|

Global sells local phones

|

|

July 12, 2000: 3:35 p.m. ET

Citizens buys 1.07M access lines for $3.65B; Global to sell Web unit?

|

NEW YORK (CNNfn) - Global Crossing Ltd. agreed Wednesday to sell its local phone business to Citizens Communications Corp. for $3.65 billion in cash.

The deal is one of two -- with a combined value of up to $10.6 billion -- that was reported being considered by the Bermuda-based phone company. The Wall Street Journal said the company is also in discussions on the sale of its Web hosting unit for up to $7 billion.

Global Crossing (GBLX: Research, Estimates), the fifth largest provider of long-distance phone services in the United States, said the local line sale involves 1,070,000 access lines, about half of them in the Rochester, N.Y., area. The rest of the lines are spread out in 13 states, including Minnesota, Iowa, Wisconsin and Pennsylvania. The company said 1999 revenue for the local exchanges was $805.2 million. Global Crossing (GBLX: Research, Estimates), the fifth largest provider of long-distance phone services in the United States, said the local line sale involves 1,070,000 access lines, about half of them in the Rochester, N.Y., area. The rest of the lines are spread out in 13 states, including Minnesota, Iowa, Wisconsin and Pennsylvania. The company said 1999 revenue for the local exchanges was $805.2 million.

Under terms of the agreement, Global Crossing will provide long-distance phone service for the local lines.

Once the sale is completed, Stamford, Conn.-based Citizens Communications (CZN: Research, Estimates) will control more than 3 million access lines in 22 states. The deal is subject to regulatory approvals, with the companies expecting to complete it in about nine months.

"The deal came in higher than the expected $3.3 billion," said analyst Patrick Comack, of Guzman & Co.

Comack has a 12-month price target of $60 on Global Crossing.

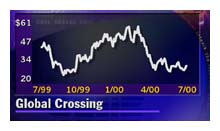

In afternoon trading, Global Crossing rose 3-3/8 to 32-1/2, while Citizens Communications traded unchanged at 18-11/16.

Global to shed Web unit?

Global Crossing's principal business is building communications networks, sometimes under the sea, to carry large amounts of data and traffic. The company is also talking to Exodus Communications Inc. (EXDS: Research, Estimates) to sell its Web unit, Global Center Inc., in a stock swap that would give the Global Crossing a near 25 percent holding in Exodus, the Journal reported.

A sale of the Web unit would make the Bermuda-based Global Crossing ripe for takeover.

"If they sold the Web hosting business that would indicate that they want to get out of the game," he said.

Any large telecom, such as Deutsche Telekom AG, Telefonica, Japan's Nippon Telegraph and Telephone, or KPN-Qwest, would be interested in picking up Global Crossing.

However, a sale would be unusual. "This would really go against the grain because all the other telecom companies have hosting," he said.

Global Crossing declined to comment, while Exodus not could be reached for comment.

Both units up for sale were part of Frontier Corp. when Global Crossing (GBLX: Research, Estimates) bought it for $10 billion in 1999.

The Journal, citing people familiar with the matters, said there was more uncertainty over the future of GlobalCenter Inc., the Web business, saying discussions were at a delicate stage.

In March, Global Crossing Chief Executive Robert Annunziata appointed Leo Hindery, formerly of AT&T Corp., to take charge. It also announced plans to issue a tracking stock to reflect the performance of GlobalCenter. The newspaper reported Wednesday that Global Crossing would revive plans for a tracking stock if the Exodus purchase falls apart.

Exodus surged 5-1/8 to 42-1/8 in afternoon trading on the Nasdaq.

|

|

|

|

|

|

Global Crossing

Exodus

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|