|

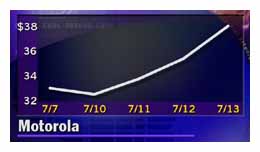

Motorola sees growth

|

|

July 13, 2000: 10:05 a.m. ET

New products credited for continuing quarterly profit improvement

|

NEW YORK (CNNfn) - Motorola on Thursday credited new products it rolled out in its second quarter with contributing to earnings and said it sees sequential operating margins growth.

During a news conference Thursday, Motorola gave stock analysts earnings estimates that included a third-quarter earnings per share of 26 cents on sales of $10 billion and 2000 earnings of $1.05 a share on sales of $39.5 billion. For 2001, the company predicts earnings of $1.43 a share on sales of $46 billion.

Motorola posted a second-quarter operating profit Wednesday that was nearly double the year earlier, earning $515 million, or 23 cents per share, matching the consensus estimate from earnings tracker First Call.

Company management said new products accounted for 95 percent of its orders in the second quarter for its second-tier handset products and that the offerings helped boost operating margins for its handset business.

"[We reached] the high end of our target margin range of 3.5 to 4 percent reinforces the fact that we are on track to show sequential margin improvement throughout year and 10 percent operating margin by the fourth quarter of the year," said Merle Gilmore, Motorola's president of communications unit. "[We reached] the high end of our target margin range of 3.5 to 4 percent reinforces the fact that we are on track to show sequential margin improvement throughout year and 10 percent operating margin by the fourth quarter of the year," said Merle Gilmore, Motorola's president of communications unit.

"These new products have a lower unit manufacturing cost than the products they replace," added Motorola president Ed Greene.

Motorola also said it foresees 30 percent growth in the worldwide chip business for 2000 and 25 percent growth for 2001.

The remarks helped Motorola (MOT: Research, Estimates) shares move higher, up 2-3/4, or 7.6 percent, to 39.

Wall Street weighs in

Ahead of the conference, Wall Street analysts gave their opinions on how well Motorola performed, based on Wednesday's earnings report.

Marc Cabi at Credit Suisse First Boston upped his recommendation on Motorola stock with a "buy" rating from a "hold" and a price target of $45.

"Motorola's second-quarter results demonstrated that the company is now showing signs of progress across each of its business segments," said Cabi in a research note.

Bear Stearns analyst Wojtek Usdelewicz told CNNfn that the Street focused mostly on Motorola's wireless unit because it derives most of its business from that segment, rather than its cable TV and semiconductor businesses.

"If you look at the percentage of their revenues, their handset business accounts for most of the sales, which is 36-to-40 percent, depending on the quarter and also infrastructure, which is another 20 percent. So, 60 percent of their business comes from the wireless industry and additionally, semiconductor sales, which is about 25-to-27 percent of sales, which are internally dependent, to a large extent, on their wireless sales," said Usdelewicz.

Usdelewicz added that the company needs to address what he sees as a decline in handset orders.

"Another big issue is that their handset sales were somewhat below our and I think most of the analyst's expectations, so we want to see some indications that the business is going to improve going forward," Usdelewicz said.

"The company assured us it's going to improve. We're still in a sort of wait-and-see mode to see if there's any handset improvement in the next quarter or so. We do think the stock price reflects a lot of expectations although it's not as bad as it was recently -- we're still a little bit cautious," said Usdelewicz.

Merrill Lynch's Michael Ching was more bullish and repeated his "buy" rating on the stock.

"We expect to maintain our estimates at $1.05 a share for 2000 and $1.43 for 2001, so Motorola remains the most attractively valued stock in our universe, at 23 times 2001 EPS estimates," said Ching in a research note.

At Banc of America Securities, analyst Mark McKechnie reiterated his "strong buy" recommendation on Motorola shares and said there was a positive margin surprise on handsets.

"The biggest positive was handset margins, which came in at 4 percent, up from 1.5 percent last quarter and our 3 percent forecast," said McKechnie in a research note. "Given fairly weak orders -- down 1 percent from last year -- and our own supply-chain checks, we suspect Motorola will reduce its 2000 unit shipment plan."

Brian Modoff at DB Alex Brown rates Motorola stock a "strong buy" but said the PCS segment continues to pose a question mark in Motorola's performance, with revenues of $3.3 billion.

Lehman Brothers analyst Tim Luke continues to rate the company's stock at "outperform," and said he expected the stock to trade higher Thursday.

"Post close [Wednesday], wireless-value play Motorola delivered results broadly in line with expectations. Given a relatively low level of investor expectations, shares may trade positively," Luke said.

|

|

|

|

|

|

Motorola

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|