|

Pepsi beats 2Q forecasts

|

|

July 13, 2000: 12:30 p.m. ET

Drink and snack food maker sees continued EPS growth; bottler also gains

|

NEW YORK (CNNfn) - PepsiCo Inc. beat analysts' forecasts in the second quarter, and said Thursday it should be able to maintain its earnings per share growth rate.

The beverage and snack maker posted net income of $563 million, or 38 cents a share, in the 12-week period ended June 10. Analysts surveyed by earnings tracker First Call had forecast 36 cents a share. The company earned $467 million, or 31 cents a share, on a pro forma basis in the year-earlier period.

"Our second-quarter performance also confirms that we can sustain 12-to-13 percent EPS growth, with occasional upsides," Chairman and CEO Roger Enrico said. "Our second-quarter performance also confirms that we can sustain 12-to-13 percent EPS growth, with occasional upsides," Chairman and CEO Roger Enrico said.

Sales climbed to $4.9 billion from $4.5 billion a year earlier. The Purchase, N.Y.-based company had stronger percentage gains overseas than in its North American business. Frito Lay, the snack food division that accounts for most of its sales, saw overseas sales climb 18 percent, compared with a 7 percent gain in North America, while the soft drink division had a 9 percent gain in overseas sales, compared with 6 percent in North America. Its Tropicana juice division's sales climbed 4 percent.

For the first 24 weeks of the year net income rose to $985 million, or 67 cents a diluted share, from $849 million, or 56 cents a share. Total sales grew 8.5 percent to $9.1 billion in from $8.4 billion a year earlier.

In related earnings news, Pepsi Bottling Group Inc., the bottling company that is responsible for about 30 percent of PepsiCo's beverage sales, easily beat earnings estimates, helped by strong pricing and North American sales. In related earnings news, Pepsi Bottling Group Inc., the bottling company that is responsible for about 30 percent of PepsiCo's beverage sales, easily beat earnings estimates, helped by strong pricing and North American sales.

The bottling company, which buys the syrup from Pepsi for the soda and bottles the drink for sales to consumers, reported net income of $85 million, or 58 cents a share, for the 12-week period ending June 10, compared with the First Call forecast of 49 cents a share for the period. The company had earnings from operations of 32 cents a share in the year earlier period.

Revenue gained 4 percent to $1.9 billion for the period. The company said pricing of product is also up about 4 percent, and that it believes those prices should hold for the rest of the year.

For the first 24 weeks of the year, Pepsi Bottling reported net income of $102 million, or 69 cents a share, up from $17 million, or 11 cents a share, a year earlier. Revenue year-to-date rose to $3.5 billion from $3.3 billion.

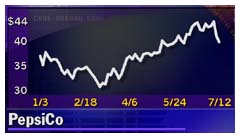

Shares of PepsiCo (PEP: Research, Estimates) gained 15/16 to 40-11/16 in trading Wednesday. Pepsi Bottling (PBG: Research, Estimates) shares, which are 37 percent owned by PepsiCo, gained 1-7/8 to 30-3/4.

|

|

|

|

|

|

|