|

Rite Aid sells unit for $1B

|

|

July 12, 2000: 12:50 a.m. ET

Advance Paradigm acquiring PCS Health Systems for cash and notes

|

NEW YORK (CNNfn) - Struggling drug store chain Rite Aid Corp., attempting to ease its massive debt load, agreed Wednesday to sell its PCS Health Systems unit to Advance Paradigm for $1 billion.

Advance Paradigm will pay Rite Aid $675 million in cash and provide the pharmacy chain with $200 million in senior subordinated notes. Advance Paradigm also will issue Rite Aid $125 million in new equity.

The transaction is expected to immediately add to Advance Paradigm's earnings per share, the company said.

Rite Aid Corp. is getting only two-thirds of the $1.5 billion it paid for PCS in November 1998.

"This is making the best of a bad job," said an analyst who declined to speak for the record. "They have lots of debt and are trying to get it down. They're trying to sell things but just not at sale prices."

Rite Aid Corp. has about $6.6 billion in debt, the analyst said.

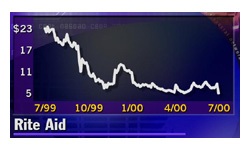

The sale comes on the heels of a dramatic earnings report for the troubled drug store chain. Rite Aid, whose stock has plummeted in the past year, reported a much wider-than-expected quarterly loss Tuesday and restated its earnings for the past three fiscal years, replacing what had appeared on its bottom line as healthy profits with even more substantial losses. The sale comes on the heels of a dramatic earnings report for the troubled drug store chain. Rite Aid, whose stock has plummeted in the past year, reported a much wider-than-expected quarterly loss Tuesday and restated its earnings for the past three fiscal years, replacing what had appeared on its bottom line as healthy profits with even more substantial losses.

The Camp Hill, Penn.-based company said it overstated profit for two years by more than $1 billion. Rite Aid also reported a net loss of $1.1 billion for its fiscal year ended Feb. 26, 2000.

For the quarter ended May 27, Rite Aid (RAD: Research, Estimates) posted a loss of $238 million, or 92 cents per share, exceeding analysts' expectations. Earnings tracker First Call Corp. had expected the company to lose 8 cents per share during the quarter.

Rite Aid's accounting problems have helped drive its stock down nearly 70 percent, and the company has been unable to report earnings since last fall. The Securities and Exchange Commission currently is reviewing the company's accounting practices. The PCS sale is expected to help the ailing company, but not by much. Rite Aid's accounting problems have helped drive its stock down nearly 70 percent, and the company has been unable to report earnings since last fall. The Securities and Exchange Commission currently is reviewing the company's accounting practices. The PCS sale is expected to help the ailing company, but not by much.

"Some problems are behind them, but now they are laden down with a huge amount of debt," the analyst said. "PCS wasn't a bad buy for Rite Aid but it would've worked much better for a healthy company."

PCS currently is one of the nation's largest drug benefit management companies, providing pharmacy-related services to employers, health plans, government agencies, and other benefit plan sponsors.

The deal

Both the Rite Aid and Advance Paradigm boards have approved the PCS transaction, which is expected to close in the quarter ending Sept. 30, 2000.

The cash portion of the purchase price will be financed with senior secured debt committed by Merrill Lynch and equity financing of $150 million committed by Joseph Littlejohn & Levy, Inc. The transaction is subject to the approval of the Federal Trade Commission and by certain of Rite Aid's lenders.

Following the acquisition, Advance Paradigm will be the nation's largest provider of health improvement services, offering a pharmacy benefit management, disease management, clinical research, and health information and analytic capabilities for 75 million Americans.

Advance Paradigm's CEO, David Halbert, said the acquisition of PCS Health Systems provided a strategic fit for the company, giving it "substantial" leverage to compete against the growing competitors within the pharmacy benefit management (PMB) sector. (799K WAV) or (799K AIFF)

Advance Paradigm (ADVP: Research, Estimates) plans to change its name at the closing to Advance PCS and will remain independent.

The combined organization will manage approximately 450 million drug claims, representing $18 billion in drug expenditures, and have approximately $3.2 billion in revenue on an annual basis.

In early trading, Rite Aid fell 5/8 to 6 while Advance Paradigm was off 9/16 at 22.

|

|

|

|

|

|

Rite Aid Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|