LONDON (CNNfn) - Europe's main markets closed mostly lower Monday after drifting in and out of negative territory for most of the session, led by drug, health-care and consumer-products stocks. Technology stocks took a turn for the worse, sliding with the U.S. Nasdaq market.

The FTSE 100 slipped 31.3 points, or almost 0.5 percent, to 6,466.4, led by drug and software companies such as Sage, Sema and Misys.

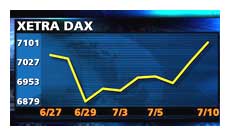

But Frankfurt's Xetra Dax rose 18.60 points, or 0.26 percent, to 7,070.82. But Frankfurt's Xetra Dax rose 18.60 points, or 0.26 percent, to 7,070.82.

The CAC 40 in Paris fell 78.55 points, or 1.2 percent, to 6,487.42, with Franco-German drug maker Aventis and data network operator Equant leading declines.

The FTSE Eurotop 300 index, a basket of the region's largest companies, fell 0.3 percent to 1,619.76. Its health-care segment slid 5 percent, due largely to a 4.6-percent drop for the London-listed medical science company Nycomed Amersham (NAM).

John Shepperd, a bond market expert at investment bank Dresdner Kleinwort Benson, said last week's relatively weak jobs numbers in the United States would dominate markets at the start of the new week, easing concerns that the world's largest economy could be overheating. "It should take some of the heat out of the U.S. interest-rate environment," Shepperd told CNNfn.

In the currency market Monday, the euro traded at 95.12 U.S. cents, little changed from 95.08 cents late Friday in New York. The dollar fell to ¥106.82 from ¥107.43 in New York.

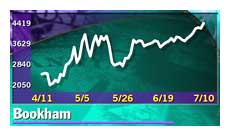

Bookham lights up

In London, computer software companies were among the decliners, Sema Group (SEM) falling 4 percent, Sage Group (SGE) lost 5 percent, and rival Misys (MSY) dropped 3.5 percent. The biggest loser in London was CMG (CMG), declining 5.8 percent.

Drugs maker SmithKline Beecham (SB-) fell 2.2 percent and merger partner Glaxo Wellcome (GLXO) dropped 1.1 percent.

Optical components maker Bookham (BHM) jumped 10.4 percent after U.S. rival JDS Uniphase (JDSU: Research, Estimates) agreed to buy SDL (SDLI: Research, Estimates) for $41 billion. Optical components maker Bookham (BHM) jumped 10.4 percent after U.S. rival JDS Uniphase (JDSU: Research, Estimates) agreed to buy SDL (SDLI: Research, Estimates) for $41 billion.

Aerospace and defense firm BAE Systems (BA) rose 2.1 percent after a report in the Sunday Times said it was in talks with Saudi Arabia to sell 48 Eurofighter combat aircraft and support services for about £6 billion ($9.1 billion). BAE called the story "speculation", but said it is marketing the Eurofighter in the Middle East.

Food and drinks company Diageo (DGE) fell 1 percent following media reports it might sell its U.S. food division Pillsbury or merge it with another firm and keep a stake. The Wall Street Journal said a Pillsbury sale could fetch as much as $12 billion. London's Sunday Times said Diageo is considering joining a consortium that might bid for Seagram's liquor unit.

Beverages firm Cadbury Schweppes (CBRY) lost 1.6 percent.

EADS fails to take off

Among the worst performers in Paris, drug maker Aventis (PAVE) lost almost 5 percent.

Chipmaker STMicroelectronics (PSTM) fell 2.2 percent, data network operator Equant (PEQU) dropped 5.2 percent, and information technology consultant CAP Gemini (PCAP) declined 3.7 percent.

The biggest loser on the CAC 40 was France's third-largest mobile phone network operator, Bouygues (PEN), which fell 5.9 percent.

Shares in the European Aeronautic, Defense and Space Co., Europe's largest aerospace company, fell 7.9 percent to  17.50 in Paris from their offering price of 17.50 in Paris from their offering price of  19. EADS was formed by the three-way merger of Aérospatiale-Matra, the Dasa aerospace unit of Germany's DaimlerChrysler (FDCX), and Spain's Construcciones Aeronauticas SA, or Casa. The combination formed the world's third-biggest aerospace company after Boeing Co. and Lockheed Martin. 19. EADS was formed by the three-way merger of Aérospatiale-Matra, the Dasa aerospace unit of Germany's DaimlerChrysler (FDCX), and Spain's Construcciones Aeronauticas SA, or Casa. The combination formed the world's third-biggest aerospace company after Boeing Co. and Lockheed Martin.

In Frankfurt, DaimlerChrysler climbed 1.2 percent after media reports said the automaker is considering measures to generate In Frankfurt, DaimlerChrysler climbed 1.2 percent after media reports said the automaker is considering measures to generate  2.5 billion in cost cuts. Rival BMW (FBMW) climbed 1.3 percent, and Volkswagen (FVOW) added 0.6 percent. 2.5 billion in cost cuts. Rival BMW (FBMW) climbed 1.3 percent, and Volkswagen (FVOW) added 0.6 percent.

Chip maker Infineon fell 0.9 percent and drug maker Schering (FSCH) shed 3.5 percent.

Reinsurer Munich Re [FSE:FMUV3] fell 3.9 percent, retailer Karstadt Quelle (FKAR) shed 2.5 percent and supermarket operator Metro (FMTR) dropped 3.7 percent.

Dresdner Bank (FDRB) climbed almost 1 percent after spokesmen said at the weekend that merger talks with Commerzbank (FCBK) would continue this week. Commerzbank rose 0.6 percent. Allianz (FALV), which owns 21.7 percent of Dresdner, lost almost 1 percent.

-- from staff and wire reports

|