|

Stock picks by the pros

|

|

July 11, 2000: 5:11 p.m. ET

Exxon, Borders Group, Intel, Powertel, CommScope, SDL win mention

|

NEW YORK (CNNfn) - Market analysts recommended large- and mid-cap oil, technology, biotech, wireless, retail and financial stocks Tuesday, such as Phillips Petroleum, i2 Technologies, Nova Corp., Goldman Sachs, Ocular Sciences and Morgan Stanley Dean Witter.

While the Dow surged ahead in midday trading, guests on CNNfn commented on the stocks they are buying, and why.

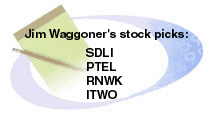

Jim Waggoner, technology strategist, Sands Bros. & Company said that his picks include SDL Inc. (SDL: Research, Estimates). "It's part of a very interesting consolidation in the optical networking components area. All of these companies make little gadgets, components, that go into the ultimate optical networking equipment, and ultimately these companies are all going to be consolidated into a silicon chip, somewhere. And this is just all part of this consolidation." Jim Waggoner, technology strategist, Sands Bros. & Company said that his picks include SDL Inc. (SDL: Research, Estimates). "It's part of a very interesting consolidation in the optical networking components area. All of these companies make little gadgets, components, that go into the ultimate optical networking equipment, and ultimately these companies are all going to be consolidated into a silicon chip, somewhere. And this is just all part of this consolidation."

"So JDSU (JDSU: Research, Estimates) buying SDLI makes all of the sense in the world - hopefully the regulators agree with that - and because they don't completely agree, there is an unusual discount - there's about a 20 percent between now and say the end of December when hopefully this thing closes. If that is realized, 40 percent annualized rate of return, most investors I think would take that as a pretty fair rate of return, given the normal risks that are associated with a deal like this."

"There's a lot of speculation these days about Deutsche Telekom (DT: Research, Estimates), WorldCom (WCOM: Research, Estimates), Sprint (FON: Research, Estimates) and so on and so forth, and how that's all going to play out. We have liked Powertel (PTEL: Research, Estimates) for some time -- on its own merits, the stock in the mid 80s we think is worth 120 - it's one of these Southeast regional wireless carriers that most of the rest of the industry has ignored. They run on the GSM standard, which is the European standard, and so they're one point in a footprint where VoiceStream (VSTR: Research, Estimates) does not have competition. So if the world is going towards VoiceStream, here's a much cheaper way of playing that, without the big takeover speculation which is present for VoiceStream."

He said that he likes RealNetworks (RNWK: Research, Estimates). "This is really the platform, the de facto standard in streaming media. And the world is moving toward streaming media - all of the B2C companies within a year will have a large dose of streaming media."

His final pick is i2 Technologies (ITWO: Research, Estimates). "It's the leader in supply chain management software. This is a highly sophisticated series of software programs that the company has developed since 1992, when it opened business. It has a 40 percent growth market, a $20 billion market. They are the leader. We think they can grow 40 percent or better on their own. And now they're taking their act, if you will, to the Web."

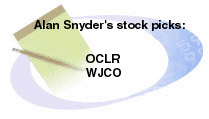

"I agree with the caveat of a middle short-term rally that should continue through the rest of the month of July -- the traditional summer rally that everybody always talks about," said Alan Snyder, money manager, Snyder Capital Management. "My feeling is that this is probably a good opportunity to get out of some stock rather than necessarily an opportunity to buy some stocks in advance of the rally." "I agree with the caveat of a middle short-term rally that should continue through the rest of the month of July -- the traditional summer rally that everybody always talks about," said Alan Snyder, money manager, Snyder Capital Management. "My feeling is that this is probably a good opportunity to get out of some stock rather than necessarily an opportunity to buy some stocks in advance of the rally."

"I think that by year's end you will see most of the market averages down from where they are today, but that an awful lot of the smaller- and mid-cap value types of stocks are going to be up from where they are today. Its going to be a very split market. And you can already see that in some of the indexes. If you look at the Value Line Index, it's been hitting new all-time highs in the last several weeks, while the Nasdaq and the Dow Jones and the S&P are still quite a bit under their all-time highs."

Within this environment, he said that: "In terms of sectors, we like the real estate area, the gold mining area and a lot of traditional retailers that have been absolutely beaten up in this market because of fears of competition from the Internet."

One of his picks is Borders Group (BGP: Research, Estimates). "It's is our anti-Internet play. It's been beaten down over the last year and a half because of fears that Amazon (AMZN: Research, Estimates) is going to dominate the business. In fact Borders every single quarter since Amazon got started has been showing higher and higher same-store sales gains and they continue to open new superstores around the country very successfully," he said. "Their earnings are growing, the stock is selling at only about nine times earnings and growing at a very nice rate whereas Amazon has never earned a profit and is still not going to earn a profit for quite a while into the future."

Another pick is Ocular Sciences (OCLR: Research, Estimates). "We really like this. The stock just dropped into a tremendous buy range over the last couple of days because of a failed acquisition. They were supposed to be acquired by Wesley Jessen (WJCO: Research, Estimates), which would have made the combined company the second largest soft contact lens maker in the country," he said. "That deal fell through. All the arbitrageurs bailed out of Ocular Sciences. And we think it's just at a mouth-watering price at this point. They are still the number three player in the business. They have some great growth ahead of them. And we believe that before the end of the year they'll be acquired by an European firm that wants to get to the US market."

"The demand for gasoline is very strong. And obviously now people are thinking ahead. And if we have a cold winter, we'll see a run up in home heating oil to above $2 per gallon," said Fadel Gheit, oil analyst, Fahnestock and Company. "The demand for gasoline is very strong. And obviously now people are thinking ahead. And if we have a cold winter, we'll see a run up in home heating oil to above $2 per gallon," said Fadel Gheit, oil analyst, Fahnestock and Company.

"It's a possibility. The rule of thumb here is that $4 to $5 per barrel drop in crude prices would translate to approximately 10 to 15 cents per gallon at the pump. We are not seeing the move to equal that. We are seeing crude oil prices moving down faster than we are seeing the price at the pump because the demand for gasoline is still very high.

"We are not likely to see a run up or similar run up in the small, independent oil stocks. We are already up 50 percent. I don't expect them to do any better. I think that they will decline. I think the money to be made right now is in the large-cap and the mid-cap oils and in the refining and marketing stocks.

"In the large cap, Exxon (XOM: Research, Estimates) could be one of them. But Phillips Petroleum (P: Research, Estimates) is by far the most undervalued mid-cap to large-cap oil company stock. I also like Ultramar Diamond (UDS: Research, Estimates), a small refining and market company. It's selling at a discount to its peers. But selectively if investors want to stay with the small-cap independent, there is Comstock (CRK: Research, Estimates), a pure natural gas play, which has nothing to do with OPEC oil prices. And that stock is undervalued and could go much higher"

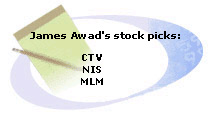

"I think you're locked in a trading range. The good news is, the consensus for now seems to be that if the Fed's done -- if it's not done, it's very close to being done -- so that relieves the interest rate pressures from the market. And you've ended the negative pre-announcement season. You're going into the regular announcement season, and earnings should be pretty good. And that should support the market," said James Awad, Awad Asset Management. "I think you're locked in a trading range. The good news is, the consensus for now seems to be that if the Fed's done -- if it's not done, it's very close to being done -- so that relieves the interest rate pressures from the market. And you've ended the negative pre-announcement season. You're going into the regular announcement season, and earnings should be pretty good. And that should support the market," said James Awad, Awad Asset Management.

"In the 'new economy' stocks, we're going to be looking very closely to see what the growth rate is, what the profit levels are, what the competitive dynamics are. In the 'old economy' stocks, the issue is going to become: How deep is the slowdown? Where does it end? And so people are going to be doing it stock by stock. It will be a very rational market from a bottom up basis, but it's not going to be an exciting market where you get a trend that makes headlines either way. So I think it'll frustrate both the bulls and the bears."

"I think it's much more of a stock picker's market where you can make good money if you find an inefficiently priced stock, but it's not going to be a momentum market that'll carry along all the players. So I think the issue here is to find growth at a reasonable price, and CommScope Inc. (CTV: Research, Estimates) is one. And what they do is they make coaxial cable and fiber optic cable for high-speed access to the Internet and wireless communications. And they've been capacity constrained -- demand for their product has just been exploding. Another niche company is called Nova Corp (NIS: Research, Estimates) and they provide outsourcing services, technology services to medium-size companies. They originally started as a credit card processor for medium-size companies, and of course, they have expanded that, selling more products into their client base. You've got a stock selling at 28 on $1.50 of earnings this year. So it's a modest multiple and we think that's a stock that has the potential to go up 10 points or more over the next 6 to 12 months."

"Then over on the value side, you've got Martin Marietta Materials (MLM: Research, Estimates), and what they're benefiting from is the Highway Act that was passed a few years ago where the government is funneling a lot of money into rebuilding the highway system, and they are one of the major manufacturers of aggregates. They'll earn $3 this year, so you have about a 13, 14 multiple on good growing earnings."

"I think it looks like we're going to have growth. And I think it's the environment. Remember in 1998, the earnings for the S&P 500 were actually down. And 1998 was a very good year. It really has to do with the environment," said Patricia Chadwick, market strategist and president of Ravengate Partners. "I think it looks like we're going to have growth. And I think it's the environment. Remember in 1998, the earnings for the S&P 500 were actually down. And 1998 was a very good year. It really has to do with the environment," said Patricia Chadwick, market strategist and president of Ravengate Partners.

"A rising interest rate environment does not have the same order of magnitude that it use to have in our economy just because we are not as much of a manufacturing economy, as much as an inventory economy. And I think that there is no doubt that the market believes inflation is not a problem. The two times we've had really horrific markets was when we had the Depression in the 1930s and when we had runaway inflation in the 1970s. Compared to both of those, this is a fabulous environment, and on top of that, for the first time in something-30 years we're now running true budget surpluses, which to me means that that money is going to have to get back into the economy, get back to the consumer in the form of investing and spending.

"I just think technology is such a powerful driver. We are the resource for technology around the world. I like Intel (INTC: Research, Estimates), Nortel (NT: Research, Estimates), Oracle (ORCL: Research, Estimates), which has been under a lot of pressure just because the president resigned recently. JDS Uniphase (JDSU: Research, Estimates), granted an expensive stock, but down 15 points yesterday. I also like financial services. And I think when interest rates peak and start to come down they tend to be a leader. We've seen stocks like Goldman Sachs (GS: Research, Estimates) and Morgan Stanley Dean Witter (MWD: Research, Estimates),and Merrill Lynch (MER: Research, Estimates) do pretty well. I think DLJ (DLJ: Research, Estimates) is a very interesting stock. You're selling at 1.3 times book value."

--Compiled by Parija Bhatnagar

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|