|

Gateway edges estimates

|

|

July 13, 2000: 6:36 p.m. ET

Direct PC seller beats 2Q projections, on track to meet forecasts

|

NEW YORK (CNNfn) - PC maker Gateway reported a second-quarter profit of 37 cents per share Thursday on revenue that rose 12 percent from the same period last year.

In the three months ended June 30, Gateway (GTW: Research, Estimates), the No. 2 direct seller of personal computers, said it earned $122 million, or 37 cents per share. That's up 36 percent from $89.2 million, or 28 cents per share, during last year's second quarter and a penny more than the consensus estimate of analysts polled by earnings tracker First Call.

Sales came in at $2.1 billion, compared with $1.9 billion during last year's second quarter.

Gateway said it shipped 1.2 million computers during the quarter, up from 1 million a year ago.

Executives at Gateway in San Diego said the consumer PC business was its strongest, posting a 32 percent increase in revenue from the same period last year. They said improved availability of microprocessors and memory chips allowed the company to better meet demand.

However, the company's sales to businesses fell 10 percent, which it attributed to its shifting focus to small and medium businesses instead of large corporations.

The lower business sales came despite the company's efforts to improve that segment. Slower business sales had forced Gateway to reduce their revenue targets for the first quarter. While the company met those reduced targets, they also told investors to expect business sales to pick up in the second quarter.

"We're not happy with the 10 percent decline, but we are making progress," John Todd, Gateway's senior vice president and chief financial officer, said in a teleconference Thursday evening. During the first quarter, the company's business sales slipped 19 percent.

Todd said Gateway will take steps including adding additional sales staff focused on small business sales and bolstering its business sales presence at the company's "Gateway Country" sales outlets.

"You will also see us meld small business advertising with consumer advertising campaign," Todd said.

The company expects its business sales to be flat in the third quarter.

Even so, Todd said Gateway is on track to meet analysts' current earnings expectation of 45 cents per share for the third quarter and $1.84 per share for the full year.

"Although they're proving that they don't need a strong business market to grow, it certainly will become more critical going forward," ING Barrings analyst Robert Cihra told CNNfn.com. "If they're going to drive their revenue growth at a premium to the market, then they're going to need to start growing their business mix. But I think they will be able to do that after this year."

'Beyond-the-box' boosts operating income

The company recorded quarterly operating income of $169 million, up 37 percent from its operating income during last year's second quarter.

Gateway (GTW: Research, Estimates) credited strong growth in its non-PC, or "beyond-the-box" revenue - which include Internet services, financing and training that the company sells along with its computer systems - in large part for the increase in operating income.

For every PC sold to consumers, an average of four non-PC items were sold along with the system, a 67 percent increase over a year ago, Gateway reported. For every PC sold to consumers, an average of four non-PC items were sold along with the system, a 67 percent increase over a year ago, Gateway reported.

Executives said they will continue to build on the higher-margin revenue lines as they move into the second half, which typically is the PC industry's strongest.

"As we move into our strongest selling season of the year, we're planning to continue leveraging our beyond-the-box business model and distribution strategy to meet our goal of delivering consistent earnings results, better- than-industry growth rates and a more diverse and profitable revenue stream," Todd said.

Non-PC income was 40 percent of overall income for the quarter, which is the percentage the company had been targeting.

"We believe now that we will exit the year with 45 percent of our total income coming from beyond-the-box," Todd said.

Gateway also expects to begin shipping the first of its family of Internet appliance products, which it is co-developing with America Online (AOL: Research, Estimates), before the December holiday season begins.

AOL currently has a pending merger agreement with Time Warner, CNNfn's parent company.

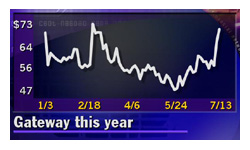

Gateway shares edged up 1/8 to 71-1/16 in New York Stock Exchange trade ahead of the announcement. It was the first of the major PC makers to report its most recent results.

ING Barrings' Cihra said the report could be a harbinger of more good news.

"Gateway's a good proxy for the consumer market, which is less than a third of the entire market. But in terms of the overall PC market, it shows that the second quarter was a fairly in line quarter and likely will be that way for most PC companies," Cihra said. "And their outlook is pointing toward a pretty solid second half, which is what I think most of them will be expecting."

Compaq (CPQ: Research, Estimates) will report its earnings next Wednesday. Dell (DELL: Research, Estimates) is set to report its most recent quarterly results on August 10. Hewlett-Packard (HWP: Research, Estimates) reports on August 15.

|

|

|

|

|

|

|