|

Yahoo! beats the Street

|

|

July 11, 2000: 6:18 p.m. ET

Web portal's second-quarter net income almost triples as revenue doubles

|

NEW YORK (CNNfn) - The Web portal and Internet bellwether Yahoo! Inc. reported second-quarter earnings that beat analyst expectations, as its revenue more than doubled and traffic on its network of sites continued to grow strongly.

The Santa Clara, Calif.-based company said its second-quarter earnings, before one-time items, totaled $74 million, or 12 cents per diluted share, compared with $27 million, or 5 cents, in the year-ago quarter. Analysts surveyed by earnings tracker First Call had expected the company to earn 10 cents per share.

Yahoo! (YHOO: Research, Estimates) said that its second-quarter revenue rose 110 percent to $270.12 million from $128.57 million in the same period last year. Traffic on the company's Web sites averaged 680 million page views per day in June, up from an average of 465 million per day in December and 625 million in March. During June, Yahoo!'s global audience grew to more than 156 million unique users from 120 million in December 1999.

Yahoo! stock closed down 4-1/2 at 105-1/2 before the earnings were released Tuesday. Its shares jumped 12-1/2 to 118 in after-hours trading, as investors responded positively to both revenue and net income that exceeded expectations.

"We made significant progress this quarter in our five key areas of focus -- mobile services, rich media and voice services, enabling transactions, business and enterprise services, and globalization," said Jeff Mallett, Yahoo!'s president and chief operating officer, in a press release.

Revenue exceeds expectations

Yahoo!'s $270 million in revenue was about $20 million higher than the mean analyst forecast, showing that the company's advertising revenue hasn't slowed. Analysts and investors had been concerned that the failure of many small dot.com companies would harm Yahoo!'s advertising sales.

In a conference call after the earnings were released, Yahoo!'s management said that the company retained all of its top 50 advertisers and 98 percent of its top 100 in the quarter. In addition, company executives said that financially weak dot.coms account for only 10 percent of Yahoo!'s revenue.

"We saw real upside surprise in the revenue number, and I think that will help the stock," Frederick Moran, an analyst at Jefferies & Co., said on CNNfn's Street Sweep. "The second-quarter report shows that despite the seasonality of the Web business, there is no slowdown at all in the revenue growth rate."

Yahoo! said that its mail and messenger functions delivered 4.4 billion messages in June, up from 3.6 billion in March. Voice minutes spent by individuals on Yahoo!'s communication services grew to more than 500 million in June, and the company hosted and distributed more than 13 million hours of streamed audio and video programming during that month, up from 11 million in March.

During the second quarter, Yahoo! enabled more than $1 billion of online transactions. Its shopping platform added 800 new stores during the quarter, bringing the total number of merchants to 11,300 in June.

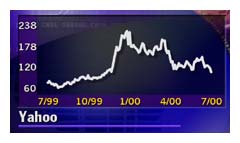

While Yahoo!'s stock is more than double its 52-week low of 55, it's also more than 50 percent below its 52-week high of 250-1/16. At Tuesday's closing price, Yahoo! sells for an astronomical 240 times expected earnings per share for all of 2000 and about 195 times its expected earnings for 2001.

|

|

|

|

|

|

|