|

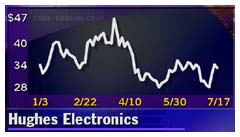

Hughes sees 2Q gains

|

|

July 17, 2000: 12:51 p.m. ET

Losses narrow as satellite TV growth leads GM unit past forecasts

|

NEW YORK (CNNfn) - General Motors Corp. said Monday its Hughes Electronics unit saw its net loss narrow and revenue increase for the second quarter, driven by growth of its satellite television operation, DirecTV.

The company does not disclose earnings or loss per share because it is a tracking stock of GM. But analysts issue forecasts based on earnings before income taxes, depreciation and amortization, also known as EBITDA.

By that measure, the unit did better than expected, reporting EBITDA of $179.6 million in the quarter, or 14 cents a share. Analysts surveyed by earnings tracker First Call forecast the EBITDA of 10 cents a share in the period. The company had EBITDA of $124.3 million, or 10 cents a share, in the year- earlier period. By that measure, the unit did better than expected, reporting EBITDA of $179.6 million in the quarter, or 14 cents a share. Analysts surveyed by earnings tracker First Call forecast the EBITDA of 10 cents a share in the period. The company had EBITDA of $124.3 million, or 10 cents a share, in the year- earlier period.

The loss in the latest quarter, excluding the effect of GM's purchase accounting, came to $63.8 million, down from $92.3 million a year earlier. The amount paid in preferred stock dividends, which is not included in that loss figure, rose to $24.1 million from $1.6 million a year ago.

Revenue increased 40 percent to $1.8 billion from $1.3 billion. More than two-thirds of revenue came from direct-to-home broadcast fees.

For the first six months o, Hughes' EBITDA came to $14.0 million, compared with a negative EBITDA of $11.5 million a year earlier. The loss before the effect of GM's purchase accounting came to $140.4 million year-to-date, compared with a loss of $14.0 million in the earlier period.

Revenue for the half climbed to $3.5 billion from $2.2 billion a year earlier.

GM recently put more of its holdings of Hughes' tracking stock onto the open market by exchanging Hughes shares for its own common shares and placing more of the shares in its pension funds. But GM declined to spin off the company as some analysts had expected.

Shares of Hughes (GMH: Research, Estimates) slipped 1/4 to 33 in trading Monday.

|

|

|

|

|

|

|