|

Stock picks by the pros

|

|

July 10, 2000: 4:27 p.m. ET

Myriad Genetics, CitiGroup, Intel, Wal-Mart and Wells Fargo make the list

|

NEW YORK (CNNfn) - Market analysts were keen on biotech, financial, oil services and retail stocks Monday, picking out names such as Molecular Devices, Bank of New York, J.P. Morgan, Sears, Fleet Boston and Home Depot.

While Monday's market drifted into late afternoon, recent guests on CNNfn commented on the stocks they are buying, and why.

"I think this had this huge race to the starting line and now we're there and I think the biotech group is just at the beginning of a long period of lots of growth," said Scott Greenstone, biotech analyst, Thomas Weisel. "I think this had this huge race to the starting line and now we're there and I think the biotech group is just at the beginning of a long period of lots of growth," said Scott Greenstone, biotech analyst, Thomas Weisel.

"Life science is a study of diseases and disease causes. But what's really exciting about life sciences is now that we have had this Human Genome Project - a lot of publicity has been about the Human Genome Project. But really all that was was this huge race to the starting line. Now we have a lot of the raw material to study the root causes of diseases, which are genes. Genes turn out to be the cause of thousands of diseases that we never knew - we never had the tools to understand before," Greenstone said. "Now all of these companies, like Invitrogen (IVGN: Research, Estimates) and Celera Genomics (CRA: Research, Estimates) and a whole host of others, have given us a tool to study those diseases."

Greenstone said that he likes: Molecular Devices (MDCC: Research, Estimates). "One of the next phases of study of genes and how they relate to diseases is to test thousands of new potential drugs to cure those diseases, and Molecular Devices makes these instruments that will test those drugs against those genes, and ultimately that's going to be a huge market to test new drugs."

Another pick is PerkinElmer (PKI: Research, Estimates). "PerkinElmer had been an industrial company. They've turned it around completely: brought in new management, made a lot of acquisitions in this area, really turning around this business from just plotting along a government contractor into a life science powerhouse," he said.

Greenstone's final pick is Myriad Genetics (MYGN: Research, Estimates). "Myriad Genetics is taking all of this genetic information, and turning it into actual therapeutic agents. They have the largest number of collaborations with drug companies, which is very important. It lays a lot of credibility. And they also have turned a lot of this gene information into diagnostic tests, and those diagnostic tests are making a lot of money for the company."

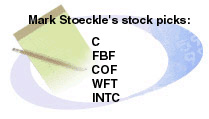

Mark Stoeckle, portfolio manager, Liberty Colonial U.S. Growth & Income Fund, said that he likes the financial sector. "CitiGroup (C: Research, Estimates) is a great example of a nice franchise with different growth drivers. They've got the commercial bank, they've got Salomon Smith Barney and it really is a business that we believe is well-priced and well-run. It also gives you a best group of companies where you don't have to rely on one part of the business. They've got a great insurance business, a great property casualty business, the bank, the investment bank. On a risk-reward basis, we think it's a terrific opportunity for a large cap fund." Mark Stoeckle, portfolio manager, Liberty Colonial U.S. Growth & Income Fund, said that he likes the financial sector. "CitiGroup (C: Research, Estimates) is a great example of a nice franchise with different growth drivers. They've got the commercial bank, they've got Salomon Smith Barney and it really is a business that we believe is well-priced and well-run. It also gives you a best group of companies where you don't have to rely on one part of the business. They've got a great insurance business, a great property casualty business, the bank, the investment bank. On a risk-reward basis, we think it's a terrific opportunity for a large cap fund."

Other financial picks include Fleet Boston (FBF: Research, Estimates) and Capital One (COF: Research, Estimates).

Stoeckle said that he likes the energy sector, particularly the oil services companies, such as Weatherford International (WFT: Research, Estimates).

His final pick is Intel (INTC: Research, Estimates). "Intel has done a very good job of managing their business and we see that not only personnel computers, but the service and wireless side of the business will continue to be robust and we see nothing but good things for the [semiconductor] sector."

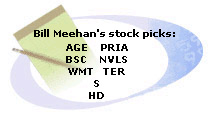

"Is the economy slowing down sufficiently? There are tentative signs, at least the way the Fed looks at it, that the economy may be slowing, but the problem is to what degree is it slowing? We have some people thinking it is slowing too quickly, and that the Fed has overshot already, and other people are saying that it is too early to conclude. And I think a lot of people are misreading the Fed. I think we are still going to get a rate hike in August," said Bill Meehan, senior market analyst at Cantor Fitzgerald & Co. "Is the economy slowing down sufficiently? There are tentative signs, at least the way the Fed looks at it, that the economy may be slowing, but the problem is to what degree is it slowing? We have some people thinking it is slowing too quickly, and that the Fed has overshot already, and other people are saying that it is too early to conclude. And I think a lot of people are misreading the Fed. I think we are still going to get a rate hike in August," said Bill Meehan, senior market analyst at Cantor Fitzgerald & Co.

"The energy stocks and technology stocks should be fairly positive. And I think that some of the retailers might surprise a little bit to the upside also," Meehan said. "I still like some of the large-cap technology names and some of the retailers for the summer rally. They still look very, very good. Some of the financial service stocks also look good to me here."

"I particularly like some of the broker-dealer stocks, which have been really beaten up. I think A.G. Edwards (AGE: Research, Estimates) just recently hit a new 52-week high. Bear Stearns (BSC: Research, Estimates) looks good there also. And a lot of the retailers have very attractive technical charts. Wal-Mart (WMT: Research, Estimates) has been one of my favorites for a while, Sears (S: Research, Estimates) looks attractive on a valuation basis and on a technical basis. And Home Depot (HD: Research, Estimates) also looks attractive technically. But there are several others, and I think some of the big-cap technology stocks, with an emphasis on the semiconductor equipment stocks look good, like PRI Automation (PRIA: Research, Estimates), Novellus Systems (NVLS: Research, Estimates), and Teradyne (TER: Research, Estimates).

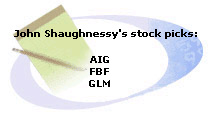

"I think frankly the Fed might even raise rates maybe 25 basis points, but that should be it, I think, for the rest of the year. And the market should breathe a huge sigh of relief that, plus the strong earnings reports for the second quarter. For example, operating earnings are supposed to be up 18-to-20 percent. So certainly the ingredients for a good strong summer and early fall rally are in place," said John Shaughnessy, chief investment officer, Advest. "I think frankly the Fed might even raise rates maybe 25 basis points, but that should be it, I think, for the rest of the year. And the market should breathe a huge sigh of relief that, plus the strong earnings reports for the second quarter. For example, operating earnings are supposed to be up 18-to-20 percent. So certainly the ingredients for a good strong summer and early fall rally are in place," said John Shaughnessy, chief investment officer, Advest.

"AIG (AIG: Research, Estimates) is the class act of the worldwide insurance industry. And as the Asian economy is picking up, AIG of course is one of the major providers of insurance products and services," Shaughnessy said. "And particularly as the Chinese economy opens up, as they join the World Trade Organization, that certainly bodes well for AIG as well. This company, which is selling at about 32 times earnings for this year, has the capacity to grow at 15 percent a year. And certainly, you know, we think the company has good prospects. Fleet Bank (FBF: Research, Estimates), the company has a capacity to grow at 7 or 8 percent a year, and yet the valuation is very attractive."

"With Global Marine (GLM: Research, Estimates), natural gas prices are firmed up, and that's providing stimulation for companies to do additional drilling. And secondly, with so many countries being dependent on OPEC, willingness to raise production, we're going to find more and more companies basically providing stimulus for oil companies to start drilling to increase the reserves worldwide," he said.

"I think that the smaller banks are probably going to have more difficulties in the upcoming six-to-12 months simply because they have relied on loan growth to drive EPS growth to meet consensus expectations. And loan growth is not where you want to be. Bread-and-butter banking is not that great of a business. And you're also the ends in terms of margin pressure. The Fed has raised rates 175 basis points, which usually translates into a much more difficult margin environment. And I think that that is going to hurt the bank below the top 15 in market cap for the near term," said Andy Collins, senior banking analyst, ING Barings. "I would say the larger-cap banks, once they get over the capital markets issues they're experiencing over the second quarter, should see a little bit more strength." "I think that the smaller banks are probably going to have more difficulties in the upcoming six-to-12 months simply because they have relied on loan growth to drive EPS growth to meet consensus expectations. And loan growth is not where you want to be. Bread-and-butter banking is not that great of a business. And you're also the ends in terms of margin pressure. The Fed has raised rates 175 basis points, which usually translates into a much more difficult margin environment. And I think that that is going to hurt the bank below the top 15 in market cap for the near term," said Andy Collins, senior banking analyst, ING Barings. "I would say the larger-cap banks, once they get over the capital markets issues they're experiencing over the second quarter, should see a little bit more strength."

"Chase Manhattan (CMB: Research, Estimates) has turned around things in the end of the second quarter. And we're expecting them to either meet or beat the consensus right now, which is at 83 cents. Our number is at 83 cents, but we think they have good earnings leverage, good revenue growth opportunities in the second quarter," Collins said. "The real strength will come in the latter half of the year as the capital markets turn around here. Bank of New York (BK: Research, Estimates) is one of the most consistent earnings companies out there. They continue to post just phenomenal growth in terms of processing. Processing is going to represent roughly 60 percent of earnings in 2001, that's up from 27 percent in 1995. And that's a great line of business. Very consistent high growth, high returns to equity."

"I like J.P. Morgan (JPM: Research, Estimates) in terms of their revenue growth opportunities," he continued. "But I think from an expense discipline standpoint they still need to turn things around and this quarter looks particularly dicey. It's a very volatile earnings stream coming in at J.P. Morgan and it fluctuates dramatically from quarter to quarter depending upon how trading revenue does. I'm not going to say they bet the farm. But trading revenue is a large percentage of their overall income and it's not going to be that good this quarter. Wells Fargo (WFC: Research, Estimates), a potentially great story. They are in all of the hot markets in California. They are in 22 western states, and are continuing to grow the Internet business dramatically. It's going to represent probably about 25 percent of their total households. And EPS growth there is growing at 15 percent compounded annually. That is versus selling at only 12.3 times cash earnings. So it really is selling at well below its growth rate. We think that the stock should hit $55 in the next 12 months."

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|