates) jumped 3-1/4 to 86-11/16 Advanced Micro Circuits (AMCC: Research, Estimates) rose 17-3/16 to 118 and PMC Sierra (PMCS: Research, Estimates) gained 14-1/16 to 183-7/8. Applied Materials (AMAT: Research, Estimates) jumped 3-1/4 to 86-11/16 Advanced Micro Circuits (AMCC: Research, Estimates) rose 17-3/16 to 118 and PMC Sierra (PMCS: Research, Estimates) gained 14-1/16 to 183-7/8.

Merrill Lynch may have sparked some buying. The brokerage Thursday came to the defense of the sector, saying it believes the sector will hit a new high by year's end. Merrill called any weakness a buying opportunity.

Still, a series of earnings warnings hurt several stocks Thursday as at least 13 firms said their results would disappoint Wall Street.

Among those feeling pain, IBM (IBM: Research, Estimates) fell 3-3/8 to 101-5/8, extending Wednesday's 5-1/4 slide. Citing concerns about its mainframe hardware and software sales, Bear Stearns analyst Andy Neff cut IBM's second-quarter earnings estimates to 97 cents a share from the $1.02 a share previously forecast. Revenue estimates also were lowered.

Prudential Securities and Merrill Lynch also made negative comments.

The setback comes a day after two companies, Computer Associates (CA: Research, Estimates) and BMC Software (BMCS: Research, Estimates), blamed some of their earnings warnings on weakness in mainframe sales.

Among those warning Thursday, FirstWorld Communications (FWIS: Research, Estimates) plunged 5-1/2 to 4-1/8 after the business Internet services provider said it expects second-quarter revenue to be in the range of $17.9 million to $18.2 million, compared to analyst expectations of about $19.9 million.

Visual Networks (VNWK: Research, Estimates) tumbled 14-1/4 to 12 after saying it expects second-quarter earnings of 1 cent per share versus expectations of 6 cents per share.

These warnings come amid a string of negative forecasts from companies trying to please shareholders during a time of rising borrowing costs. The Federal Reserve raised interest rates six times since June 1999, hoping to slow growth enough to prevent inflation. But some stock investors fret the central bank may have gone too far, triggering a slowdown that hurts corporate profits.

"We have more profit warning jitters as the U.S. economy appears to be slowing," said Alan Ackerman, senior vice president at Fahnestock & Co.

But not all companies were disappointing Wall Street. Marriott International Inc. (MAR: Research, Estimates) rose 1 to 37-3/4. The hotel operator posted second-quarter profit of $126 million, or 50 cents a share, up from $114 million, or 42 cents a share, a year earlier. Analysts had expected earnings of 48 cents a share.

Jobs data ahead

In the latest economic data, the government said factory orders rose 4.1 percent in May, above expectations. The number counters a series of data that suggested the economy is cooling.

But many investors were more focused on Friday, when the Labor Department releases its jobs report for June.

"If we get a strong number (Friday) it could rekindle fears of another Fed tightening and that will keep investors on the defensive," said Peter Cardillo, director of research at Westfalia Investments.

A strong number could be coming. Analysts surveyed by Briefing.com forecast the unemployment rate fell to 4 percent from 4.1 percent in May. Some 250,000 jobs are seen having been created during the month, after a gain of 231,000 in May. Average hourly earnings are forecast to have jumped 0.4 percent after a slight 0.1 percent gain.

Still, SunAmerica's Gannon forecasts the economy will continue to cool in the months ahead, taking pressure off the Fed to tighten credit.

"We need the employment numbers to show a slowdown," he told Street Sweep.

|