|

IP beats 2Q forecasts

|

|

July 11, 2000: 12:12 p.m. ET

Price hikes, savings from mergers help Dow component to triple profits

|

NEW YORK (CNNfn) - International Paper said Tuesday that merger savings allowed it to more than triple second-quarter earnings and that further profit gains lie ahead.

The company reported earnings, excluding special items, of $315 million, or 75 cents a diluted share.  Analysts surveyed by earnings tracker First Call forecast the company to earn 74 cents a share in the period. A year earlier, the company earned $103 million, or 24 cents a diluted share, excluding special items. Analysts surveyed by earnings tracker First Call forecast the company to earn 74 cents a share in the period. A year earlier, the company earned $103 million, or 24 cents a diluted share, excluding special items.

Including a $75 million pre-tax charge related to facilities closings and severance, net income in the period came to $270 million, or 64 cents a share, for the quarter, compared with a net loss of $71 million, or 17 cents a share, a year earlier when costs associated with its merger with Union Camp hit results.

But the company said that the savings from that merger helped it produce the strong results in the most recent period, and that it is now focusing on savings from its recently completed acquisition of Champion International in June.

" Now that the merger is completed and we have had a closer look into Champion's businesses, we are even more optimistic about the opportunities this acquisition will provide," said a statement from John Dillon, chairman and chief executive.

The company previously announced that it saw annual savings of $425 million from the recent purchase.

Revenue rose to $6.8 billion from $6 billion. The company saw improved pricing in its industrial packaging, consumer packaging and industrial papers division, although pricing fell in its building materials group.

For the first six months of the year, net income came to $648 million, or $1.55 a diluted share, compared with a net loss of $9 million, or 6 cents a share, a year earlier. Revenue in the first two quarters rose 10 percent to $13.2 billion from $12 billion a year earlier.

International Paper (IP: Research, Estimates) is the second component of the Dow Jones industrial average to release second-quarter results. On Monday, Alcoa Inc. (AA: Research, Estimates) reported it beat forecasts and helped lift the Dow into positive territory for the day.

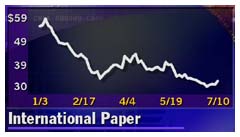

Shares of IP were up 1-1/8 to 33-3/8 just after the late morning announcement.

|

|

|

|

|

|

International Paper

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|